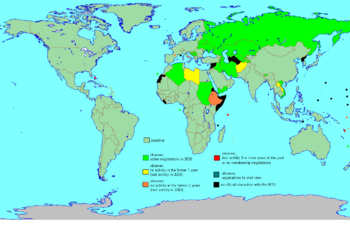

The Doha Development Round started in 2001 and continues today. (Photo credit: Wikipedia)

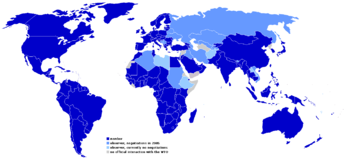

WTO map 2005en (Photo credit: Wikipedia)

The Political Economy of International Trade Learning objectives

• Identify the policy instruments used by governments to influence international trade flows.

• Understand why governments sometimes intervene in international trade.

• Summarize and explain the arguments against strategic trade policy.

• Describe the developments of the world trading system and the current trade issues.

• Explain the implications for managers of developments in the world trade system.

This chapter focuses on the political systems and tools of trade policy. The major objective of this chapter is to describe how political realities shape the international trading system including tariffs, subsidies, and the development of the world trading system. This chapter describes the evolution of the World Trade Organization and its impact on the global business environment.

While in theory many countries adhere to the free trade ideal outlined in Chapter 5, in practice most have been reluctant to engage in unrestricted free trade. The US continues to restrict trade in technological and militarily sensitive products as well as in textiles, sugar, and other basic products in response to domestic political pressures.

The opening case explores the battle over tariffs imposed on Chinese tires exported to the United States and whether the tariffs violate trade agreements. The closing case explores the effect of the recent global financial crisis on the volume of world trade as well as the implications of the protectionist measures some countries have taken in an effort to protect jobs and provide a competitive edge for domestic companies.

Another Perspective: To see additional current figures regarding world trade and tariffs, go to the WTO website {http://www.wto.org/english/res_e/statis_e/statis_e.htm}. For additional information on how the WTO views nontariff barriers, go to {http://www.wto.org/english/thewto_e/whatis_e/tif_e/agrm9_e.htm}.

What is the Political Reality of Free Trade? Free trade refers to a situation where a government does not attempt to restrict what its citizens can buy from another country or what they can sell to another country. Free trade is a policy in international markets in which governments do not restrict imports or exports. Free trade is exemplified by the European Union / European Economic Area and the North American Free Trade Agreement, which have established open markets. Most nations are members of the World Trade Organization (WTO) multilateral trade agreements. However, most governments still impose some protectionist policies that are intended to support local employment, such as applying tariffs to imports or subsidies to exports. Governments may also restrict free trade to limit exports of natural resources. Other barriers that may hinder trade include import quotas, taxes, and non-tariff barriers, such as regulatory legislation.

The main instruments of trade policy are: • tariffs • subsidies • import quotas • voluntary export restraints • local content requirements • antidumping policies • administrative policies Tariffs are the oldest form of trade policy. The principal objective of most tariffs is to protect domestic producers and employees against foreign competition. Tariffs also raise revenue for the government. Domestic producers gain, because tariffs afford them some protection against foreign competitors by increasing the cost of imported foreign goods. Consumers lose because they must pay more for certain imports. Tariffs reduce the overall efficiency of the world economy.

Subsidies take many forms (cash grants, low-interest loans, tax breaks, and government equity participation in domestic firms). By lowering production costs, subsidies help domestic producers in two ways: they help them compete against foreign imports and they help them gain export markets. Subsidy revenues are generated from taxes. Governments typically pay for subsidies by taxing individuals. Therefore, whether subsidies generate national benefits that exceed their national costs is debatable. Subsidies encourage overproduction, inefficiency and reduced trade. In practice, many subsidies are not very successful at increasing the international competitiveness of domestic producers. Rather, they tend to protect the inefficient and promote excess production.

Quotas and Voluntary Export Restraints (VER) are direct restrictions on the quantity of some good that may be imported into a country. The quota restriction is usually enforced by issuing import licenses to a group of individuals or firms. A VER is a quota on trade imposed by the exporting country, typically at the request of the importing country’s government.

Local content regulations have been widely used by developing countries to shift their manufacturing base from the simple assembly of products whose parts are manufactured elsewhere into the local manufacture of component parts. They have also been used in developed countries to try to protect local jobs and industry from foreign competition. From the point of view of a domestic producer of parts going into a final product, local content regulations provide protection in the same way an import quota does: by limiting foreign competition. The aggregate economic effects are also the same; domestic producers benefit, but the restrictions on imports raise the prices of imported components.

Governments sometimes use informal or administrative policies to restrict imports and boost exports. Administrative trade policies are bureaucratic rules that are designed to make it difficult for imports to enter a country.

Information about U.S. trade is readily available on government sites. Visit {www.business.gov} to access an array of links. You can also review the current U.S. tariffs at the U.S. Office of Tariff Affairs and Trade Agreements at {www.usitc.gov/tata/index.htm}. Dumping is defined as selling goods in a foreign market at below cost of production or at below “fair” market value.

The Case for Government Intervention has two types of arguments:political and economic. Political Arguments for Intervention include: • protecting jobs • protecting industries deemed important for national security • retaliating to unfair foreign competition • protecting consumers from “dangerous” products • furthering the goals of foreign policy • protecting the human rights of individuals in exporting countries The most common political reason for trade restrictions is “protecting jobs and industries.”

Countries sometimes argue that it is necessary to protect certain industries because they are important for national security. Defense-related industries often get this kind of attention (e.g., aerospace, advanced electronics, semiconductors). Government intervention in trade can be used as part of a “get tough” policy to open foreign markets. Consumer protection can also be an argument for restricting imports.

Since different countries do have different health and safety standards, what may be acceptable in one country may be unacceptable in others. Sometimes, governments use trade policy to support their foreign policy objectives. Governments sometimes use trade policy to create pressure for improving the human rights policies of trading partners. For years the most obvious example of this was the annual debate in the United States over whether to grant most favored nation (MFN) status to China. MFN status allows countries to export goods to the United Status under favorable terms. Under MFN rules, the average tariff on Chinese goods imported into the United States is 8 percent. If China’s MFN status were rescinded, tariffs would probably rise to about 40 percent.

In the United States, the Bureau of Export Administration enhances the nation’s security and its economic prosperity by controlling exports for national security, foreign security, foreign policy, and short supply reasons. To learn more, go to {http://www.bis.doc.gov/} and click on Export Administration regulations.

There are many economic arguments for Intervention. Protecting infant industries and strategic trade policy are the main economic reasons for trade restrictions. The infant industry argument has been considered a legitimate reason for protectionism, especially in developing countries. Many economists criticize this argument: protection of manufacturing from foreign competition does no good unless the protection helps make the industry efficient. Brazil built up the world’s 10th largest auto industry behind tariff barriers and quotas. Once those barriers were removed in the late 1980s, however, foreign imports soared and the industry was forced to face up to the fact that after 30 years of protection, the Brazilian industry was one of the most inefficient in the world.

Strategic trade policy where the existence of substantial scale economies suggests that the world market will profitably support only a few firms, and may justify government intervention in industries with possibly large economies of scale. Such intervention reduces the competitive effect of existing first-mover advantages held by foreign companies. While strategic trade policy identifies conditions where restrictions on trade may provide economic benefits, there are two problems that may make restrictions inappropriate: retaliation and politics. Krugman argues that strategic trade policies aimed at establishing domestic firms in a dominant position in a global industry are beggar-thy-neighbor policies that boost national income at the expense of other countries. Special interest groups may influence governments.

The Development of the World Trading System has evolved. Until the Great Depression of the 1930s, most countries had some degree of protectionism. Great Britain, as a major trading nation, was one of the strongest supporters of free trade. Although the world was already in a depression, in 1930 the United States enacted the Smoot-Hawley tariff, which created significant import tariffs on foreign goods.

As other nations took similar steps and the depression deepened, world trade fell further. After WWII, the United States and other nations realized the value of freer trade, and established the General Agreement on Tariffs and Trade (GATT). The approach of GATT (a multilateral agreement to liberalize trade) was to gradually eliminate barriers to trade. Over 100 countries became members of GATT, and worked together to further liberalize trade.

For a full review of GATT, containing an actual copy of the agreement, is available at {http://www.ciesin.org/TG/PI/TRADE/gatt.html}.

Protectionism is motivated by 3 factors:

1. Japan’s success in such industries as automobiles and semiconductors coupled with the sense that Japanese markets were closed to imports and foreign investment by administrative trade barriers.

2. The world’s largest economy, the United States, was plagued by a persistent deficit. The loss of market share to foreign competitors in industries such as automobiles, machine tools, semiconductors, steel, and textiles, and the resulting unemployment gave rise to renewed demands in the U.S. Congress for protection against imports.

3. Many countries found ways to get around GATT regulations. The Uruguay Round wrote the rules governing: -the protection of intellectual property rights -the reduction of agricultural subsidies -the strengthening of GATT’s monitoring and enforcement mechanisms

The Future of the WTO, unresolved issues and the Doha Round must be explored. In addition to the impasse at the meetings over agricultural subsidies, the Seattle round was a lightning rod for a diverse collection of organizations from environmentalists and human rights groups to labor unions that opposed free trade. All these organizations argued that the WTO is an undemocratic institution that was usurping the national sovereignty of member states and making decisions of great importance behind closed doors. They took advantage of the Seattle meetings to voice their opposition.

The Doha Round had several initiatives: Cutting tariffs on industrial goods and services. In 2000, for example, the average tariff rates on non-agricultural products were 4.4% for Canada, 4.5% for the European Union, 4.0% for Japan, and 4.7% for the United States. On agricultural products, however, the average tariffs rates were 22.9% for Canada, 17.3% for the European Union, 18.2% for Japan, and 11% for the United States.

Phasing-out subsidies that introduce significant distortions into the production of agricultural products. The net effect is to raise prices to consumers, reduce the volume of agricultural trade, and encourage the overproduction of products that are heavily subsidized (with the government typically buying up the surplus).

Reducing antidumping laws and the WTO, allow countries to impose antidumping duties on foreign goods that are being sold cheaper than at home, or below their cost of production, when domestic producers can show that they are being harmed. WTO on intellectual property should allow for health protection in poorer nations. Rich countries have to comply with the rules within a year. Poor countries, in which such protection generally was much weaker, have five years’ grace, and the very poorest have ten years.

To see current issues at the WTO, go to {http://www.wto.org} and click on “News.” In addition, consider {http://www.businessweek.com/news/2011-05-20/doha-talks-on-trade-face-unbridgeable-gaps-apec-ministers-say.html}.

Managers need to consider how trade barriers affect the strategy of the firm and the implications of government policy on the firm. Trade barriers are a constraint upon a firm’s ability to disperse its productive activities. International firms have an incentive to lobby for free trade, and keep protectionist pressures from causing them to have to change strategy.

WTOmap (Photo credit: Wikipedia)