For a learner, the core of insurance is the subject matter of insurance; in a Motor Car Policy – it is Car; in Property – it is the building, Plant & machinery or stocks; in Marine Cargo – it is the goods that are in transit and so on….. - in Wedding Insurance, it is not literally the Wedding – getting Wedded to the person of your choice or liking or the person so wedded continuing to be pleasant can never be guaranteed !

Many of us have experienced it – may not be in

the glitzy manner as we hear them to be.

Again there could a North – South divide in this as well. The auspicious months and days heralds the

red letter day in the lives of Couples getting married, as also their parents

and their near and dear. To say, Indian

marriages are lavish will be an understatement depending upon the class and

status of those involved in the marriage.

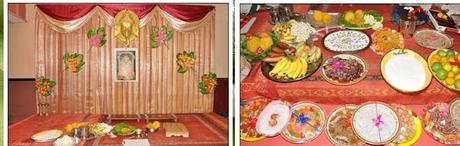

To some, it is a fairy-tale

affair – colourful and chaotic, pomp, display of wealth, people decorating

themselves in rich ornate dresses, wearing costly and beautiful jewellery,

choicest serving of food and beverage spending lakhs of rupees and of course

conducted in beautifully decorated marriage hall to the accompaniment of

traditional and modern orchestra of musicians.

Many of us have experienced it – may not be in

the glitzy manner as we hear them to be.

Again there could a North – South divide in this as well. The auspicious months and days heralds the

red letter day in the lives of Couples getting married, as also their parents

and their near and dear. To say, Indian

marriages are lavish will be an understatement depending upon the class and

status of those involved in the marriage.

To some, it is a fairy-tale

affair – colourful and chaotic, pomp, display of wealth, people decorating

themselves in rich ornate dresses, wearing costly and beautiful jewellery,

choicest serving of food and beverage spending lakhs of rupees and of course

conducted in beautifully decorated marriage hall to the accompaniment of

traditional and modern orchestra of musicians.

Typically, the ostentatious Indian marriage (by South Indian calculations) can cost anything from 10 lakhs upwards - and this does not involve the marriage jewelry or the goods that often accompany the bride as gift from parents and other relatives for starting new family. So Millions of rupees is what average Indian family spends on the occasion of a grand gala wedding – the sum is only to one’s imagination and it could turn to billions also, depending on who you are in the society !

Traditionally, Marriages are match-making based on horoscopes and called to be ‘made in heaven’ – not so these days, where lot of other aspects, especially the status in the society precede everything else. This post is nothing about match-making process, the hassles or the money involved but the business opportunity for our community i.e., the Insurers. Insurance is a protection against undesirable happenings – it is a protection against operation of a peril causing monetary loss. Insurance would provide financial indemnity to the property or value lost.

Wedding Insurance seeks to provide indemnity against losses caused to the proposer arising out of ‘unforeseen cancellations’ or operation of other perils. In a traditional society, where marriage is held to be most sacred, it would be sacrilege to talk of anything negative but in Tamil there is a oft quoted proverb meaning ‘to say fire would not hurt the mouth’.

Be sure that this Wedding Insurance (Marriage Insurance) is nothing seeking to indemnify the wedlock turning sour due to perceived difference of opinions between those to be married or those who have arranged for the marriage. It is protection against losses arising out of external factors like accidents, catastrophes or unintentional man-made disasters or disruptions. Though Wedding can spread to over 2 days or more, the entire function is treated as One event and most of the coverages offered treat ‘Wedding Insurance’ as a single product, and of course can be customized to suit the needs of the wedding function of the area / society / community/ religion and more.

Conceptually, the major coverage offered under this would be : · Cancellation or postponement of the wedding ceremony due to fire, natural calamities like flood and inundation earthquake etc, riot and strike · Read that some extended coverage could be - non appearance of bride, groom and other family members or the named person due to accidental death, personal injury either temporary or permanent and illness resulting in hospitalisation. Primarily the Insurance is intended to cover expenses - actually and already incurred or advances paid in connection with marriage hall, cooks, catering, Priests, beauticians, decorators, accommodation reserved for the bride, bridegroom, guests, music parties, photos and videography and entertainment programs. The amount of indemnity could include, the cost of consumables which can neither be returned not used after lapse of time, loss on cancellation of travel tickets, forfeiture of caution or security or deposits.

There could be a liability element also added in – i.e., Third party liability of the Insured arising out the usage at the marriage hall. This again could be considered as most unlikely as the visitors to the marriages are ‘near and dear’ and would not litigate nor fight against those known people.

The Insurance would also cover physical loss or damage to property like the decoration / jewellery, gift material etc., caused by fire, natural calamities, earthquake, riot and strike and can be extended to cover the risks of Burglary and theft for the jewellery, valuables and money also.

The Insurers make it a pre-condition that the Policy is availed certain days in advance (15 days) of the occasion. The period of Insurance would be for specified days (5 !) – starting 24 hours prior to the start of customary rituals till the end of events as on the Invitation or till the end of functions or 5 days, whichever occurs earlier. The coverage is for a proposed Sum Insured, which would be the ‘limit of indemnity’. Understand that the market product has the maximum sum insured of Rs.5 lakhs and sure could be negotiated for a higher limit, depending on the actual expansiveness of the proposal.

This Insurance would by no means offer coverage for losses arising out of ‘disputes between parties’, criminal acts, willful negligence and the like. Most of the time and to everyone’s wish, marriages occur very smoothly. But when something unexpected or unwanted occurs, this insurance would provide financial support is what is intended to be.

To think of it properly, it is not as though only very big budget wedding require this – any one planning wedding with their hard earned money should look to have this coverage to ensure that in the unfortunate event of loss, they are protected by insurance.

With regards – S. SampathkumarPS: post made in 2012 ... found in draft and now published, lot many changes may have taken place thereafter !!!!