Trump wants people to believe his tariffs (on China and others) are paid by other countries. They are not. They are paid by American companies, and then passed on to the American people. In essence, they are nothing but a big (and sneaky) tax increase -- one of the biggest tax increases in many years. But other tax increases were voted on and passed by Congress (as is supposed to happen). Trump's were done by executive order, and the men and women in Congress (of both parties) had nothing to do with them.

The following is by Scott Liesman at cnbc.com:

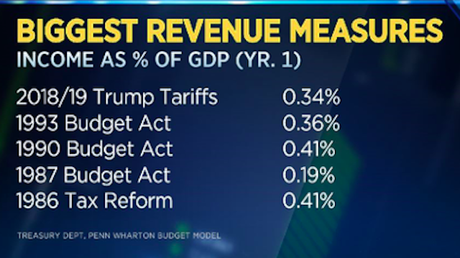

President Donald Trump, having championed one of the larger tax cuts in recent years, has now enacted tariffs equivalent to one of the largest tax increases in decades. A CNBC analysis of data from the Treasury Department ranks the combined $72 billion in revenue from all the president’s tariffs as one of the biggest tax increases since 1993. In fact, the tariff revenue ranks as the largest increase as a percent of GDP since 1993 when compared with the first year of all the revenue measures enacted since then, according to the data. Only the revenue raised in the fourth year of the Affordable Care Act is greater, but not by much. The nonpartisan Tax Foundation estimates all the tariffs enacted by the president, including the latest increase from 10% to 25% on $200 billion on Chinese goods, will raise $72 billion in revenue, equal to 0.34% of U.S. gross domestic product. Revenue raised in the first year of the 1993 budget and reconciliation act equaled 0.36% of GDP. . . . Kent Smetters of the Penn-Wharton Budget Model and a former Treasury official during the Bush administration, estimates that the tariff increase will cost the median U.S. household with earnings of $61,000 about $500 to $550 a year. It’s the equivalent, he said, of raising the Social Security retirement tax by 1 percentage point to 11.6%. Such a large revenue measure, according to Pomerleau, if it were a tax, would have been subject to considerable economic analysis from the Congressional Budget Office or the Joint Committee on Taxation for the potential effects on growth, inflation and jobs. No such analysis has been offered or is believed to have been conducted by the administration regarding the current tariffs. And the revenue measure is by far the largest enacted without congressional approval. Congress, in a series of laws, has ceded to the president vast powers to levy tariffs.