There are simply too many choices. There are way too many sites and coins to invest in, and no single source provides a whole picture. That is why we are making this article for you to help out with this situation. Let's rank the centralized and decentralized techniques for staking your crypto, since this is important, and I'll explain why.

Let's imagine you wanted to put your money on Cosmos. This is what your returns would be if you invested $1,000 in Cosmos on Coinbase at their 5% rate after five years if there was no price change. A total value of $1,276.

If you staked Cosmos directly, that is, without using an exchange, at the present rate of 12.49 percent, your ending balance after five years would be $1,801, a gain of 190 percent over simply staking your coin someplace else. Nothing irritates me more than a squandered chance, and all I want for you is to acquire more.

Staking Break Down

The process through which a proof-of-stake cryptocurrency validates transactions on its ledger is known as staking. It's similar to Bitcoin mining, only Bitcoin employs physical restrictions like power or expensive technology to ensure that no fraudulent transactions take place.

A proof-of-stake cryptocurrency relies on your assets as a kind of good faith to keep the system functioning smoothly. Because you are not really transmitting or borrowing your cryptocurrency, staking it is about as risk-free as passive revenue gets.

The largest danger of staking is human mistakes, such as forgetting a password. Staking, in my opinion, is better for cryptos that you already want to keep for a long time. Staking is a no-brainer if this is the case. Simply put, you make more money. If you're a short-term investor, here is where staking may expose you to additional volatility concerns, and you should reconsider your approach.

Let's take a look at some of the best staking solutions available on the internet, starting with centralized exchanges.

Centralized Exchanges

Centralized Option 1

You can really stake directly on Coinbase if you're a Coinbase customer. Staking alternatives, on the other hand, are quite restricted. Staking is available on Coinbase for Cosmos, Tezos, Ethereum, and Algorand.

Each currency yields between 4% and 5% APY, which doesn't seem awful until you consider what those coins earn in their natural form. Tezos and Ethereum 2.0 aren't bad at all. After fees, we can observe that their native staking payouts aren't far behind Coinbase's.

On Coinbase, Algorand is actually rather good. On Coinbase, they give 4%, which is higher than the 2.53 percent you'd get natively.

Coinbase's rates For Cosmos, on the other hand, are horrible. Staking rewards on Cosmos are 12.5 percent, on Coinbase they are 5%, and this isn't exclusive to Coinbase; you'll note that staking payouts on big platforms are practically random.

Centralized Option 2

Outside of Coinbase, though, you start to see greater returns, and CEX.io is a good illustration of this. You have access to a considerably larger number of tokens for staking, like MetaHash, which pays 14 percent APY. This may be the first time you've heard of MetaHash, and that's because it's a rather small coin, and you'll observe this tendency as well.

Certain exchanges will provide a few minor cryptocurrencies with large incentives for staking on their platforms. These may appear to be a fantastic deal, but keep in mind that while staking, you are still exposed to volatility risk. If MetaHash drops 14%, you've already lost a year's worth of incentives.

So just be cautious and don't get into a project simply because it offers huge stakes. Aside from that, Cex.io gives some fairly significant prizes for a few well-known projects. Solana and Tezos receive rewards that are comparable to native rates, which is quite essential.

Polkadot and Polygon are also not bad. Personally, I would stay away from Cosmos and Cardano on this platform.

Centralized Option 3

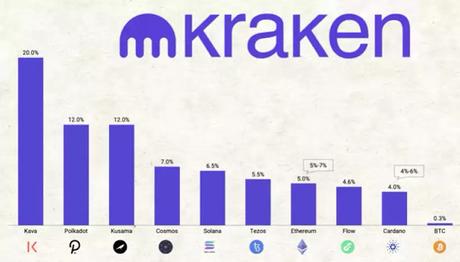

Kraken is unquestionably one of the best staking choices, particularly for Polkadot, Solana, and Ethereum 2.0, where yields aren't too far off native rates. However, with a percentage of 20%, Kava stands out. This looks to be comparable to Kava's native stake rates.

Kraken is also one of the best Cardano exchanges, with a 4 percent compared to roughly 5% if you stake directly through the Cardano stake pool. Kraken's Kusama rates are acceptable when compared to native rates, but Cosmos is terrible when compared to other options.

Centralized Option 4

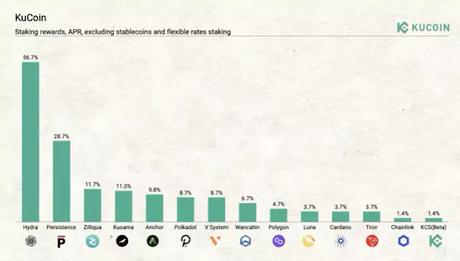

Okay, we've got Kucoin now. I like Kucoin for a lot of reasons, but staking isn't one of them. Kucoin, I apologize. The rates are simply unacceptable. I would mention that they do have a great feature called Soft Staking that reduces the need to store your tokens for such a lengthy period of time.

But, Kucoin, you need to raise your prices. I'd want to invest here, but the rates aren't attractive. Hydra has the highest APY staking on Kucoin, at 56 percent, which is insanely high. However, this is another one of those cryptos with a minimal market valuation.

As a result, investment in that coin has a higher risk of volatility. Then we have Persistence with a 28% yield. But beyond that, rates aren't amazing.

