Note: This is the #longread version of posts from "Hop Week."

Note: This is the #longread version of posts from "Hop Week." There are many repeated discussions in the beer industry these days.

But one aspect that widely gets discussed by beer enthusiasts and the mainstream media with great regularity: hops. Where they're growing, how they're growing and what it means to beer - especially craft - going forward. It's not hard to find reporting on one of the hottest stories in beer, whether we're talking about hops growing in Colorado, Florida or anywhere else.

Even if it means we may be missing one of the most important angles of this often discussed topic.

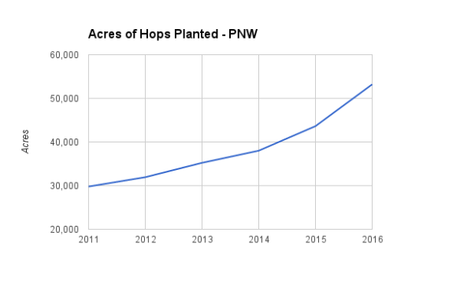

Everyone's super excited that more acres of hops are being planted. That's why we keep seeing news stories all over reporting about hops going into the ground (and growing upward):

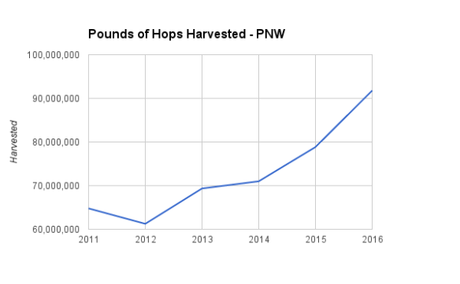

So, of course, more hops are being harvested than ever before. That IPA you really like is getting a great boost because more hops are plucked from their bines:

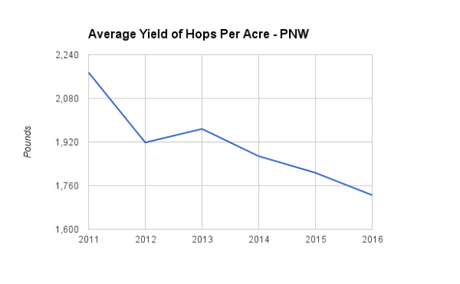

But here's where we check in with what these things really mean together. Acres are up. Harvested hops are up. That's good, right? Well, not necessarily:

All those news stories highlighting the rise in acreages and harvest have been missing something: the average yield of hops has been decreasing pretty steadily. The projected yield of 1,725 pounds per acre to be harvested in the Pacific Northwest in 2016 is the lowest amount since 1998, according to data collected by the Hop Growers of America.

In terms of hop availability, this isn't a problem. Overall production levels are very high. 2016 would be only the second time in the last 20 years the total number of pounds harvested eclipsed 90 million, representing 16 percent growth over 2015 and not far from double the total pounds harvested a decade ago.

Instead, lower yields represent a problem for the craft beer industry based on its ambitious goal of 20 percent market share by 2020. With an average of two new breweries opening each day and roughly 4,700 already in operation, the need for more raw materials becomes an issue beyond sheer volume. It's also one of efficiency.

Because craft brewers use such large quantities of hops - the most recent estimated figure is 1.42 pounds per barrel - our focus shouldn't necessarily be about how many hops are grown, but how successful the industry can be given a finite amount of space and resources with which to grow more hops.

According to estimates shared by Loftus Ranches' Patrick Smith at this year's Craft Brewers Conference, in order to produce enough hops to supply breweries the materials needed to hit production goals for 20 percent market share, brewers need to add about 15 million more barrels by 2020, requiring 21.3 million pounds of additional hops. To do that, based on a recommended average yield of 1,800 pounds of hops per acre, the US needs to add 11,833 new acres by 2020 to meet demand.

Of note: this goal only counts Brewers Association-defined breweries and doesn't include businesses like Elysian, 10 Barrel, Founders, Widmer Brothers and more, who still source hops from American farms.

