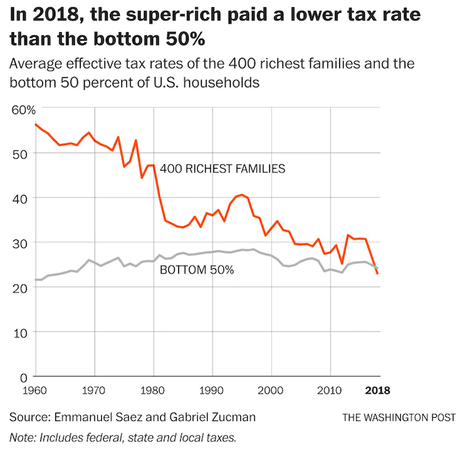

The chart above is frustrating. And it has not changed since 2018. The super rich still pay a smaller tax rate than the bottom 50% (who are basically living paycheck to paycheck) when all taxes are considered. That not an equitable tax system.

Robert Reich explains why this is so, and what needs to be done. Here is part of what he has written:

I’m hoping Harris sticks with Biden on Biden’s most important tax proposal: A 25 percent minimum tax on Americans worth more than $100 million. This 25 percent tax would apply to a combination of their regular income and their unrealized capital gains.

It would raise roughly $500 billion in tax revenue over a decade, according to the Treasury Department.

Biden would also tax unrealized gains at death for those holding more than $5 million worth of assets.

Why is Biden’s 25 percent minimum billionaire’s tax so important?

Consider Warren Buffett. Several years ago, Buffett made a claim that would become famous. He said that he paid a lower tax rate than his secretary, thanks to the many loopholes and deductions that benefit the wealthy.

The 400 wealthiest Americans today still pay a lower total tax rate — spanning federal, state, and local taxes — than any other income group, according to newly released data.

According to Forbes, Buffett now has $149.9 billion in wealth. On the conservative assumption that the rate of return on his wealth is 5 percent, Buffett’s real pre-tax income last year — his share of his company Berkshire Hathaway’s profits — was roughly $7.5 billion. Yet Buffet paid an effective income tax rate of less than 1 percent.

How did Buffett accomplish this? His increasing wealth, consisting of shares in his company Berkshire Hathaway, is all in unrealized capital gains. One share now costs some $715,778 — more than 60 times what it sold for in 1992.

To finance his personal lifestyle, Buffett has needed to sell only a few shares each year. By selling just 20 shares, for example, he moves $14 million over to his personal bank account. He then pays tax on the small amount of capital gains he realized by selling 20 shares.

Alternatively, he can finance his lifestyle by taking out tax-free loans backed by the stock he owns.

This is why merely raising the top marginal income tax rate won’t affect Buffett’s (or Bezos’s or Zuckerberg’s or Musk’s) tax bills. They don’t have much taxable income in the first place. It’s why the important action is found in capital gains, especially unrealized — that is, uncashed — gains.

Under current law, if they hold most of their wealth until they die, their heirs can inherit it without paying a dime of capital gains taxes. That’s because it was never cashed out.

Here’s the thing: According to the tax code, the basis from which capital gains are calculated — the original price of the assets — is wiped out on death. Instead, the basis automatically rises to the asset’s current market value.

Which is why the United States is rapidly moving toward an aristocracy of dynastic wealth.