Cash Flow for Normal People – Don’t be Normal!

People don’t plan to get into credit card debt and other consumer debt. They start out thinking that they will just use the card to earn cash back or points for an airline seat. They figure it is just like buying things with cash since they’ll pay off the balance each month. Or maybe they keep one in case of an emergency, where they need cash fast and a credit card seems like a good way to be ready.

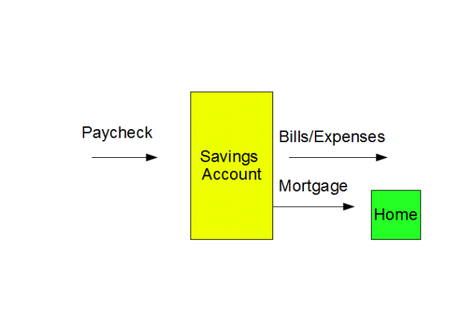

And then the car breaks down and they need a $1000 repair. They whip out the credit card, even though they don’t have enough money to pay it off in addition to their other bills since their monthly spending equals their monthly earnings. (Call it the law of the cash flow equilibrium, where your spending will always grow to equal your income, no matter how high your income is.) They figure, however, that it’s an emergency – they need their car – and they’ll just pay it off over a few months. Maybe they do, maybe they don’t, but eventually their air conditioner goes, or they need to go to the emergency room, or the car breaks again, or their friends ask them to go on vacation with them, and the balance reappears on their credit card statement, bigger than ever.

Before they know it, that $1000 balance goes to $2000, then $10,000. Suddenly that silly little $10 per month interest payment becomes $100 or $200. After a while, debt begets debt and they’re doing everything you can to just pay the debt each month. Each little event causes them to go deeper and deeper into debt. This is the debt spiral. At first, everything is easy and manageable, but as things get worse it gets harder and harder to pull yourself out. Eventually it becomes impossible and sending in a check to the credit card companies feels like trying to empty a lake with a teaspoon.

The way to prevent heading down this spiral is to be ready for emergencies so that you can handle them without going into debt. This is the next item in the list provided in 10 Dirt Simple Rules of Money Management, where I provided 10 rules to follow to maintain a healthy and happy financial life. (Note, you can find all of the posts in this series by choosing Dirt Simple from the category list in the right sidebar.) Today we cover the third rule:

3. Have a store of cash for a rainy day. It will rain at some point.

If you were a farmer, you probably wouldn’t sell or eat all of the food you grew. You would know that some years you’ll have a great harvest, but others the locusts will come, or it won’t rain, or it will rain too much, or you’ll see a hail storm right as the wheat gets ready to pick. So you would store some in the silos or preserve it in mason jars in your root cellar. And yet most people spend every dime they earn each month, and even get so many loans and subscriptions for things that they couldn’t cut their spending if they wanted to, as if they will never face a financial storm. This means that they need to go into debt if something happens (anything happens) and they have an unusual expense one month. Often this is credit card debt, probably the worst kind second only, perhaps, to payday loans.

If instead you put aside some money to handle these issues, what would have been a financial emergency turns into an inconvenience. Break a leg and need to go to the emergency room? You just dip into your emergency fund to pay the deductible. Need a car repair? The money is sitting there, waiting for you in your emergency fund. You get out of these potholes in life without taking on debt. And staying out of debt means you’ll pay a lot less for things since you’ll typically pay about twice as much for things you buy with debt than things you buy with cash.

Some facts about your Rainy Day Fund or your Emergency Fund:

1. It should be about 3-6 month’s worth of expenses. Figure out how much it would take to meet expenses for three to six months if you really cut back to the minimum needed, and then save that much up. This will give you time to find a new job should you lose your current one. If you have other sources of money like an investment account, you can save less. If you don’t, then save up for 6 months.

2. Your emergency fund should be in a combination of a bank money market account and bank CDs. You need to have your emergency fund available when you need it, which means it can’t be invested in stocks or other things that go up and down in price. Start out with cash and see how low you tend to dip in your emergency fund when you need it for a couple of years. Keep that amount, plus maybe another $1000 in a money market fund so you can access it as needed. Put the rest in a bank CD since you’ll still be able to access the cash if needed, perhaps paying an interest penalty, but you’ll earn a bit more on the money you’ll probably never access unless you have a life event like a long job loss.

3. If you dip into it, save like a mad man (or woman). If you deplete your emergency fund for something, you’re now vulnerable should something else happen. If you need to dip into your fund for any reason, cut way back on spending and investing until the fund balances are back to where they need to be.

4. Emergency means emergency. You don’t dip into your emergency fund to go on vacation or a night out on the town. This could literally be the food in your children’s mouths should you lose your job. It is also the only thing between you and the debt spiral. Guard it jealously and only spend money from it for real emergencies. If there is a way to leave it alone, do so.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.

About these ads