Foreign hop production offers some relief, but growers outside the U.S. are already doing their part to provide enough stock for their own countries and as the world's top hop-producing nation, American growers are leading the way.

So what does that mean for the number of growers we need and what they're supplying to brewers?

Which is good, because craft beer is going to need those hops. But in order to fulfill the requirement of producing enough beer to meet 20 percent market share by 2020, there's still work to be done.

From building the infrastructure to choosing hop varieties, the country needs more farmers, more hops and more investment to make it happen.

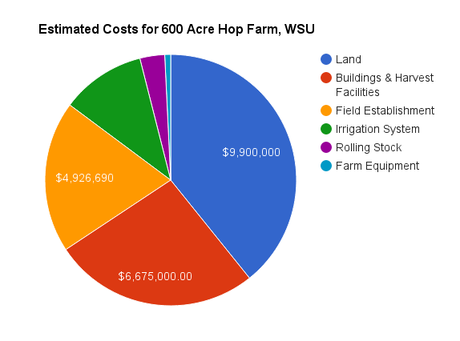

A first step to address decreasing hop yields is simply adding more farms, especially considering the American hop market will need about 12,000 more acres by 2020 to fulfill the need of the nation's craft brewers, according to a presentation made by Loftus Ranches' Patrick Smith at this year's Craft Brewers Conference. That's not an inexpensive proposition.

A 2015 study by Washington State University listed a 600-acre farm as an ideal example for the Pacific Northwest based on a range of agricultural, economic and business practices. That size is nothing to scoff at: 600 acres is roughly what California, Colorado and New York have strung for harvest in 2016 combined. Michigan is estimated to have 650 total acres strung in the state.

Whether that 600 acres is realistic given available land for agricultural pursuits is another discussion all together. The average Yakima Valley farm is 450 acres.

All the same, to create that 600-acre farm, the estimated investment would be in the range of $23 million:

To produce the amount of hops necessary, that size farm would need to be created 20 times over, a total cost of nearly $500 million.

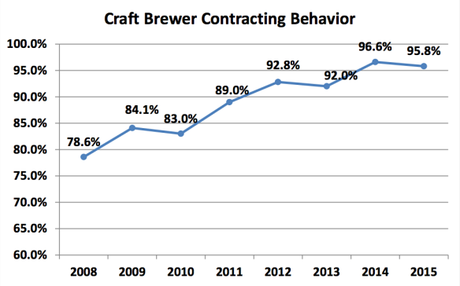

A similar cost was also recognized by the Brewers Association, which even admitted that estimate may actually be low due to rising labor costs, infrastructure and other factors. However, the cost is a shared one, as BA economist Bart Watson noted: "Hop contracts serve as a promise of future payments and guarantee growers and dealers a return on their investments." In addition, the overall cost to grow a pound of hops - depending on variety - may be in the range of $1 to $1.50 in the coming years, according to one estimate.

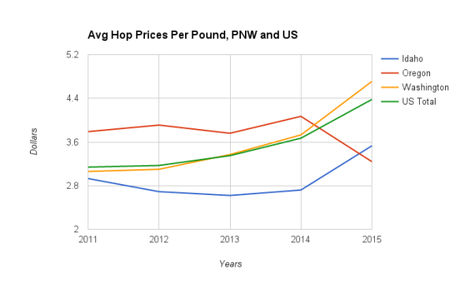

Achieving that return is becoming slightly easier thanks to rising hop prices, although the markets can certainly fluctuate. The national average went up $1.24 per pound from 2011 to 2015, reaching $4.38.

A quick aside on that price drop off in Oregon.

Like elsewhere, Oregon's overall state yield has dropped even as acreage has increased by 52 percent since 2011:

That's not the potential reason for a decrease in price per pound, but it may put a greater emphasis on the need for stronger yield. The top-five varieties grown in Oregon saw a mixed bag of results in 2015, according to YCH Hops:

- Nugget, 1,418 pounds - "exceptional"

- Cascade, 1,160 pounds - "well"

- Willamette, 792 pounds - "off"

- Centennial, 701 pounds - "big disappointment"

- Citra, 538 pounds - "average"

But back to the national view. The decision of what to plant - driven by geography and weather - should be viewed with a couple important views, according to a Washington State University study:

Lower yielding hop varieties are more expensive to produce: The popular aroma variety Citra for example will come at a premium to other varieties, since its yield is relatively lower. This also serves to illustrate the agronomic reality that in poorer crop years with lower yield, the cost per pound will increase.

Higher yielding hop varieties are less expensive to produce: Simcoe for example, may cost relatively less to produce than many varieties, since its yield is relatively higher.

As interest in growing hops increases - especially if it's to meet rising demand - the geographical choice of what and where to grow is certainly important. Not all hops are created equal when you're comparing the ideal climate of the Pacific Northwest to the Southeast, for example:

Pearson says Florida is a long way from being the new Yakima. For one thing, the yield of Florida hop plant has been small as compared to Yakima or even North Carolina. Pearson compares the harvests: "In Yakima, they traditionally harvest about eight pounds of hops per plant. In North Carolina, they get two to three. In Florida, we have been getting one pound per plant." Pearson admits that he only had room to let [University of Florida] hop plants grow to 13 feet and the plants like to stop growing around 18 feet.

All this points at a trend impacting the beer industry: the type of hop most beloved by drinkers and brewers is greatly impacting production decisions. The good: beer lovers get new, exciting flavors. The bad: there may be more of a need for variety diversity in order to be efficient in hop production.

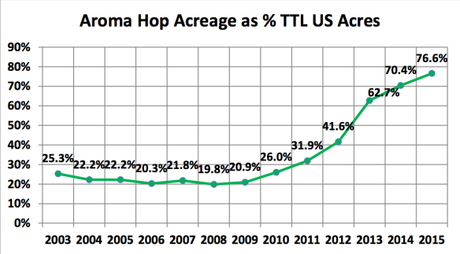

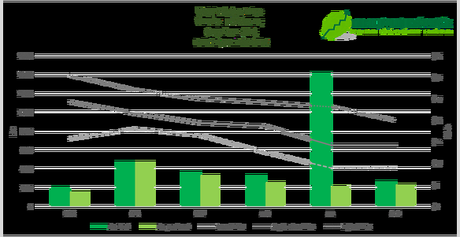

When it comes to hops, the well-known elephant in the room is the prominence now taken up by aroma varieties, which aren't just driving high ratings on Beer Advocate or RateBeer, but also the presence on farms across the country. Over the last decade, the shift from alpha to aroma varieties has been stark.

The change has been illustrated in several ways.

From its annual hop report, the Brewers Association collects the most heavily-used varieties by craft brewers. The lists from 2007 to 2015 are certainly different:

There is actually one less specific aroma variety on that 2015 list than 2007, but the increase in dual purpose hops is stark, especially when you consider how most brewers are using something like Simcoe or Centennial and the flavors they're extracting.

Spoiler alert: it's heavy on the late addition side to emphasize their unique fruity/juicy characteristics:

So what does this mean in terms of what - and how - varieties are being grown? More important, how can these changes be done efficiently when space is at a premium?

Our expectations as drinkers have quickly changed in the past decade and brewers have responded in kind, making regular adjustments to the IPA, America's favorite craft beer, to step further away from the bitter concoctions of the past. That's clearly influenced how hop producers are doing their jobs, too.

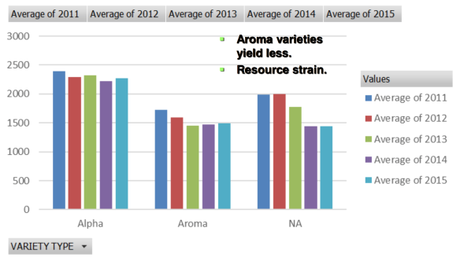

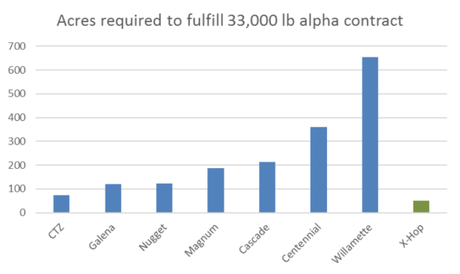

People up and down the supply chain love aroma hops, but if an issue the industry faces relates to space available and the overall yield of hops, a continued focus on aroma varieties across the board presents a unique challenge. During a presentation at this year's Craft Brewers Conference, Jason Perrault of Perrault Farms, Inc. pointed out the contrast in yields between alpha and aroma varieties.

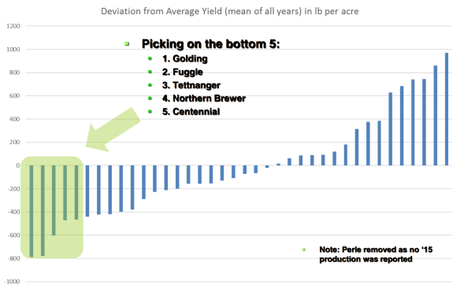

He even went a step further, showing how a handful of varieties stack up when compared to the average amount of pounds per acre.

Which raises the question: how could producers adjust to better reflect the need for hops, especially with an eye toward increasing production levels to fulfill demand for the craft beer industry?

For example, here's the breakdown of the acres harvested and pounds yielded for Mt. Hood, Willamette and Fuggle from 2015:

If we use the threshold yield of 1,800 pounds per acre, a figure suggested as an ideal return rate, all these varieties fall well below. Together their 1,862 combined acres is minimal to what's planted across the U.S., but could potentially be made more efficient with another hop choice. Dual-purpose Loral, a newly released - but private - variety that has expected yields around 2,000 pounds per acre.

(There are many other factors to consider here, like brewer use, flavor preference and most important, the time needed to plant and grow a hop like Loral to maturation. There's also the fee that would need to be paid to access Loral.)Another example may be Magnum, which has a profile not far off from Warrior, but offered a yield below 1,800 pounds per acre in 2015:

Warrior, its latest figures from 2014, yielded 1,821 pounds per acre.

There are also cases like Mosaic, Columbus/Tomahawk/Zeus, El Dorado, Crystal and Apollo, all of which saw yields above 2,000 pounds per acre in 2015. Comet, now coming back into style after a hiatus, saw a yield of 1,780 pounds per acre in limited use in 2015.

Fluctuation is obviously something to consider, but by increasing the acreage diversity across hop production, two things happen: first, current acreage becomes more efficient, then extra space is opened up for additional varieties.

(Obvious caveat: I am not an economist or agricultural expert and I realize the myriad of business variables associated with making these kinds of changes. I'm just trying to point out general ideas.)

(Obvious caveat: I am not an economist or agricultural expert and I realize the myriad of business variables associated with making these kinds of changes. I'm just trying to point out general ideas.) If Loral were to replace Fuggle and double that yield without any additional investment in infrastructure, a farmer could potentially open up some acreage to try a new hop or fill in with another variety preferred by brewers and drinkers at that time. Options abound.

But even if all these changes were to be made in order to better assist the craft beer industry with the raw ingredients needed to hit its 20/20 goal, there is still another way to help address America's' insatiable love for hops. But is it too different to appease beer lovers?

Beer, forever bound to agriculture, seems like it should be philosophically opposed to the use of the word "industrial." In an era where "big" is bad to many beer lovers, the mere suggestion of the word can significantly alter perceptions.

