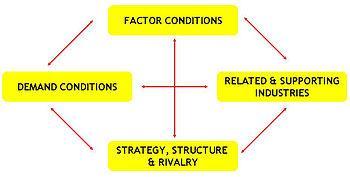

Michael Porter’s Diamond of Advantage (Photo credit: Wikipedia)

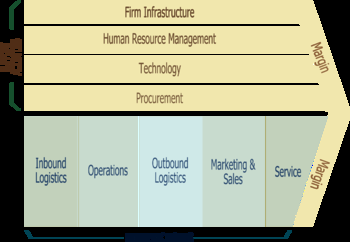

English: Porter’s Value Chain (Photo credit: Wikipedia)

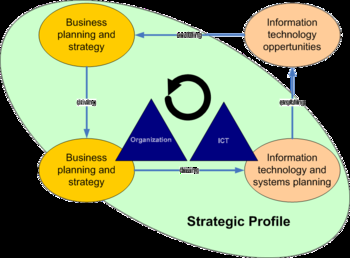

Marine Institute Ireland, Strategic_Planning_Symbol (Photo credit: Wikipedia)

Català: Michael Porter. Česky: Michael Porter. Dansk: Michael Porter. Deutsch: Michael Porter. Español: Michael Porter. Suomi: Michael Porter. Bahasa Indonesia: Michael Porter. Nederlands: Michael Porter. Norsk (bokmål)‬: Michael Porter. Polski: Michael E. Porter. Português: Michael Porter. Српски / Srpski: Majkl Porter. Svenska: Michael Porter. Українська: Майкл Портер. 16 лютого 2009. (Photo credit: Wikipedia)

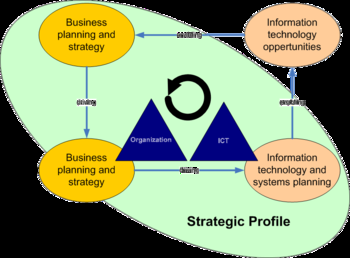

Strategic Aligment Cycle (Photo credit: Wikipedia)

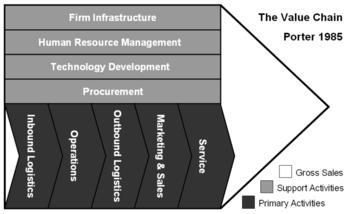

Value Chain Porter 1985 (Photo credit: Wikipedia)

Chapter 4 – Internal Assessment

Overview

Chapter 4 explains how to conduct an effective internal strategic management audit to provide an excellent foundation for formulating strategies.

Key aspects of the basic business functions (management, marketing, finance, production/operations, R&D, and MIS) are reviewed along with value chain analysis, benchmarking, breakeven analysis, and cost/benefit analysis.

“A value chain is a chain of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. The concept comes from business management and was first described and popularized by Michael Porter in his 1985 best-seller, Competitive Advantage: Creating and Sustaining Superior Value”.

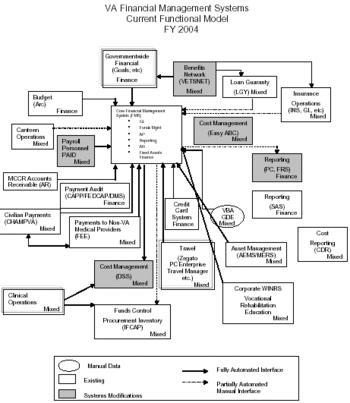

Financial Management System (Photo credit: Wikipedia)

Chapter 4 explains how to develop an Internal Factor Evaluation (IFE) Matrix, an important strategic planning tool.

Learning Objectives:

1. Explain how the nature and role of chief marketing officer has changed.

2. Be able to work out breakeven analysis business problems.

3. Describe how to perform an internal strategic-management audit.

4. Discuss the resource-based view (RBV) in strategic management.

5. Discuss key interrelationships among the functional areas of business.

6. Identify the basic functions or activities that make up management, marketing, finance and accounting, production and operations, research and development, and management information systems.

7. Explain how to determine and prioritize a firm’s internal strengths and weaknesses.

8. Explain the importance of financial ratio analysis. “A financial ratio is a relative magnitude of two selected numerical values taken from an enterprise’s financial statements. They are used to evaluate the overall financial condition of a corporation. Financial ratios may be used by managers within a firm, by current and potential shareholders (owners) of a firm, and by a firm’s creditors. Financial analysts use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in a financial market, the market price of the shares is used in certain financial ratios.”

9. Discuss the nature and role of management information systems in strategic management.

10. Develop an Internal Factor Evaluation (IFE) matrix.

11. Explain cost/benefit analysis, value chain analysis, and benchmarking as strategic-management tools.

Complete the ASSURANCE OF LEARNING EXERCISE 4C: on page 124

**PERFORM A FINANCIAL RATIO ANALYSIS FOR PEPSICO

Follow the 3 steps and tweet your answers.

Table 4.5 on p.105 has a list of websites that offer financial information:

www.money.msn.com

http://finance.yahoo.com

www.morningstar.com

www.hoovers.com in the library database under “Lexis Nexis”

http://globaledge.msu.edu/industries/

Here’s the link to the Food and Beverage Industry: http://globaledge.msu.edu/industries/food-and-beverage

Strategic Aligment Cycle (Photo credit: Wikipedia)

COMMENTS ( 1 )

posted on 14 August at 00:02

Hi there, yes this paragraph is in fact fastidious and I have learned lot of things from it on the topic of blogging. thanks.