Bitcoin

The cryptocurrency market has recently experienced a significant surge, with Bitcoin and Ethereum leading the charge. This uptick follows the release of the U.S. Consumer Price Index (CPI) report, which has had a notable impact on investor sentiment and market dynamics. The cryptocurrency landscape is known for its volatility, with prices influenced by a myriad of factors. Recently, Bitcoin and Ethereum have experienced substantial price increases, coinciding with the release of the U.S. Consumer Price Index (CPI) report. Understanding the interplay between economic indicators like the CPI and cryptocurrency valuations is crucial for investors and enthusiasts alike.

The U.S. CPI Report and Its Significance

The Consumer Price Index measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is a key indicator of inflation and provides insights into the purchasing power of the dollar. In December 2024, the CPI rose by 0.4%, bringing the annual inflation rate to 2.9%, slightly above the Federal Reserve's target of 2%.

Impact on Bitcoin and Ethereum Prices

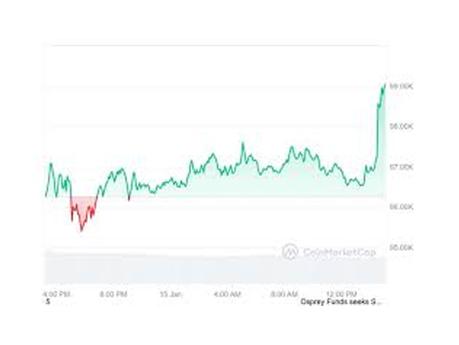

Following the CPI report's release, Bitcoin's price approached the $100,000 mark, reflecting a 2.6% increase. Ethereum mirrored this trend, with its price rising significantly. This positive movement is largely attributed to investor speculation that the Federal Reserve may implement interest rate cuts sooner than anticipated to curb rising inflation. Lower interest rates can decrease the appeal of traditional savings, prompting investors to seek higher returns in alternative assets like cryptocurrencies.

Broader Market Implications

The surge in Bitcoin and Ethereum prices has had a ripple effect across the broader cryptocurrency market. Altcoins such as XRP, Solana, and Dogecoin have also experienced notable gains. For instance, XRP jumped 15% amid favorable developments in legal proceedings involving Ripple, while Solana and Dogecoin climbed by approximately 5.4%. Barron's

Investor Sentiment and Future Outlook

The correlation between economic indicators like the CPI and cryptocurrency valuations underscores the growing interconnectedness between traditional financial markets and digital assets. As inflationary pressures persist, cryptocurrencies are increasingly viewed as potential hedges against currency devaluation. However, it's essential to recognize the inherent volatility of the crypto market. While recent trends are encouraging, investors should remain cautious and consider the broader economic context when making investment decisions. The recent surge in Bitcoin and Ethereum prices following the U.S. CPI report highlights the sensitivity of cryptocurrency markets to economic indicators and monetary policy expectations. As the financial landscape continues to evolve, staying informed about such developments is crucial for navigating the dynamic world of digital assets.