Bizarrely the pound’s value dropped significantly as the EU formally approved the first round of EU and UK Brexit talks. The confirmation, therefore, signalling the second round of talks in the new year, with the road almost certainly leading to UK’s much-anticipated trade talks and single market access.

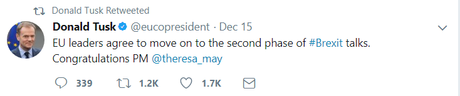

The successful outcome of the first stage of Brexit talks being signalled on social media by the European Union president Donald Tusk who congratulated Prime Minister May.

The involved parties will have now formally approved the next steps which will include a rigid timetable of points to cover, with a priority being the transition period the UK will be given to separate from the European Union. Many remain sceptical of the UK’s being able to conclude the process by March 29th, 2019. In many cases, experts have predicted the process could take up to five years.

All the time the UK remains under the transition period it will remain under EU law, so this will also be a hot topic of conversation, especially with the UK voter naming this as one of their key points of leaving the EU.

On the UK side, Theresa May has been given three months to set out her interpretation of her wishes for trade talks. In previous interviews on the BBC Davis has voiced his views on what the UK’s trade deal should describing his desired arrangement as a

“Canada-plus plus plus”.

With the leader of the UK’s Brexit talks saying that he would want to see an “over-arching trade deal” which would be similar to that of Canada’s trade pact with the added benefits of the services sectors which will certainly mean access to the single market and passporting rights for London’s financial hub.

Commons rebellion ensures UK parliament have final Brexit say

Before the final approval of the second round of talks from the EU, Prime Minister May was dealt another inconvenience of now not being able to sanction the final Brexit deal autonomously with her cabinet. Wednesday saw parliament vote the opportunity to approve the final Brexit bill. The vote essentially weakening the Tories power in parliament, highlighting the divide on Brexit within the party and the lack of confidence many have in the PM.

Essentially any final Brexit bill will now have to be formally approved by MP’s, potentially offering labor the chance to scupper the final deal or at least delay its progress.

Theresa May open to compromise

Friday saw May attempt to calm the Tory MP rebellion which attributed to essentially a vote of no confidence on the final Brexit vote. In total eleven Tory MPs voted for the final say on Brexit negotiations to be handed back to MPs rather than the Brexit committee.

Theresa May is now attempting to fill in the cracks of her crumbling government and seek for compromise in order to placate hardline brexiteers, issues have stemmed from points such as; the UK’s divorce bill which some believe should be paid during the UK’s transition period, the Brexit final date which she was looking to write into UK law.

Its understood that the PM will still look to make the final date for Brexit set in law but will allow MPs to push back if the twenty-seven EU nations agree in order to harmonise the process and critically to avoid further embarrassment for May.

The pound value drops against Euro and USD

This week has once again provided a good level of volatility for the Pound against the USD and Euro. Incredibly investors began selling off the pound after the EU signalled that talks would now move on. The reason for the pound value dropping was that Donald Tusk confirmed that talks would recommence again in March giving negotiators little time to negotiate before having to seek approval from the EU nations. The disclosure of the timing has raised fears that Brexit talks will once again fall into disarray. The Pound dropped significantly following the news as markets had estimated talks would begin sooner leaving more time for deliberation. Especially as now the final vote will sit with parliament to approve.

The Pound value dropped significantly following the admission from the EU. However, the pound had performed strongly as markets anticipated the next move on US tax reform. In terms of data, the UK’s CPI equalled is highest annual level prompting a call for more rate hike to curb inflation. UK retail sales were also triumphant, demonstrating a determination from the UK consumer although it’s naturally worth mentioning Black Friday and the fact that Christmas is just around the corner.

GBP/USD this week has traded as high as 1.3455 and as low as 1.3307. the pair closed trading on Friday at 1.3322. in total the pound value dropped by 0.82 % on Friday.

The saga of the Pound value gaining against the Euro before tumbling back continued again this week. It’s clear that despite positive moves on Brexit investors and traders are clearly waiting for the final product. This is actively demonstrated week in week out by the way the Pound drops and ascends against the single currency. GBP/EUR has traded as high as 1.1412, this move prompted by the ECB keeping interest rates on hold and Draghi highlighting risks to Europe which included foreign exchange rates and global factors, this, in turn, saw the Euro come under pressure. The pound dropped significantly as with the dollar on Friday and GBP/EUR fell over 0.6% in Fridays trading closing at 1.1334