Centralized Option 5

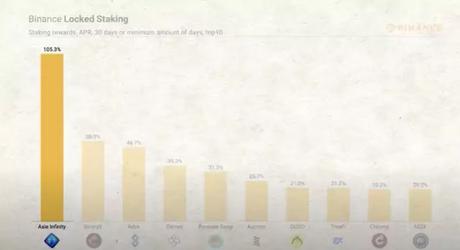

Let's take a look at Binance lock staking, which is a little different than Binance DeFi, which we'll talk about in a minute. Because my data is based on the percentage yield for the previous 30 days, the annual outcome may fluctuate significantly. And the same could be said for any of the tokens described today.

In many circumstances, they aren't like fixed rates. As you can see, the AXS token for Axie Infinity is at the top of the list, with staking payouts of more than 105 percent. This is approximately the biggest income you'll get for large-size crypto staking outside of the wild world of DAOs.

If you own AXS or play the game, not staking this currency is a huge mistake. We have high APR data for BinaryX, another play-to-earn gaming token, in addition to Axie. Because this game was built on the Binance smart chain, it's only natural that Binance would give some of the finest staking payouts.

Many more tokens, like Adex, PancakeSwap, and many others, are available on Binance for large 20 percent to 45 percent APYs.

Binance also provides a huge number of stackable currencies, including competitive prices for Cardano and Solana, and they may have the highest amount of alternatives in general, so it's not a terrible pick among the centralized options.

So far, we've looked at some of the higher-yielding staking choices available on centralized exchanges. Now we must discuss DeFi, which will result in improved prices. Usability, on the other hand, is significantly lower. You must ensure that your personal wallet is secure. You can't call customer support if you have problems, so you'll have to be a little more tech-smart, but you'll make more money.

Decentralized Options

Decentralized Option 1

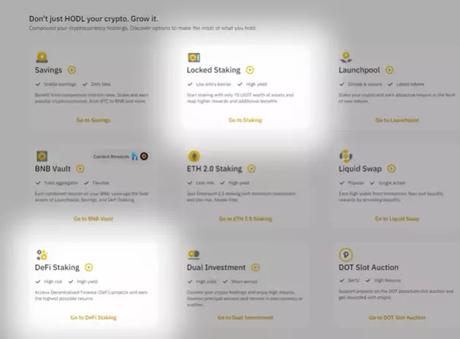

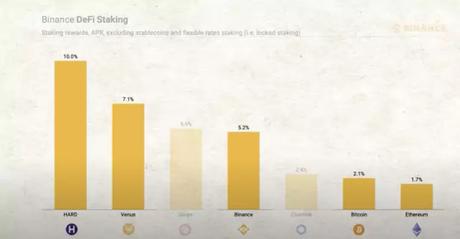

Binance, for example, has created DeFi staking, which is an attempt to bridge the gap between centralized and decentralized staking. The Kava lend HARD Token and Venus token are now the best two performing tokens on the site, with 10 percent and 7% returns, respectively, while the stats for Bitcoin, Ethereum, and BNB aren't any better than what we can obtain elsewhere.

Decentralized Option 2

We can't talk about defi staking without mentioning PancakeSwap, as they name themselves, the most popular decentralized platform in the Galaxy.

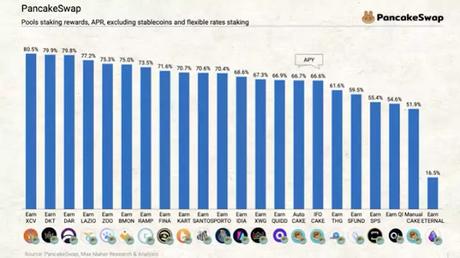

I organized all of the syrup pools into this chart by yield, and at the moment I obtained this data snapshot, the highest APY was for XCarnival, which is a Metaverse asset aggregator with an APY of well over 80%. DKT and DAR, both with a 79 percent APY, are close runners-up for pools.

Both of those tokens are utilized in play-to-earn games, but they don't appear to have the same level of support as a game like Axie Infinity, so the dangers are significant. They are investments with a high level of risk.

You may now go with a more popular choice and invest in PancakeSwap's very own CAKE token in their Auto CAKE pool, which now pays a 66 percent annual percentage yield. This is one of the highest-yielding cryptos with a greater market value that you may invest in.

How do they are at such high rates?

Now, here's a comparison of some of the highest-yielding cryptos, with staking yields as high as 120 percent. And you could be thinking to yourself, "How is this really conceivable in the long run?" or "How is this even sustainable?"

The answer is that it isn't. Long-term inflation would be far too high to maintain those rates for several years. Many cryptocurrencies will offer high dividends for a limited time in order to attract investors, but this does not always imply that they are a fraud.

It's easiest to think of it as a more advanced version of air-dropping coins. People that keep their tokens for a long time are rewarded with extremely high APYs. However, just because the returns are substantial doesn't imply you should invest your whole life savings in a project like this.

So let's summarize this

If you're going to hold a cryptocurrency for a long time, staking is the way to go. It's a no-brainer to stake and earn more money if that's the case. The ideal staking platform is determined by the cryptocurrency you want to stake and your level of internet knowledge.

Centralized exchanges, like Coinbase or Binance, will make it as simple as possible for you to stake your coins and then forget about them. However, as we can see, these exchangers almost all charge hefty fees, with only a few exceptions.

Decentralized staking, on the other hand, which is basically going straight to the source, will provide you the greatest payout possible, but it will take a lot more time.