Donald Trump and the Republican Congress gave the biggest tax cuts to corporations in their new tax law. The corporate tax rate was lowered to only 20% (with loopholes and subsidies left intact) -- a cut of over 50%. They told Americans that corporations would use that extra money to pay higher wages and create new jobs, and thus, the middle class would be the primary beneficiaries of that corporate cut.

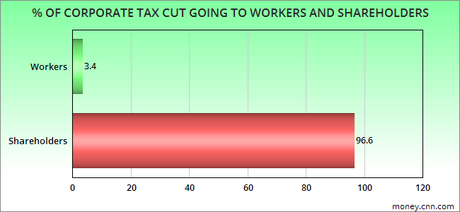

That has not happened. The corporations were honest about what they would do with the tax savings before the law was passed -- use it to buy back their own stocks (driving up the stock prices and benefitting their shareholders). And that's exactly what they have done. Only 3.4% (about $6 billion) of the tax cut has gone to workers (mostly in one-time bonuses), while a whopping 96.6% (about $171 billion) has gone to enrich the shareholders.

This should not be a surprise to anyone. Trickle-down economics (which this tax cut is a prime example of) has always made the rich richer while doing little to nothing for the rest of Americans. It simply doesn't work as the Republicans have always promised it would.

Here is what former Labor Secretary Robert Reich tells us about it:

H

ow to build the economy? Not through trickle-down economics. Tax cuts to the rich and big corporations don’t lead to more investment and jobs. The only real way to build the economy is through “rise-up” economics: Investments in our people – their education and skills, their health, and the roads and bridges and public transportation that connects them. Trickle-down doesn’t work because money is global. Corporations and the rich whose taxes are cut invest the extra money wherever around the world they can get the highest return. Rise-up economics works because American workers are the only resources uniquely American. Their productivity is the key to our future standard of living. And that productivity depends on their education, health, and infrastructure.Just look at the evidence. Research shows that public investments grow the economy. A recent study by the Washington Center for Equitable Growth found, for example, that every dollar invested in universal pre-kindergarten delivers $8.90 in benefits to society in the form of more productive adults. Similarly, healthier children become more productive adults. Children who became eligible for Medicaid due to expansions in the 1980s and 1990s were more likely to attend college than similar children who did not become eligible. Investments in infrastructure – highways, bridges, and public transportation – also grow the economy. It’s been estimated that every $1 invested in infrastructure generates at least $1.60 in benefits to society. Some research puts the return much higher. In the three decades following World War II, we made huge investments in education, health, and infrastructure. The result was rising median incomes. Since then, public investments have lagged, and median incomes have stagnated. Meanwhile, Ronald Reagan and George W. Bush’s tax cuts on the top didn’t raise incomes, and neither will Donald Trump’s. Trickle-down economics is a hoax. But it’s a convenient hoax designed to enrich the moneyed interests. Rise-up economics is the real deal. But we must fight for it.