The explanation for growing wealth inequality proposed by Thomas Piketty in his iconic book Capital in the Twenty-First Century, is that the rate of growth from capital exceeds that of the entire economy in general. Thus, the wealth of owners of capital (i.e. investors) will increase faster than everyone else. However, even if the rate of growth were equal, any difference in initial conditions or savings rate, would also amplify exponentially. This can be seen in this simple model. Suppose  is the total amount of money you have,

is the total amount of money you have,  is your annual income,

is your annual income,  is your annual expense rate, and

is your annual expense rate, and  is the annual rate of growth of investments or interest rate. The rate of change in your wealth is given by the simple formula

is the annual rate of growth of investments or interest rate. The rate of change in your wealth is given by the simple formula

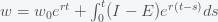

where we have assumed that the interest rate is constant but it can be easily modified to be time dependent. This is a first order linear differential equation, which can be solved to yield

where