The mortgage industry is a fast-growing one in the real estate space. Most people are acquiring home loans to build houses, and therefore they need information about mortgages before going forward with the purchase.

So, whether you're a mortgage officer, lender, or real estate agent, you can use this opportunity to become an authority in your niche by writing blog posts on mortgage topics. When you provide information on mortgage-related topics, you help your audience learn more about the industry.

Furthermore, this can help you build trust with your readers and establish yourself as an expert on mortgages. This will build your domain authority and boost your business as clients will easily trust you and be willing to work with you.

Here is the top 14 Mortgage Blog Topics That Enhance Your Niche Authority:

1. Mortgage Marketing

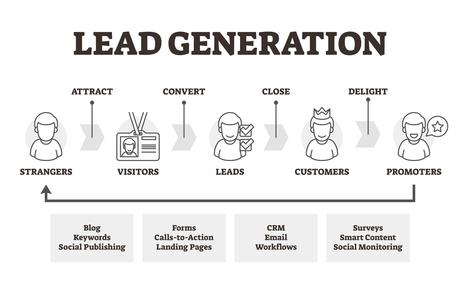

Most loan officers in the mortgage space want to reach as many clients as possible. However, the competition can be stiff. And if you don't have a strong marketing strategy, you might miss out on potential customers.

Hence, the best way to help loan officers bridge the gap between them and the clients is by blogging on marketing ideas for mortgage services.

You can start by writing about online marketing for mortgage loan officers, social media strategies for mortgage companies, and mortgage search engine optimization (SEO). Writing about these topics will help educate loan officers on how to target quality leads and sell their services.

Once they find your site informative, they'll keep coming back to it as a source of relevant information. As a result, your niche authority will keep growing with every update you make about marketing mortgage loans.

2. Mortgage Interest Rates

Interest rates are a hot topic in the mortgage industry as they tend to fluctuate often. Mortgage interest rates directly impact how much a borrower will pay for their loan. As such, it's essential to stay updated on any changes in the industry to advise your readers accordingly.

Consequently, you can write blog posts about how mortgage interest rates affect home buyers or how to get the best mortgage interest rates.

By providing information on these topics, you'll be able to help your readers understand how interest rates work and how they can get the best deal possible.

At the same time, you can also get loan officers interested in learning about interest rates, which helps them set theirs based on market conditions and government rules. This will ensure they don't overcharge or undercharge and remain compliant when setting mortgage rates.

3. Types Of Mortgages

Another mortgage blog topic you can write about is the different types of mortgages available. This will help educate your audience on the various financing options they have when looking to buy a home.

You can write about topics such as 'What Are the Different Types of Mortgages?', 'Which Mortgage Is Right for Me?', and 'How Do I Qualify for A Mortgage?'.

You can also discuss each of the mortgage types available for homebuyers in detail. This will include Federal Housing Administration (FHA) loans, Veterans Affairs (VA) loans, bridge loans, fixed-rate loans, and conventional mortgages.

All these loans are unique in their perks and constraints. So, blogging about them will help your readers when they apply for a mortgage.

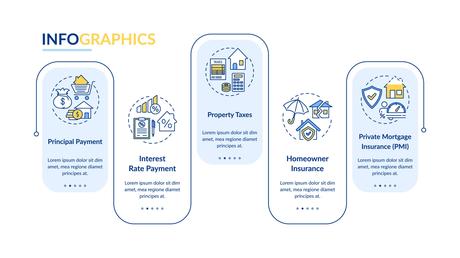

4. The Mortgage Process

The mortgage process can be a bit complicated for first-time home buyers. So, writing a step-by-step guide on how to go about it can be very helpful. You can write about how to get a mortgage, the mortgage application process, or what the requirements are to apply for a mortgage.

You can also provide useful information about the documents, fees, and other costs that home buyers may face throughout the process. In addition, you can write about loan origination fees, home appraisals, and lender credit, for example.

Moreover, you can educate first-time homebuyers with topics such as 'What Is Mortgage Insurance?', 'Should I Pay Points to Lower My Mortgage Rate?' and 'What Are Mortgage Escrow Accounts?'.

Significantly, writing about these subjects will help your readers understand the mortgage process better and know what to expect. This will reduce the anxiety that comes with applying for a mortgage loan. It'll also help them avoid mistakes in the application process.

5. Technological Tools In Mortgages

The mortgage industry is rapidly evolving, and new technologies are being developed to make the process more efficient. For instance, mortgage companies are now using client relationship management (CRM) software to manage their clients and prospects. This software helps mortgage companies automate repetitive tasks, freeing up time for loan officers to focus on selling.

However, not everyone in the mortgage industry is aware that there are tools to help them sell more loans or manage clients better. On the other hand, those who are using such technologies may be unaware of their full potential.

Therefore, you can remove the content gap by writing articles about the benefits of mortgage CRM software and how it can help mortgage companies increase their sales.

6. Foreclosure And Short Sales

The mortgage industry isn't all about happy stories. Some mortgage companies find themselves having to deal with foreclosures and short sales.

Foreclosure is the legal process wherein a mortgage company tries to recover the balance of a loan from a borrower who has defaulted on their payments. On the other hand, a short sale is when a mortgage company allows a borrower to sell their property for less than what they owe on the mortgage.

You can educate people on these topics by writing about the difference between a foreclosure and a short sale. Furthermore, you can provide information on the consequences of a foreclosure or how to avoid a foreclosure.

In addition, you may also write about subjects like 'Making Mortgage Payments on Time' and 'Working with Your Mortgage Lender' if you want folks to learn more about preventing foreclosure.

