A number of factors have caused the NZ Dollar to plummet this week, further US tariffs on Chinese goods have seen the NZ Dollar Tumble to levels not seen since 2016 against the US Dollar. The increased tariff plans have also seen the safe haven currencies such as the Yen and Swiss Franc capitalise.

US-China trade war latest news

Following recent unsuccessful talks between US and Chinese trade negotiators, it would now appear that Trump is looking to increase his grip on imports. The President is expected to announce tariffs on a further $267 billion worth of goods shortly. This will almost be matched by China, unsettling the scenario further.

Trump’s additions tariffs now mean that the vast majority of Chinese goods now fall under the tariffs which have begun to cause huge issues for Chinese exporters. So much so that the Ministry of Finance has announced that will exports rebates on nearly 400, the rebates will be implemented from September 15th.

Last week’s data highlighted that China’s trade surplus grew further, now standing at $31.1 Billion. This was despite the growth in US bond exports falling to the slowest rate since March, with shipments from China now costing roughly 9.8% more. The changing of the trade landscape is now leading economists to the conclusion that China’s economic growth could be affected in 2019. If this economic prediction does indeed materialise further pressure could be put on the NZ and Australian Dollar due to their close links to the Chinese economy.

Governor Orr speaks on geopolitics

Speaking in Auckland the Reserve Bank of New Zealand Governor Adrian Orr addressed a crowd on Geopolitics, New Zealand – The Winds of Change. Bearing in mind the current global scenario the speech could have been more appropriate, despite the temptation, Orr’s speech remained entirely for the future sustainability of the Reserve Bank.

Orr spoke candidly promoting NZ’s economic growth plus his aims to develop a health financial ecosystem. Addressing the workplace saving conference Orr said:

“Too often, due to short-termism, we view economic growth as something that comes at the expense of a sustainable environment, or social cohesion and cultural acceptance. A short-term focus can be driven by the need to survive from day-to-day. However, it is too often driven by the desire to consume at an unsustainable rate. The desire for instant gratification or reward can often leave behind a trail of unintended consequences.”

His comments potentially highlighted that the Reserve bank is in no hurry to make short sharp policy changes but rather, more sustainable financial decisions to ensure New Zealand’s economic outlook.

NZ interest rate diverging from US interest rate

FX traders and investors were concerned with the pressure being applied on the antipodean currencies by the current US-China Trade scenario.

The NZ interest rate outlook is now lower than the US interest rate, 1.75% to the US interest rate of 2%. The NZ interest rate has remained static since being cut in November 2016.

The US economy, despite recent dovish tones from Governor Powell, is primed for further rate rises which will almost certainly see the USD gain further momentum against the NZ Dollar. This diversion in interest rates has been highlighted in the NZD-USD rates which have breech lows last seen in January 2016.

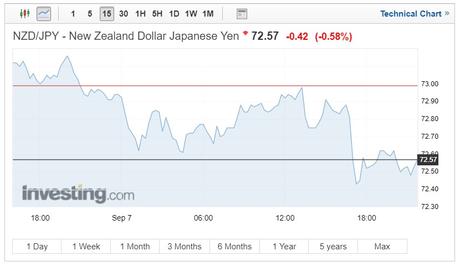

NZ Dollar tumbles vs safe havens

The ‘trade war’ rhetoric saw traders holding Kiwi Dollars to flock to non-USD safe havens such as the Yen and Swiss Franc. Following President Trump’s plans to roll out further import tariffs, the NZD/JPY fell from 72.88 to 72.43, over Friday’s trading session the pair fell 0.58%, despite the NZD recovering slowly.

Against the Swiss Franc, the NZD also suffered, with the pair falling nearly 0.5% in Friday’s trading session. Trump’s tariff’s omission saw the NZD/CHF fall from 0.6361 to 0.6344. The losses continued with the pair touching a multi-year low of 0.6332.

NZ Dollar forecast

Whilst NZ Dollar forecast related economic data remains limited this week with only NZ manufacturing data being released this week markets will await further movement. Developments on or implementation of Trumps plans will almost certainly weigh on the NZ Dollar.

Markets will also have an eye on the effects of the tariffs are having on the Chinese economy. Monday marks the latest CPI y/y inflation figures forecast at 2.1% last month data beat expectation. However, if lower this could weaken the NZ Dollar and Australian Dollar further.

Featured image: © enjoynz – stock.adobe.com