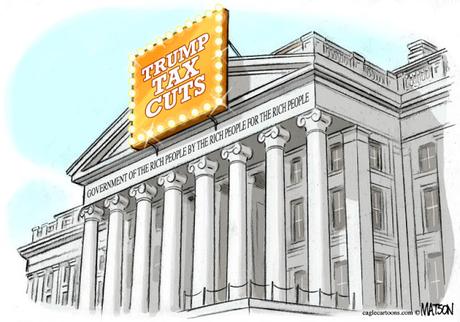

(Cartoon image is by R.J. Matson at cagle.com.)

(Cartoon image is by R.J. Matson at cagle.com.)When Donald Trump and the GOP Congress passed their tax plan, they tried to call it a middle class tax cut. That was immediately recognized as a lie, since the richest Americans and corporations got almost all of the tax cuts. They then tried to say workers would benefit from the plan, because the benevolent corporations would pass their enormous savings on to workers in the form of higher wages and new jobs. That has also turned out to be nothing but a LIE! Job creation has not substantially increased and worker wages have not increased either.

Ryan Koronowski at Think Progress gives us the sad truth about what has (not) been passed down to workers by the corporations:

According to President Trump, we are living in “the greatest economy in the HISTORY of America and the best time EVER to look for a job.” The details reveal something a little different. While unemployment may be low, workers are experiencing historically low wage growth, while companies are responding to Trump’s recent tax cut by routing their profits predominantly to top executives and big shareholders in the form of stock buybacks. A Wall Street Journal analysis of how 1,111 companies pay their workers released Wednesday morning illustrates this in stark terms. While “median pay lies between about $44,000 and $95,000 for about half of the 1,111 companies in the S&P 1,500 index that have disclosed median employee pay,” zooming into specific large companies that have been actively padding the wallets of their largest shareholders through stock buyback programs reveals that the true priority here is not sustainable long-term raises for middle-class workers. The Journal’s Theo Francis and Yaryna Serkez found that “employing low-wage workers directly drags median pay down. Median pay at McDonald’s was much lower, at $7,017, in part because McDonald’s directly employs hourly servers at more of its restaurants.” The low median pay at McDonald’s comes as the fast-food behemoth bought back $1.6 billion in stock in the first quarter of 2018 alone. “At Walmart, with 2.3 million workers, half made less than $19,177,” the Francis and Serkez found. Late last year, Walmart launched a stock buyback initiative to the tune of $20 billion in order to boost its stock prices, which disproportionately enriches the biggest stockholders in the company. Gap’s very low median pay of $5,375 per year coincided with the company buying back $100 million in stock last quarter. The median pay at Chipotle was $13,582 — last year it offered a $100 millionstock buyback program. They did it again in April. Yum Brands, the parent company of brands like Taco Bell, KFC, and Pizza Hut, paid its workers a median yearly wage of $9,111. Late last year they offered a $1.5 billion stock buyback program, and recently reporting $528 million in buybacks in the first quarter of 2018 alone. Amazon, anomalous with the companies on this list, has not run a stock buyback in six years, and its median pay was $28,446, according to the Journal. Some of these figures are misleading — median pay at Dunkin Donuts appears high because most of its direct employees are office workers, for example, with nearly all of the people who work in or operate the retail stores working for franchisees. Similarly, Hasbro reported a median pay of $74,207 as it outsourced factory workers who earn far less, while Mattel’s figure of $6,271 reflects the fact that it directly employs its factory workers rather than using secondary employment tactics. Other companies employ many seasonal or part-time workers. Overall, however, this is what weak wage growth looks like. This is also how corporate America works. A study from the National Employment Law Project and the Roosevelt Institute, released Tuesday, found that between 2015 and 2017, “companies spent almost 60 percent of net profits on buybacks.” They do this instead of investing in worker pay. In fact, the restaurant industry spent more money on stock buybacks than they actually earned in profits, fueling the buybacks with debt and existing cash reserves. “Companies in the retail and food manufacturing industries spent 79.2 percent and 58.2 percent, respectively, of their net profits on share buybacks,” the report’s authors found. This was the state of play just before the tax cut, passed late last year, caused an even higher surge of buybacks — which reveals the priorities of these companies, and the politicians who fought so hard to cut corporate taxes. If McDonald’s had spent the money it poured into stock buybacks between 2015 and 2017, it could have given raises of $4,000 per year to its 1.9 million workers, according to the new study. The effort to make the nation’s wealthiest investors even richer doesn’t stop with tax cuts and stock buybacks — the Trump administration is also considering a ploy to bypass Congress and let people who sell their assets pay even less in capital gains, which would mean a $100 billion tax cut for the rich.