These topics will help home buyers stay informed about foreclosure cases and learn how to bounce back from a foreclosure or a short sale. In turn, your blog site will be their go-to option for such resources, and this will build your niche authority.

7. Mortgage Pre-Approval

Mortgage pre-approval is one of the most popular topics in the mortgage industry. A mortgage pre-approval is when a mortgage company agrees to lend a borrower a certain amount of money before finding a property. This gives home buyers confidence when looking for their dream home, knowing they've already been approved for a mortgage loan.

Under this category, you can write topics about the mortgage pre-approval process, what mortgage companies look for when approving a borrower, how to improve your chances of getting mortgage pre-approval, etc. These topics are popular among home buyers as most of them are always looking for ways to get pre-approved mortgages.

8. Mortgage Refinancing

Mortgage refinancing is one of the most important topics that you should write about. Homeowners are always looking for ways to lower their monthly payments. Thus, getting better mortgage plans and financing can help them do that.

When writing about this topic, you can tell your readers about the best refinancing options, where to get the best refinancing lenders, and the best time to refinance your mortgage. You can also write about how much a homeowner can save through mortgage refinancing.

Furthermore, you can also provide information about the risks of mortgage refinancing. In addition, you can write about the benefits and drawbacks of refinancing so that your readers can make informed decisions before refinancing.

9. Compare Mortgage Lenders

Mortgage companies are always looking for ways to stand out from the competition and attract more borrowers. You can help them by writing articles that compare mortgage lenders. In these articles, you can provide comparisons based on their interest rates, customer service, fees, etc.

On the other hand, you can also write about the pros and cons of working with a particular mortgage lender .

This will help home buyers choose a suitable mortgage lender. It'll also attract loan officers as they would want to see how they compare against other lenders in the region and where they excel or fall short.

For example, writing a topic like '10 Best Lenders in Nashville' makes home buyers and loan officers in the region click the link to see the best lender. But always make sure to update your listing as services change and new lenders come into the market.

10. Down Payments

Down payments are another popular topic in the mortgage industry. A down payment is a percentage of the purchase price of a property that a borrower pays upfront. The remaining balance is then paid in monthly installments over the life of the loan.

Under this category, you can write about how much a home buyer needs for a down payment or how to save for a down payment. These topics are popular among home buyers as they're always looking for ways to save money when buying a property.

11. Mortgage Trends

The COVID-19 pandemic has had a significant impact on the mortgage industry. Many mortgage companies have had to change how they operate due to the pandemic. For example, some mortgage companies now offer digital applications and virtual loan closings.

You can write about these topics and how they've affected home buyers and the mortgage industry. Additionally, you can also write about the mortgage trends you expect to see in the next year.

Significantly, these topics will help home buyers stay up-to-date with the latest trends in the mortgage industry. The information you'll provide will assist them when applying for a home loan. They'll also know how to stay safe and curb the spread of COVID-19 even when they interact with loan officers and others during the mortgage process.

12. Mortgage Regulations

The government heavily regulates the mortgage industry. To keep your readers informed about these regulations, you can write about the different mortgage restrictions and how they impact home buyers.

For instance, you can write about the Qualified Mortgage Rule and how it affects home buyers looking to get a mortgage loan. You can also talk about the Real Estate Settlement Procedure Act on your blog and how it protects home buyers from being taken advantage of by mortgage companies.

Consequently, these topics will help home buyers to understand the mortgage industry and know their rights as borrowers.

On the other hand, you can also write an informative piece on the Truth-In-Lending statements and how they help borrowers understand their mortgage loans' terms.

Moreover, writing about Good Faith Estimate (GFE) and how it can help borrowers compare different mortgage offers can be a good option.

These topics will help home buyers and lenders understand the regulations guiding mortgage applications and repayment. They'll also know each party's rights and remain compliant with the rules.

13. Buying And Renting

There are cases where people buy houses and then choose to rent them afterward. Even in cases where this wasn't the original plan, they can still rent a space in the house to help with the mortgage payments.

Therefore, buyers are always looking for schemes that can accommodate these arrangements.

Information regarding these arrangements can be helpful to those who are considering or already in this situation. You can help them by writing about the buy-to-let schemes, how to get a mortgage for rental properties, temporary leasing your home to cover mortgages and other topics of interest to buyers.

In addition, you can also provide information about the different types of mortgages available for people who want to buy a property and rent it out.

These topics will help buyers decide properly when buying a property. This will also assist them in finding the best mortgage product for their needs.

14. First-Time Home Buyers

First-time home buyers make up a large proportion of the mortgage industry. They're always looking for information on how to get a mortgage, save for a down payment, and find the best mortgage rates.

You can write about these topics and provide helpful tips for first-time home buyers. You can also write about the different mortgage products available to them. These topics will help first-time homebuyers make informed decisions when applying for a mortgage loan.

Quick Links:Conclusion: Mortgage Blog Topics That Enhance Your Niche Authority 2022

As a mortgage blog owner, you can enhance your niche authority by writing about topics of interest to mortgage leads. You can write about the mortgage process, mortgage regulations, different types of mortgages, and other topics that will interest your audience.

These topics will help you attract more leads and convert them into customers. You can also use your blog to build relationships with mortgage companies and other industry experts.

By writing about these subjects, you'll be able to position yourself as an expert in the mortgage industry.

John Rey

John Rey is a mortgage expert with over 15 years of experience in the industry. He has helped thousands of people to get mortgage loans and find the best mortgage rates.

He has also written several mortgage blog posts that have been featured on top websites.

John is also an expert in mortgage regulations and has written about the different regulations that impact home buyers. During his free time, he loves cycling and watching documentaries.