Uber and Lyft, 2 giant players of on-demand taxi industry are planning to go public in 2019. A major revenue growth is sure on their (Uber’s & Lyft’s) way.

What does going public means? Private companies offer IPOs to public and financial companies, ownership shifts to individuals buying the IPOs of the company.

Uber’s value will be as much as $120 billion if it goes public in 2019.

Which is more that General Motors, Ford, and Fiat Chrysler combined, or eight times Lyft’s current valuation at $15 billion.

Let us understand their current financial stand in the market.

Uber

Uber is dealing with low growth since the data breach disaster and the controversial CEO resigning from Uber. It saw profits in first quarter of 2018, that too after inclusion of proceeds from the sale of assets in Russia and Southeast Asia. In second quarter they incurred net loss of $891 million.

The reason for slower growth rate can also be Uber moving to different ventures like food delivery simultaneously than their core function of providing rides to customers.

Overall, as 2017 was not really a very profitable year for Uber and it got reflected on its growth rate in 2018. Considering all the whirlpool of scams it fell into, it might take some time for general public to move on from the entire scenario.

Thankfully, new CEO Dara Khosrowshahi has been successful in cleaning up Uber’s image in the market up to some extent.

Lyft

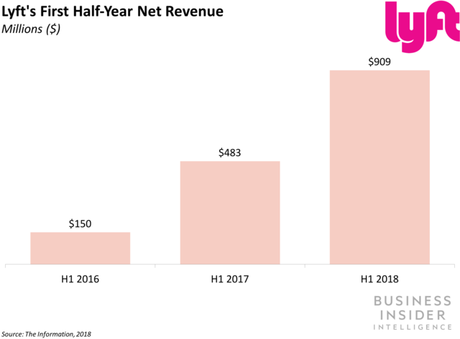

Lyft’s accelerated revenue growth has led to its valuation to $15.1 billion in its recent funding round, which is double than company’s previous valuation.

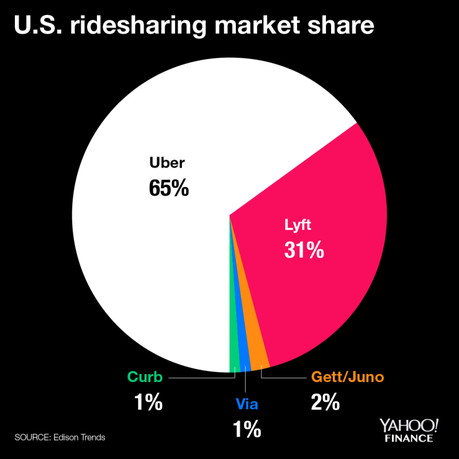

Lyft only operates in Canada and US as against Uber’s global presence but has captured around 31% of US market as its closest competitor Uber was stuck in the year full of disputes.

Lyft has recorded a substantial growth in no. of rides for past few years and expect it to reach 550 million rides at the end of 2018.

Lyft’s revenue is on rise continuously, it recorded $909 million as revenue this year(2018) and the revenues are expected to be around $8.5 billion in 2030!

Lyft & Uber going public!

Lyft & Uber are both in the news for their decision of going public. Investors are waiting to buy the IPOs of these 2 taxi providing giants.

Lyft is said to have appointed JP Morgan(an American multinational investment bank & financial services company) to go ahead with the plan of going IPO, which is scheduled for early 2019.

Lyft is planning to go public before Uber to gain the sizable portion of investors appetite. Uber being the larger business amongst the 2 has more takers for its IPOs and Lyft is suspicious that investors might not remain interested in buying Lyft’s IPOs if Uber goes public first.

Even though Uber has larger market share globally, Lyft’s increasing popularity and promising growth is what makes it interesting for investors to buy its IPOs.

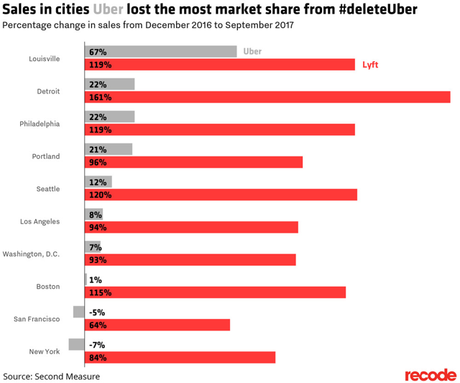

The above infographic shows how Lyft made big advances in cities like San Francisco and New York, compared to Uber.

The above infographic shows how Lyft made big advances in cities like San Francisco and New York, compared to Uber.

It will be very interesting to see both of these ride hailing giants going public and its after effects on their respective growth rates and revenue generation.

In Conclusion

Lyft being a smaller organization operating in US & Canada has a capacity to stand against Uber, which has wider global presence and capture around 1/3rd of US ride hailing market.

This explains that the ride hailing business is still open for new entrants to make it big against the well established players of the industry.