Most of us would have heard of the saying "you can afford to die but not get sick in Singapore". There is definitely truth in this saying because healthcare cost is really a bomb and this bomb will get bigger in the future. Healthcare spending budget is the 4th largest in Singapore at $10.2 billion for 2018. This amount is expected to be increased over the years as we prepare for an ageing population and rising healthcare cost.

A more scary cost than hospitalisation bills

While all of us know that hospitalisation bills can be quite scary, I think many do not know that there is another more scary cost than hospitalisation bills. This is the long term healthcare costs after a patient discharges from hospital. Hospitalisation bills can often be covered by Medishield life or private integrated shield plans but long term healthcare cost can rarely be covered by any insurance at all. The best we have is disability income or Eldershield which pays out a sum of money in the event of any disability but not many people would have this.

According to statistics from MOH, in 2016, there are 2.6 Million people with integrated shield plans but only 437,000 Eldershield policyholders with supplements. MOH did form a special committee to look into this Eldershield and some recommendations were made. You can read about it here.

The purpose of my article here is not to talk about insurance but to go into detail the possible long term healthcare cost needed and the various subsidies available. The question is are there safety nets for this in the event if our love one falls ill and require long term medical treatment and are subsidies enough? What can we do to prepare for this?

Another purpose of writing this article is to create awareness on the difficulties which caregivers faced when caring or supporting a family member with disabilities. This is a concern which many people face but help is limited. I've done a survey where many people participated in and voiced out their main concern areas which I will share in this post as well.

The scenario of needing long term healthcare cost

A family of 4 with a Father, Mother and 2 children live in a 4 room HDB flat in Singapore. The father is the sole breadwinner of the family and earns about $5000 while the mum is a housewife. Their 2 children are studying in University in their final year of studies. One day, the father suffered a heart attack and was rushed to the hospital. He survived but the father became disabled and became bedridden. He also lost his ability to eat and drink and requires to be fed through tube feeding of milk only. He is unable to work and the family lost their only income as a result.

The above is a typical scenario of what happens when a family member suffers a critical illness. It can be heart attack in the above case but can also be other critical illness such as stroke, cancer, accidents, organ failures etc. With advance healthcare, most patients survive but the illness renders most people disabled after surviving the episode.

Long Term Healthcare cost required

When a person becomes disabled due to a sudden illness, the income is lost completely. The family members most probably have to find ways to sustain their lifestyle and find as much help as they can. Continuing the above story, it is fortunate that the 2 children just managed to graduate from university and they found a job. They earn a combined gross salary of $7400 which is quite a decent salary and they decided to care for their father at home after he discharges from the hospital.

However, they soon found out that the long term healthcare cost needed for their father are as follow:

The list above may not be conclusive and there may be more or less items according to different circumstances. Just like that, the 2 children have to fork out additional $3765 a month just to care for their father. This is on top of their current life which they still have to continue sustaining. With combined gross salary of $7400, their combined take home pay is only $5920. After deducting the healthcare cost needed, they are left with $2155 for a family of 4. Is this even enough for living expenses?

This scenario is more real than we think. I can come up with the various cost at my fingertips because this happened to people around me recently and I've been researching and finding out more in order to help them.

Also, with their income, they are not eligible for most subsidies even though they don't really earn a lot.

The above scenario is for more severe cases of disability. For those with less severe cases of disabilities, the cost may be lower. The costs are also before subsidies.

As mentioned earlier, I had done a survey to gather information on the issues which people face when they are caregivers for a disabled family member at home. With disabilities, there will certainly be long term healthcare cost involved as the disabled family member cannot work anymore and have to depend on someone to take care of him or her. Let's take a look at the questions and the responses in detail: Survey of People Who Need To Take Care of disabled family members

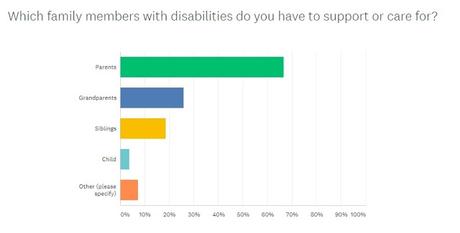

Most people are supporting their parents (66.67%) or their grandparents (25.93%).

Q1: Which family members with disabilities do you have to support or care for?

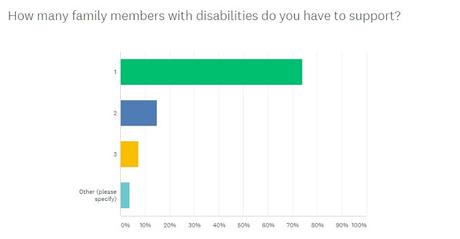

Q2: How many family members with disabilities do you have to support?

Most people are supporting one family member. There are some who are supporting 2 or even 3 family members which is quite tough.

