I didn't know before-hand, but apparently every HDB owner is required to have a mortgage insurance to protect members of your family from losing the flat should you die or suffer any terminal illness or permanent disability. The thing is most people (including me) assume that we have to take up the insurance by HDB. You can actually use your life insurance policy as a replacement for the mortgage insurance if you insured it at a high enough value (mine is very low value, by the way) and skip buying a mortgage insurance.

You can also opt out (a lot of liasing and conversations as usual) and take up the insurance from a private insurer instead. My bank loan was with DBS so a personnel called me about it, but honestly the guy was so lousy. He was only keen to make a sale and didn't really have any of my best interest at heart. (Note: If you have a multiplier account with DBS, the premiums paid can also count towards it. However this staff was so pushy that I decided NOT to even open a multiplier account with them and seek my own insurance instead.)

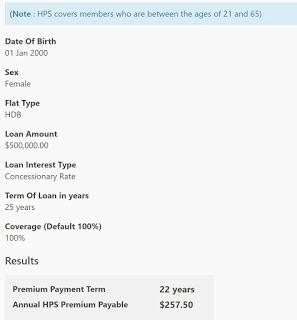

Personally, I felt the premiums of the HPS was quite competitive. You can use the calculator to obtain the annual premiums. This was caculated for an mortgage-reducing policy. I used this as a guideline to seek other quotations from other insurers. Quite honestly, only my Manulife agent bothered to get back to me promptly. At the time, they even had a promotion so I gamely took up the policy with them.

Just in case you are wondering, you have to insure both owners (if there are two). Under a private insurer, you also have the option to insure the full loan amount throughout the loan years (at a slightly higher premium). I didn't choose that cos I felt it was very unnecessary since I already had a life insurance.

Most of the information can be found at CPF website. However, they did not mention the minimum interest for the mortgage to be based on. I insured mine at a very conservative 3% (my loan interest is less than 2.6%) and they rejected my application to opt out of HPS. I had to make a call and provide another supporting document (i.e. my life insurance policy) before the application went though.

The only silver lining was that CPF didn't put me on hold for very long and I could speak to an officer immediately who quite promptly resolve my issue. :) If you have some time on your hand, I guess you can find your own insurance. Going through it, I can tell you the savings ain't that significant if it wasn't for the promotion at Manulife.

***

Disclaimer: I am no finance guru. All the above rambles are my own opinions.