In what has become an annual tradition, 24/7 Wall Street released their list of "beers Americans no longer drink" this week, sparking no outrage or surprise for beer enthusiasts around the country.

This year's list includes beers that may leave you scratching your head wondering why people still bother, but while distribution networks are large for Big Beer, the sales of these beers are not.

The 2014 list, which represents "barrels shipped" in 2013, includes home run hitters like Budweiser Select, Milwaukee's Best and even Budweiser itself. Of biggest surprise is the inclusion of Miller High Life and Miller Lite, both which hadn't appeared in earlier versions of this list.

For our visually-minded friends, I've gone back to the previous four lists and charted the downward course of six of these beers that appear in multiple years. Worth noting, 24/7 Wall Street counted "barrels sold" in the lists covering 2010 to 2012 and changed it to "barrels shipped" for 2013. For sake of argument, let's just assume all the barrels shipped were sold, even if this is based on figures from a piece about beers nobody wants to drink.

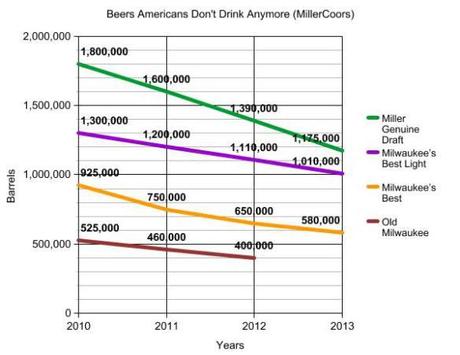

First, here are beers represented on the list brewed by parent company MillerCoors:

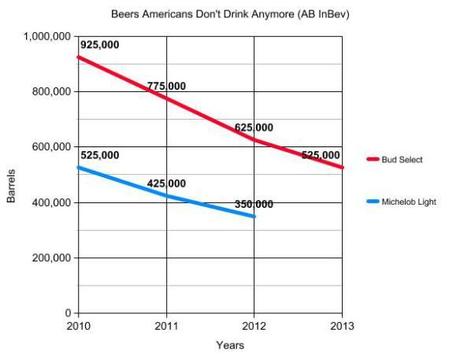

And here are beers made by parent company AB InBev:

Not pictured in these charts, Miller High Life and Miller Lite (MillerCoors), who lost 21.2 percent and 22.6 percent in sales from 2008 to 2013, respectively. Miller Lite won't be on this list next year, thanks a boost in sales from its retro label rebranding.

Budweiser, which has lost 27.6 percent of sales from 2008 to 2013, was down to 16 million barrels shipped last year. No surprise, given that Millennials don't care for it.

All of these brands are obviously huge, with the smallest tally in 2013 coming from Budweiser Select. Even at 525,000 barrels shipped in 2013, that was still roughly 76 percent more than what Lagunitas sold in the same year.

By now, we all know the gimmicks multinational companies are taking to rebrand and gain attention. AB InBev has made news lately for buying craft breweries, which is certainly good for its future prospects, but I'm mostly curious about MillerCoors.

That company seemingly dominates this "beers Americans don't drink" list year-in and year-out, but does get a decent bounce from owning brands like Blue Moon and Leinenkugel Brewing Company, which both sell very well.

I do take this showing as a paring with the idiotic comments made by MillerCoors chairman Pete Coors, however, and wonder what kind of necessary innovation is on the horizon for the company. In terms of stock, MillerCoors is doing alright, but Miller Fortune hasn't performed as gangbusters as they expected and do you remember the failure that was Miller Chill? Maybe hard ciders Crispin and Smith & Forge are their best bets moving forward, along with their continued push of a reinvigorated Miller Lite.

Above all else, these two charts showcase why craft beer had another consecutive banner year and why companies like MillerCoors and AB InBev are on the hunt for ways to get into the craft game.

Related: He Said What? Pete Coors and His Magical Mystery Press Tour+Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac