What makes a person poorer each day? Is it his daily expenditure? His compulsive spending habits? His indulgence on food? You may be surprised that getting poorer is not so easy. Spending money on food, buying clothes etc will not make us that much poorer. To be honest, how much can you spend on food or buying clothes?

In April this year, I wrote an article declaring that I will stop tracking my daily expenses. In the past, I used to track every single spending I had in an APP but it wasn't that useful for me. Yes it made me conscious of my spending and I did save a lot of money but that is not what I want to live my life on. Being too frugal can have an adverse impact on our lives instead.

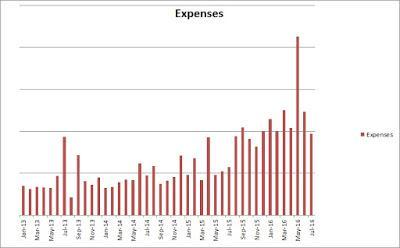

Now, I only track my expenses on a monthly basis and I found that even after I stop tracking my daily expenses, the effects are not that much of a difference, only a slight increase except for a month where I went overseas.

Expenses has gone up over the years and I'm actually happy that it has happened. The irony is when expenses went up, my income went up as well.

Now, back to what will cause us to be poorer each day. The answer is LOANS. There are many different types of loans or what we call as debts but some of them work differently from each other. Let's look at some common loans and see whether will they actually make us poorer?

Car loans is quite common in Singapore. Due to the high price of cars now, how many people can actually affoed to pay that $100,000+ in cash for that car?

SGCarMart has a good new car loan calculator which i'm using for the below illustration:

New Car Model: Toyota Vios 1.5 Elegance

Car Price: $104,888

Loan Amount: $73,422

Interest Rate: 2.28%

Loan Tenure: 7 Years

From the above example, the monthly instalment will be $1014. Total interest paid at the end of 7 years will add up to $11,718. This is 11.17% of the original car price. This is still 2.28% per year even though we are paying a monthly instalment whic reduces the outstanding loa amount. This is because car loans interest are always calculated base on the initial loan amount instead of the remaining loan amount

Housing loan is even more common in Singapore. We can choose not to have a car but we need to have a roof over our heads. For this illustration purpose, I'll be using a mortgage calculator from MoneySense.

Price of HDB flat: $340,000

Loan Amount: $306,000

Interest Rate: 2.6%

Loan tenure: 25 years

For the above example, the monthly instalment will be $1388.23. Total interest paid at the end of 25 years will add up to $110,468.61. This is 32.49% of the property price value.

The interest paid is quite scary to be honest. This means if your property price is not more than $416,469 in 25 years and you sell it, you'll be making a loss instead. Nevertheless, if we calculate the average interest paid yearly, it is only about 1.29%. This is because housing loan interest are amortised. This means the interest is calculated based on the remaining loan amount yearly as compared to a car loan which calculates interest base on the initial loan amount.

Credit Card Debt

Credit card is not considered a loan but it is a debt if we missed the payment or did not pay the bills on time. Let's see how credit card interest is calculated and what happens if we did not pay the bills.

Credit Card debt: $1000

Interest rate: 24% p.a (2% per month)

Years of Owing: 3 years

Base on the above example, if we did not pay a single cent on the amount owing, the $1000 debt would grow to $2000 in 3 years. This is double of the initial amount of $2000. The reason why it doubles is because interest is compounded on a monthly basis. To calculate how long it takes for your credit card debt to double, you can use a simple method called the rule of 72. By using 72 divided by the credit card interest rate per annum, you will get the number of years which the credit card debt will double. In the above example, it is 72 divided by 24 which is 3 years.

Another thing to note about credit card is if we were to make partial payment, the payment paid will be used to pay for the interest first before it is used to pay for the outstanding amount. For example if the credit card debt is $10,000 and interest is $240 per month, if we just pay $240, the initial debt of $10,000 will not reduce at all. We are just paying interest every month for as long as it goes without reducing the debt amount.

Conclusion

Loans or debts can cause us to be poorer without us realising it. Our daily expenditure or spending money on food or clothes can be consciously tracked but for loans, it is sometimes hard to visualise exactly how much money we actually pay for the interest.

For the 3 different loans, all 3 of them work differently:

- For car loans, the interest is base on the initial amount

- For housing loans, the interest is base on the reducing balance

- For credit card debts, the interest is base on the outstanding amount compounded monthly

Before committing to a loan, we should know how much interest we are paying. For debts, we should not get into any in the first place as it can be very hard to get out base on the example above.

Make the right financial choice today!