Most of us would know that housing prices is rising again in Singapore. The sales of new private homes are also going up where we see more and more people getting interested to buy properties now. This seems to be the right time to purchase a property at the right price and also when loans are still cheap.

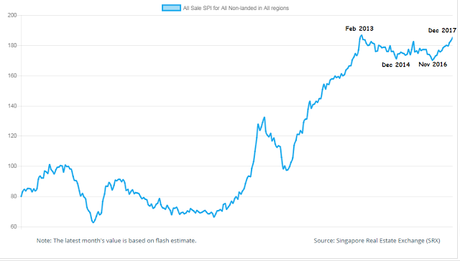

The following chart shows the SRX non-landed private property index from January 1995 to December 2017. We see a dip in the property market after the high in February 2013. The lowest price recorded was in December 2014 and November 2016. At current prices, it has almost reached the high back in February in 2013. It seems like the property market may breakthrough that level and continue to go higher soon. This explains why many people are entering the private property market now hoping that prices will continue to go higher.

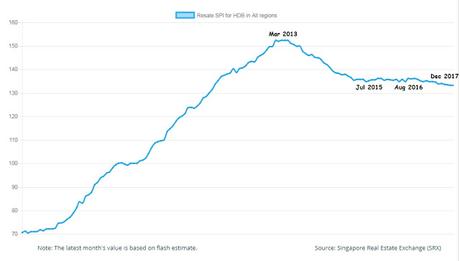

For HDB, it is a totally different picture. Resale prices of HDB seems to be continuing on a downtrend after falling from the high in March 2013. The regulations for HDB flats such as the 5 years minimum occupation period, the limitation of loans to 30% of your gross monthly salary, the maximum loan tenure of 25 years as compared to 30 years for private properties and the restrictions of not being able to rent out your HDB flat even if you purchase a private property makes it hard for the prices to go up.

This is in line with the government's push for affordable public housing in Singapore. I don't see HDB as an investment at all because the main use of it is still for personal accommodation. However, I do foresee that private home prices should continue to go up moving forward with better economic outlook.

For those who already own a property

On the other side, many people would have already bought a property previously. If you've bought your private property at a high back in 2013, the good news is that prices are going above that soon. For HDB, its a different story.

With better economic outlook and rising property prices, interest rates are rising as well. If your housing loan is still currently on a floating rate package, its time to take a look at it before it creeps up. The SIBOR, which is the Singapore Interbank Offer Rate is the most commonly used benchmark for housing loans in Singapore. The 3M SIBOR now stands at 1.42% and the 12M SIBOR is at 1.66% as at 5th January 2018. You can refer to the official SIBOR rates here. The 3M SIBOR has increased more than 0.5% from the previous low.

Interest rates will surely go higher from here. There is no doubt about that. Its just a matter of time interest rates will increase. With the US Federal Reserve hinting on more rate hikes and stock markets across the globe rising to record levels, interest rates should not be remaining low forever.

How Much Your Loan Instalments will Rise?

If you have a $300,000 loan, a 1% increase in interest rates will result in your monthly instalment increasing by close to $150/month. That is additional $1800/year. For a $500,000 loan, an increase in interest rates of 2% will result in your monthly instalment increasing by about $500/month. This is $6000/year. The higher your loan amount, the greater the impact it will be.

Don't forget that the norm for interest rates were about 3%-3.5% in the past. We should always be prepared for this to happen.

Refinance Your Home Loans to Lessen the Impact now

Fortunately, before the rates rise even higher, we can always refinance our home loans to lessen the impact at least for the next few years. I have worked with banks in Singapore for many years now and always on the lookout for the best loan packages for everyone.

It is recommended to go for fixed rates now and the best I can get is as below:

For both HDB and private property (Min loan amount $200,000)

2 years fixed rate

Year 1: 1.65% (Fixed)

Year 2: 1.65% (Fixed)

Year 3: SIBOR + 0.70%

Thereafter: SIBOR + 1.00%

3 years fixed rate

Year 1: 1.85% (Fixed)

Year 2: 1.85% (Fixed)

Year 3: 1.85% (Fixed)

Thereafter: SIBOR + 1.00%

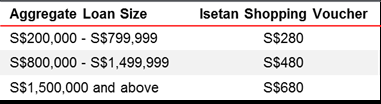

For the above 2 packages, you can get cash rebate and shopping vouchers as below:

*Cash rebate for refinancing only

If you're interested, click on one of the options below to fill up a form for me to contact you back:

Alternatively, you can email me directly at [email protected]

I'm not sure when this fixed rate package will be revised as many banks have already adjusted their fixed rate package upwards in the last few weeks. This is the last one which still has attractive rates.

For those looking to buy a HDB flat or a private property, now is a good time to look at it. If you need assistance in your property purchase such as knowing your loan eligibility or not sure what's the process, you can email me as well. Any other questions you have, I'll try to help as much as possible too.