The math behind finances can seem daunting. Things like compound interest, PE ratio, and loan-to-value ratio may be foreign terms that you cannot quite wrap your head around. But the most important math, figuring out what you need to do to grow wealthy over time, is really quite simple:

Change in Net Worth = (Income – Expenses) * Time

So, if you want to increase your net worth and grow wealthy over time, you need to spend less than you make. It’s really that simple. The issue is developing the behaviors that cause your income to be greater than your expenses every month. It is also increasing your income, by moving up and by investing, and cutting your expenses so that you can increase the difference between your income and your expenses so that you can grow wealthy faster.

(Note, this site contains affiliate links. As an Amazon Associate I earn from qualifying purchases. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase. This helps keep The Small Investor going and free. I don’t recommend any products I do not fully support. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link and buy whatever you wish. The Small Investor will get a small commission when you do, again at no cost to you.)

Calculate your Free Cash Flow

Cash flow is the amount of money you have flowing through your bank account each month. It is your total income coming in, that which you spend on things plus that which you save and invest. If you subtract off from your income the expenses that you have every month, like rent, food, clothing, car payments, phone bills, etc…, you can calculate your free cash flow. This is money that you have left over each month after you pay for everything. Your free cash flow is the key to growing wealthy since that is the money that you can save and invest to increase your net worth. Even if you make $10 M per year through your job, if your free cash flow is zero, you’ll never grow wealthy.

(If you enjoy The Small Investor and want to support the cause, or you just want to learn how to become financially independent, please consider picking up a copy of my new book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early This is the instruction manual on how to become financially independent.)

To calculate your free cash flow, sit down with a piece of paper or a spreadsheet. Start by putting your net income (the amount that gets placed in your bank account each month) from jobs at the top. Then add other income you have from side jobs, investments, bank accounts, etc…. If you get some income less than once per month, just take the yearly amount you receive and divide by 12 to get the average amount you make per month. Once you’re done, sum this all together and place the total at the bottom. This is your total monthly income. Here’s what this may look like for a given couple, Bob and Theresa:

Income

Bob’s Salary$2,230

Theresa’s Salary$2,750

Ebay Selling$130

Mowing Lawns$250

Mutual Fund Income$145

Bank Interest$6

Total Income$5,511

Bob and Theresa’s IncomeNext, write down all of your regular monthly expenses. Start with the things that are fixed that you pay every month like rent or mortgage, car payments, loan payments, phone bills, and so on. Next, make monthly estimates for things you buy that don’t have a fixed cost like grocery store food, eating out, clothing, gasoline, and so on. Finally, find the bills that you only pay once per year or once per quarter like property taxes, insurance, and so on. Divide the total amount you pay per year by 12 to find the monthly average, then add these items to your list. Sum everything at the bottom and you now have your total average monthly expenses.

For Bob and Theresa, here’s their list:

Expenses

Rent$900

Bob’s Car Pmt$275

Theresa’s Car Pmt$375

Cable$56

Phones$230

Internet$55

Food$250

Clothing$350

Kid’s School Supplies$60

Pet food$30

Vet$50

Medical$200

Car Insurance$140

Renter’s Insurance$30

Yoga classes$50

Football Tickets$80

Eating Out$1,200

Total Expenses$4,331.00

Bob and Theresa’s ExpensesTo find your free cash flow, subtract your total expenses from your total income. For Bob and Theresa, this would be $5511 – $4331 = $1180 per month. Over a year, they would have a free cash flow of 12 x $1180 = $14,160.

Want all the details on using Investing to grow financially Independent? Pick up a copy of The SmallIvy Book of Investing

Want all the details on using Investing to grow financially Independent? Pick up a copy of The SmallIvy Book of Investing

Allocating your Free Cash Flow

Now that you know your free cash flow number, the next question is how you are allocating it. If you do nothing, it will just be building up in your bank account, so your balances will be growing. Most people, however, spend money on random purchases, vacations, and other things that they don’t buy every month. Because most people base these purchases on how much money they have available, most people will spend all of their free cash flow. This is why they don’t grow wealthy despite having an income that would allow them to do so.