Instead of some handcrafted, artisanal product, we suddenly have something wildly opposite. A beer that sounds so ... macro.

With craft brewers using hops at a per-barrel rate many times greater than big breweries like Anheuser-Busch, it may be worth our time to better understand academic and even industrial advancements that can offer solutions to brewers and not take anything away from the beer we love.

There's a simple challenge here: if craft brewers are going to need millions more pounds of hops to keep up their pace and crank out all those IPAs Americans crave, the process of how they use hops can become more efficient in several ways. Anyone can pile pounds of hops in a kettle, but if there's some strategy and science behind it, maybe there isn't as much of a rush figure out where 21.3 million pounds of hops need to come from to achieve 20 percent market share by 2020.

From a brewing process standpoint, there's lots to consider.

In recent years, pale ales and IPAs have taken on a new flavor of the day, barely focusing on bitterness in lieu of bright aromas and flavors that are akin to the fruit we eat, but in beer form. This shows up in changes in our regular IPA or the recent rise of New England IPAs, aiming for as much a certain flavor as look. The use of hops has shifted in the process, focusing more on late additions, which keep more hop oil in the liquid, and dry hopping, which can provide an array of sensory impressions.

(Of note: this piece by Stan Hieronymus is a great primer on hop characteristics, in addition to the myriad of other work he's done, including this book.)From that point on, however, studies are showing a range of alternatives that might require fewer hops with just as much efficiency. This is most certainly known to brewers, but the research is worth highlighting all the same.

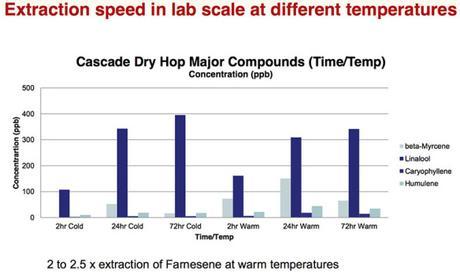

For example, one Oregon State study found that oils from dry hopping were almost fully transferred to a beer after 24 hours, offering a quicker end to the process. It also highlighted the difference between stirring dry hops and leaving them still in the beer, finding that optimal levels of hop characteristics can be achieved within hours, not a "4-12 day industry practice." Modern Times' Jacob McKean highlighted this point in a recent post, noting the success of whirlpool additions commonly used in brewing.

This finding was emphasized at this year's Craft Brewers Conference, where Boulevard Brewing's Steven Pauwels showed in lab testing that after 24 hours, whether at 4 or 20 degrees Celsius, extraction is mostly complete.

While brewers are keen to these findings, the ultimate goal of highlighting this research is to show how the process can be as important as the ingredients used. Even if hop production is slow to catch up to demand, the way brewers are using hops makes this potential issue a little less daunting. In a presentation made at this year's Craft Brewers Conference, researchers from Oregon State showed the following slide as a way to discuss the topic.

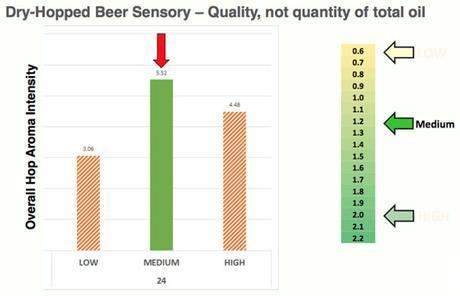

"In this experiment, it was not necessarily the quantity of hop oil that was related to high hop aroma intensity," Dan Vollmer, a Ph. D. candidate explained.

As determined by participating subjects in the study, the "medium" amount of hop oil displayed by Cascade hops delivered better scores than "low" or "high." This finding carried over into additional research in late 2015, leading Vollmer and others to determine that it's not always about the amount of hops you use, but their composition and how you use them.

