Analysts have tried depicting a consumer's digital path to purchase in a variety of ways — loops within loops, funnels, circles, and so forth. The reason it is so difficult to depict is that consumers have many ways to access the Web and you really never know at what point they are going to jump onto the path. For example, the path to purchase could begin after seeing an ad in a magazine while sitting in the doctor's office or after watching a commercial on television or hearing an advertisement on the radio or receiving a flyer in the mail or with an online search. As a result, consumer's may jump onto the "digital" path to purchase anywhere along path. They don't necessarily begin down that path digitally. Regardless of where they jump onto the digital path, Tyson Goodson believes, "There are six distinct segments of consumers who exhibit similar behaviors and intent." ["The 6 Types of Digital Consumers and Their Paths to Purchase," Compete, 30 May 2013] Goodson writes, "Of consumers who utilized digital at least once in their purchase pathway, six distinct segments emerged. The segments, as identified by GroupMNext, are:

- "Basic Digital Consumers: These are not highly digital users. They are comfortable with Internet shopping and research, but they are not mobile or social and have the second-highest likelihood of buying offline.

- "Retail Scouts: These consumers have short journeys and prefer retail sites to brand sites. They use mobile, but are twice as likely to use it in the home as out. They are comfortable buying online but did not express a preference between online and offline.

- Brand Scouts: Brand Scouts are the spiritual partner to the Retail Scouts except instead of having a favorite retailer, they have a favorite brand. When asked, 72% said they start their journey with a brand in mind.

- "Digitally Driven Segment: They use every digital tool at their disposal. They use social and mobile more than any other segment in the study, value convenience above all else and they do everything in their power to avoid physically going to a store. The Digitally Driven exist in good numbers already, but within five years this will be the dominant segment of consumers.

- "Calculated Shoppers: These shoppers seem to know they are going to make a purchase, but they are deciding which brand to choose. They are similar to the Digitally Driven Segment, but have no urgency to their purchase and they're willing to take the time to get the best deal.

- "External Shoppers: These are non-mobile shoppers. They want the answers to, 'Should I buy?', 'What do I buy?' and 'What brand do I buy?' – all at the same time. These shoppers have no urgency to make a purchase and they do their research on desktop and laptop computers."

If GroupMNext is correct and the Digitally Driven Segment is indeed going to be the dominant segment of consumers within the next five years, you can understand why it is important for companies to have a solid multi-channel strategy. Goodson's article was also accompanied by an excellent graphic that helps explain why depicting the digital path to purchase is so difficult. In the graphic below, note how many different steps (on average) are involved in purchase decisions by the various consumer segments and how they jump off and on the digital path to purchase.

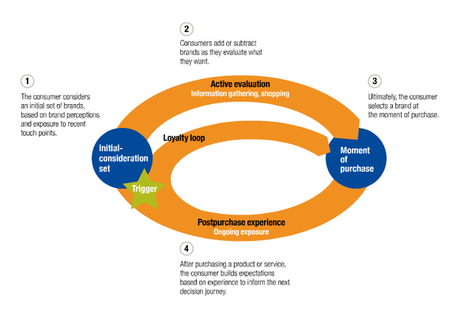

Several years ago McKinsey & Company analysts, David Court, Dave Elzinga, Susan Mulder, and Ole Jørgen Vetvik, wrote, "Marketing has always sought those moments, or touch points, when consumers are open to influence. For years, touch points have been understood through the metaphor of a 'funnel' —consumers start with a number of potential brands in mind (the wide end of the funnel), marketing is then directed at them as they methodically reduce that number and move through the funnel, and at the end they emerge with the one brand they chose to purchase." They went on to note, "Today, the funnel concept fails to capture all the touch points and key buying factors resulting from the explosion of product choices and digital channels, coupled with the emergence of an increasingly discerning, well-informed consumer." ["The consumer decision journey," McKinsey & Company, 1 June 2009] From their research, the McKinsey analysts concluded:

"The decision-making process is a more circular journey, with four primary phases representing potential battlegrounds where marketers can win or lose: initial consideration; active evaluation, or the process of researching potential purchases; closure, when consumers buy brands; and postpurchase, when consumers experience them (see below). The funnel metaphor does help a good deal — for example, by providing a way to understand the strength of a brand compared with its competitors at different stages, highlighting the bottlenecks that stall adoption, and making it possible to focus on different aspects of the marketing challenge. Nonetheless, we found that in three areas profound changes in the way consumers make buying decisions called for a new approach."