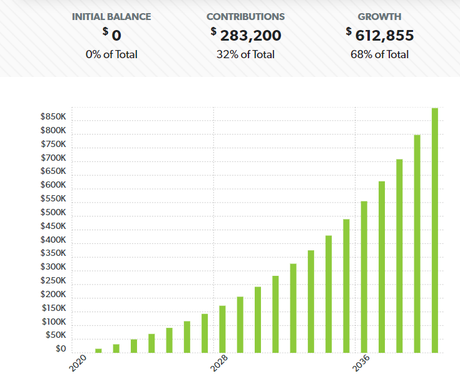

For example, if we take Bob and Theresa’s free cash flow and put it into an investment calculator, assuming that they invest the money and make 10% annualized, here is what their net worth will look like over a twenty year period:

Bob and Theresa’s Net Worth Growth over a 20-year Period

Bob and Theresa’s Net Worth Growth over a 20-year Period

So, they will have saved $283,200 over that time, but investments will have added $612,855 to their investment account, so they’ll end up with over $850,000 in 20 years. This assumes that their income stays the same, they don’t touch the money for any reason, and that they’re able to make 10% annualized by investing. It also doesn’t account for inflation, which would zap about 3% per year from their gains.

Investing increases your income, which increases Free Cash Flow

Note that investing your money, as opposed to simply saving it, adds to your income. This increases your free cash flow, which increases your net worth faster. If Bob and Theresa had simply left their free cash flow in the bank, they would have had about $280,000 after 20 years of saving. By investing it, they were able to add a lot more and end up with almost four times as much. If you don’t have the income of a rock star or a sports star, where you can simple save hundreds of thousands of dollars per year, investing is the key to growing wealthy.

Not only does investing add income, investing creates a feedback loop that amplifies the growth of your net worth. Let’s say you start out with nothing and invest $3000 in a year. If you make 10% on your investments that year, you get an additional income of $300. If you invest that $300 along with another $3000, you’ll generate $630 the second year. You’re generating $30 more that year than you would have if you had not reinvested the money. If you keep doing this, your income will continue to grow each month. You will be earning interest on the interest you make.

Eventually, the income you’re getting from investing will equal the amount of income you need to live. At this point you’ll be financially independent, where you are no longer dependent on your job to live. This gives you the freedom to quit your job entirely and retire early, change jobs to something that pays less but that you enjoy more, or simply expand your lifestyle and take better vacations, drive better cars, or add on to your home. This is what true wealth is — freedom and financial security. Never needing to worry about losing a job or an unexpected expense that arises because you have the income you need to cover things.

It’s all about balance

You might be tempted to take all of your free cash flow and invest it as we did in this example with Bob and Theresa in order to grow your net worth as fast as you can. If you do this, however, it is like going on a fad diet where you lose a lot of weight by starving yourself, but then gain it all back and then some when you stop dieting. You need to have a financial plan that you can stick with your whole life. This means that you should be allocating some of your free cash flow each year to things like vacations and purchases just for fun. Figure out what you need to be content, then direct the rest into investments.

Also realize that as your investment account and your income grows, you’ll be able to afford to take nicer vacations and buy nicer things. The difference is that you’ll be buying these things with money you’re earning from your investments, which replenishes itself, instead of borrowing money. Note when you take out a loan and add new payments, it reduces your free cash flow since it is a new expense you need to pay each month. If Bob takes out a loan for a boat of $500 per month, their net worth decreases to $680 per month. This would decrease their net worth in 20 years dramatically. You’re also paying interest on the loan, meaning that you’ll be paying more for things than you would have if you had simply saved up and paid cash.

Another issue is that there will be big expenses that come up over time like new cars, home repairs, and medical bills. Having an investment account will help with these since you will have the cash needed to simply pay for them. This means you won’t be adding a new loan with more interest payments. Over your working lifetime this means that you’ll have more free cash flow, which will increase your net worth even further. Investing doesn’t help just a little, it helps a lot!

What if your free cash flow is low or negative?

If your free cash flow is low or negative, it means that you’re overspending your income. This means that you need to cut expenses or increase your income. Easy places to cut are to go to a cheaper car which you buy for cash or at least have lower payments, reduce the amount you spend eating out by eating at home more, and get a hold on your impulse purchases at places like Walmart by developing and sticking to a shopping list. Simply going to cash for places like Wal-mart will likely cut your spending dramatically since it is harder for most people to spend cash psychologically than to use a credit card. Imagine handing the cashier a stack of $20s for a purchase instead of pulling out your credit card.

You can also look to grow your income. Long-term this means getting additional skills and training so that you can increase what you make at your main job. Short-term you can do things like take side-jobs or find other ways to make income on the side like dog walking and delivering food. These aren’t the kind of things you will want to do forever, but you can use them to avoid taking out loans and build up your investing account so that it will be generating more income for you. It can also be used to pay off a loan so that you can eliminate that payment, freeing up more of your cash flow for investing.

Have a burning investing question you’d like answered? Please send to[email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.