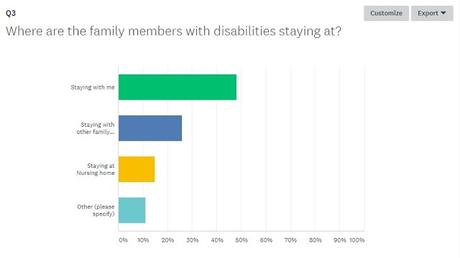

Q3: Where are the family members with disabilities staying at?

Most of their family members are either staying with them or staying at another family member's house where they have to take care of the family member at home. There are some who have family members staying at nursing home probably due to lack of time to take care.

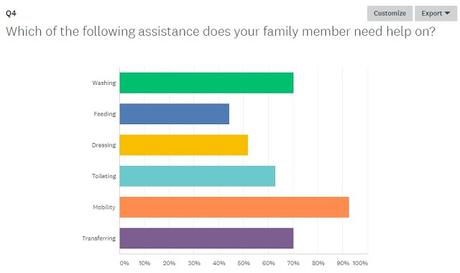

Q4: Which of the following assistance does your family member need help on?

Most family members when they are faced with disabilities, they need help for most of the 6 daily living activities with mobility ranking the highest.

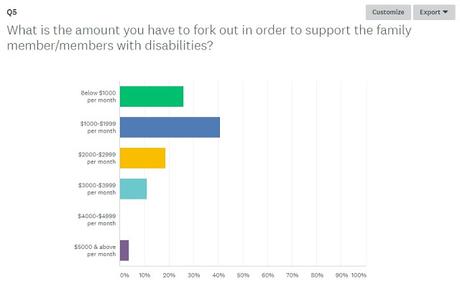

Q5: What is the amount you have to fork out in order to support the family member/members with disabilities?

Now comes the financial cost part. Most people have to fork out between $1000-$1999 per month just to care for the disabled family member at home. I reckon this will be for the milder cases of disabilities where the family member still can eat and perform some daily living activities at home.

There are some who have to fork out between $2000-$3000 a month or even more than $3000 per month for more severe cases of disabilities.

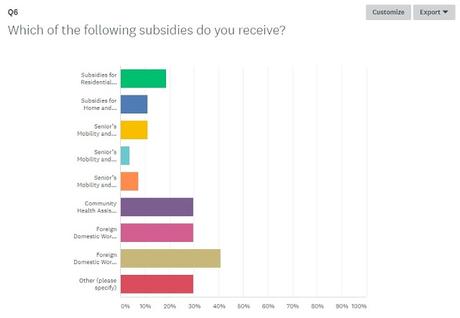

For the subsidies, we can actually see that most people do not get the subsidies which are available out there. The most common subsidy which people get is the foreign domestic worker concession levy and the grant where they will be eligible when they hire a maid to take care of their disabled family member. Other than that, most people do not get much other subsidies. I'm not sure if it is a lack of knowledge on knowing the subsidies available or the subsidy is just too difficult to get once you have a higher income. By higher income, the threshold is actually only $1800 monthly household income per person. Q6: Which of the following subsidies do you receive?

Question 6 is all about subsidies. There are various subsidies which I will talk about in a subsequent post. People who are in this situation would have tried to find all kinds of subsidies available in order to continue living a normal life as much as possible. Ultimately, this is not a situation which families would like to be in so it is a tough time to go through.

Once you are above $1800, you would most likely not be able to get most of the subsidies.

For the response which people put as "Other", most of it is NIL which means they do not get any subsidies at all.

For those who are caregivers currently, the road is certainly tough and you would probably need as much support as possible. You can refer to AIC silver pages to find some of the help you need:

The Scary Truth Of Long Term Healthcare Cost In Singapore

I hope this article has done its purpose of raising awareness on the issues which people faced when caring for a loved one with disabilities. The last 2 questions I had in the survey were open ended questions where I asked what is the biggest financial cost and also what is the greatest challenge they faced.

The biggest financial cost comes from the milk feed, medication, transport fees, diapers, domestic helper, hospital bills, medical equipment and many more. The responses were vastly different for different people which shows that the cost involved is quite wide ranging.

The greatest challenge was more aligned where most people comments were quite similar. Most people stated that having not enough time and money was the greatest challenge. There were also emotional stress dealing with the issues at hand including the worry of the family member's health going forward.

Being a caregiver is not just about the long term healthcare cost but also the emotional anxieties and stress involved. I'm sure more can be done to support these caregivers in the form of support groups and also financial assistance. There are already schemes in place and support rendered which I will go into detail in the next post. However, I still think more can be done for this group of people.

If you're from any voluntary welfare organisations or the relevant government ministries, I would love to have a chat and hear from you if there are more things which can be done for caregivers in Singapore. You can drop me an email at [email protected] and I will get in touch with you.

https://www.silverpages.sg/

Everyone can help to share this post to help create awareness for those who are facing challenges on being a caregiver.