Although this depiction of the consumer digital path to purchase seems to have gathered support, it doesn't capture either the nuances or complexities of the six types of consumer discussed by Goodson. If you click on the link to Goodson's article, you'll find an infographic that is much more complex. To be fair, the McKinsey analysts did go on to note that the landscape has dramatically shifted beneath the feet of marketers. They wrote:

"The second profound change is that outreach of consumers to marketers has become dramatically more important than marketers’ outreach to consumers. Marketing used to be driven by companies; 'pushed' on consumers through traditional advertising, direct marketing, sponsorships, and other channels. At each point in the funnel, as consumers whittled down their brand options, marketers would attempt to sway their decisions. This imprecise approach often failed to reach the right consumers at the right time. In today’s decision journey, consumer-driven marketing is increasingly important as customers seize control of the process and actively 'pull' information helpful to them. Our research found that two-thirds of the touch points during the active-evaluation phase involve consumer-driven marketing activities, such as Internet reviews and word-of-mouth recommendations from friends and family, as well as in-store interactions and recollections of past experiences. A third of the touch points involve company-driven marketing. Traditional marketing remains important, but the change in the way consumers make decisions means that marketers must move aggressively beyond purely push-style communication and learn to influence consumer-driven touch points, such as word-of-mouth and Internet information sites."

Two other McKinsey analysts, Peter Dahlström and David Edelman, agree with their colleagues that the business landscape is shifting and that consumers are becoming more empowered. "Digital marketing," they write, "is about to enter more challenging territory. Building on the vast increase in consumer power brought on by the digital age, marketing is headed toward being on demand — not just always 'on,' but also always relevant, responsive to the consumer’s desire for marketing that cuts through the noise with pinpoint delivery." ["The coming era of ‘on-demand’ marketing," McKinsey & Company, April 2013] They continue:

"The developments pushing marketing experiences even further include the growth of mobile connectivity, better-designed online spaces created with the powerful new HTML5 Web language, the activation of the Internet of Things in many devices through inexpensive communications tags and microtransmitters, and advances in handling 'big data.' Consumers may soon be able to search by image, voice, and gesture; automatically participate with others by taking pictures or making transactions; and discover new opportunities with devices that augment reality in their field of vision (think Google glasses). As these digital capabilities multiply, consumer demands will rise in four areas:

1. Now: Consumers will want to interact anywhere at any time.

2. Can I: They will want to do truly new things as disparate kinds of information (from financial accounts to data on physical activity) are deployed more effectively in ways that create value for them.

3. For me: They will expect all data stored about them to be targeted precisely to their needs or used to personalize what they experience.

4. Simply: They will expect all interactions to be easy.

"... One thing is clear: the consumer's experiences with brands and categories are set to become even more intense and defining. That matters profoundly because such experiences drive two-thirds of the decisions customers make, according to research by our colleagues; prices often drive the rest."

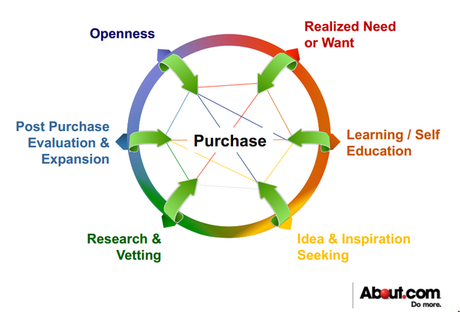

Ned Smith, BusinessNewsDaily Senior Writer, appears to agree with the results of proprietary research conducted by About.com in collaboration with Latitude that seems to merge McKinsey's circular approach with the behaviors exhibited by GroupMNext's six consumer segments. He writes, "The linear churn of the purchase funnel has been supplanted by the 'Purchase Loop,' a spider web of six behaviors that steer the path to purchase." ["Understanding the 'Purchase Loop': Why Consumers Buy," BusinessNewsDaily, 6 February 2013] A press release about the study states, "Key elements of the study found that: Shopping is more complex than simply identifying a need, exploring options and purchasing. Paths to purchase are more complex and less linear. Paths to purchase may require a greater number of 'stops' along the way but purchases happen more quickly. Consumers' relationships with brands are much more personal. Shopping today is less about brands and products themselves and more about the consumers' feelings and needs." ["Press Release – About.com Purchase Loop," Latitude, 5 February 2013] The release goes on to describe the six behaviors along "The Purchase Loop." They are:

- Openness – consumers are receptive to new or better experiences stemming from pre-existing interest in or curiosity about a category or topic area. Consciously or subconsciously, brands, products or services may be on the consumers’ radar.

- Realized want or need – something acts as a catalyst giving the consumer a reason to start looking into things he/she wants or needs to do.

- Learning and education – understanding the broad fundamentals in order to make a purchase the consumer can feel good about.

- Seeking ideas and inspiration – looking for, noticing and keeping track of examples, thought-starters, and motivators in order to take the next step.

- Research and vetting – comparing options, looking for deals, comparing prices, reading reviews and determining personal associations with the brand.

- Post purchase evaluation and expansion – consumer uses or experiences a purchase and decides how he/she feels, might post reviews and share experience, can send the consumer into additional purchase loops if renewed openness to brand or inspiration to look into related products, tasks or needs.

According to the study, those behaviors connect inside the Purchase Loop and can interact with elements of loop along the way (as depicted in the following graphic).

It should be apparent by now that understanding the consumer digital path to purchase is not a straight-forward endeavor. There are nuances and complexities that make the digital path to purchase both difficult to understand and to depict. The most important thing for manufacturers and retailers to understand is that regardless of when or how a consumer gets on the digital path they expect a good experience. Failure to provide that experience almost guarantees a "no sale."