When I first started investing, I thought about how good it would turn out, how investing can be the answer to a better life. I went for seminars where the speakers promised good returns if you learn it correctly. With much hope and expectations of a good outcome, I started investing.

10%, 20% returns were easy at first. Maybe it was beginner's luck, I made over $1K in a short period of 3 months with just only $5K. That was 20% return on investment. If you ask me what was the factor behind the success that time, I would have told you it was because I expected it. However, I was totally wrong. The reason why many people fail in their investments is not just because of a lack of knowledge or luck, it is having the wrong expectations.

Fast forward to one year later, I lost everything and more. In fact, I lost half of my savings which I painstakingly saved through my allowances during my school days, the many part time jobs I worked while still studying and the little NS allowance I got. The savings were built up a dollar at a time and I saved so hard by working part time. All the savings for 5 years were wiped out in just a few months. I had many sleepless nights due to insomnia, I didn't know what to do and was totally lost that time.

All these taught me to have a more realistic expectation for investments. In fact, not only just investments but it taught and humbled me on the expectations of life. Sometimes, we have so much expectations that it makes us unhappy when those expectations go unmet, it strains relationships too. For investing, it caused me to lose the hard earned money I saved up. This was a lesson that will not be forgotten.

There is no easy money

If you're thinking investing will be your easy way out in life to give you more money, you may have the wrong expectations. There are people who believe that they can double or triple their money easily through the stock market or think that trading is an easy way to make money so you don't have to work. All these are easy money thinking. Be careful of this as it may land you into trouble with the stock market.

Wanting to make more money from the stock market will indirectly cause you to take on more risk. In the pursuit for more money, people get into speculation to pick the next hot stock. "This stock may be the next big thing and will go up 10 times!!" If this is what you heard, its speculation. Yes it may go up 10 times but what if it went down and worse still collapse instead? We may lose a lot of our money or even everything.

Reality isn't all that bad

Even though there are no easy money, reality isn't all that bad either. Growing our wealth through investing is still important. As we all know, the purpose of investing is not only to preserve wealth but to build up our wealth for retirement. If we do not invest, our wealth will deplete over the years due to inflation.

I have not been good at Maths since primary school. I was careless with numbers and always make silly mistakes during my mathematics exams and tests. To grow our wealth, we need to have plans and see it happen in the future. Fortunately, even for people like me who are not good with numbers, there is an easy way to see how our money will grow in the future.

The rule of 72 is the easiest way to see how much our money would grow. At 7.2% investment return annually, our money would double every 10 years. How you get this number is take 72 divided by 7.2 and you get 10 years. If we have 10% annual investment return, our money would double every 7.2 years. You can just take 72 divided by the annual investment return and you will know how long your money will take to double.

With the rule of 72, I can plan for my future easier. If I want to double my money 3 times in 30 years, I would have to achieve 7.2% ROI every year. $200,000 would become $800,000 30 years from now using this calculation. This is assuming we have $200,000 and stop saving money now and just grow our money through investments.

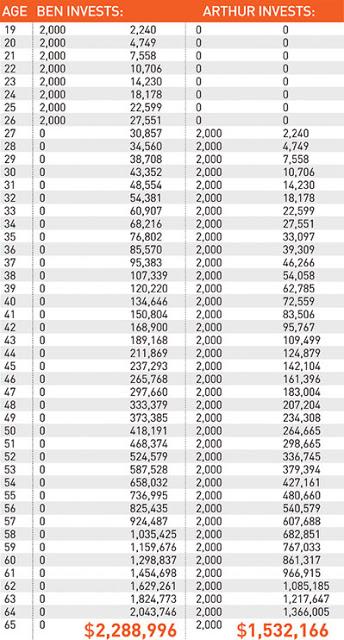

One lesson from this is the more we save earlier, the faster it is to reach our financial targets later.This was an example I read before on 2 person, Ben and Arthur. At age 19, Ben decided to invest $2,000 every year for eight years. He picked investment funds that averaged a 12% interest rate. Then, at age 26, Ben stopped putting money into his investments. So he put a total of $16,000 into his investment funds.

Now Arthur didn't start investing until age 27. Just like Ben, he put $2,000 into his investment funds every year until he turned 65. He got the same 12% interest rate as Ben, but he invested 23 more years than Ben did. So Arthur invested a total of $78,000 over 39 years.

When both Ben and Arthur turned 65, they decided to compare their investment accounts. Who do you think had more? Ben, with his total of $16,000 invested over eight years, or Arthur, who invested $78,000 over 39 years?

The result above shows the stark difference and the power of compounding. Ben just saves earlier at age 19 and stops saving at age 26 but in the end he has more money than Arthur who saves and invest from age 27 to 65. Just that 7 years difference makes a very big difference because of the power of compounding.

Expectations kills successful investments but the reality isn't that bad either. The road to wealth building is easy: save early, invest early and let the power of compounding take effect. There is no shortcut to wealth building. Expecting that investing will make you rich in a short time is a dream but getting back to reality that the effects of compounding has on the long term will create successful investments for us.