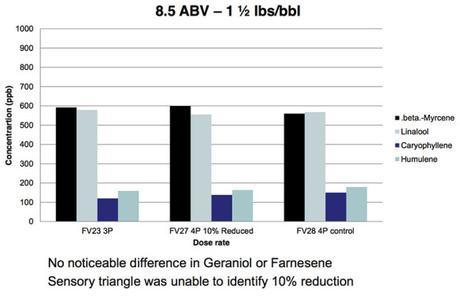

Pauwels also showed a similar result. When doing sensory tests, Boulevard staff found that they could reduce hopping rate by 10 percent at a certain gravity rate (in this case, 4 Plato) and there was no noticeable difference in quality.

He went on to say that depending on usage, tests even showed a 20 percent reduction still gave similar sensory scores. A difference first became obvious once tests went to 30 percent reduction.

"If you think about how much hops you use, how much hops you buy, what impact does it have?" he asked the audience at CBC.

But hop use efficiency isn't the only way to approach how many hops are grown - and ultimately needed for a beer.

In addition to pellets, Founders Brewing regularly uses liquid hop extract. Alec Mull, vice president of brewery operations, has noted that Devil Dancer, the brewery's Triple IPA, wouldn't be able to be transferred among vessels without using extract because of the volume of physical hops they would make the process rather difficult.

This "industrial" complement to Founders' "traditional" method of hop use is found at all stages of the boiling process for beers, from 10 minute "hop" additions up to the 60 minute bittering charge. Mull pointed out that extract's efficiency takes nothing away from the beer - sensory examinations show brews with hop extract are preferred "100 percent of the time" - but that's not all.

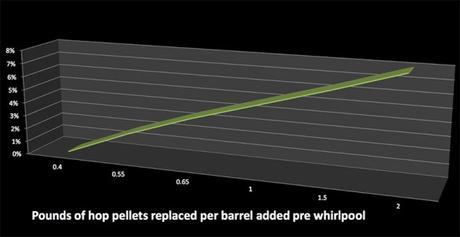

First, consider how much extract is used against hop pellets. This image shows the equivalent of one box of Mosaic extract to three boxes of T90 pellets to achieve the same general amount of impact.

But saving space and resources before making a beer isn't the only benefit. Consider what comes after, too.

- Hoppy pale ales and session IPA yields 1 to 2 percent more wort

- IPAs yield 3 to 5 percent more wort

- Double IPAs yield up to 8 percent more wort

Hell, there's even a company that is thriving off the creation of hop extracts created to mimic tropical fruit and grapefruit character. Wave of the future or too industrial for our tastes?

However brewers may choose to address their own hopping needs, one thing is for sure: there are ways to get creative when it comes to brewing beer to stay fresh, trendy and at the forefront of beer lovers' minds. Among the many sub-categories of IPA, one particular approach may be most attractive from an educational and sales standpoint.

At our current state of human evolution, our attention span is reportedly eight seconds. That's less than a goldfish.

By one estimate, the amount of time we can pay attention to a singular beer brand is three years. I'm sure there are many who would argue that number is actually less and, like our regular attention span for everything else in life, is shrinking rapidly.

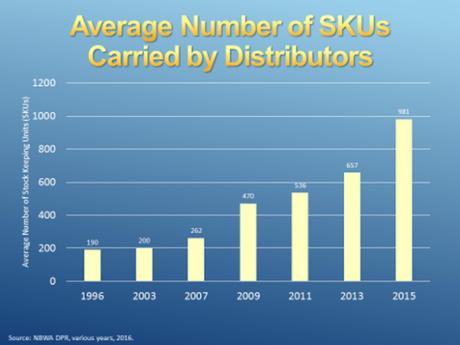

It makes sense, given the rise in the number of brands carried by distributors and how many end up on the shelves of our local beer aisles, making us spend more and more time simply figuring out what it is we're going to buy.

So when it comes to addressing the availability of hops and what people want, one of the trendy techniques in craft beer is offering a smart approach.

"If you look at data for beer styles, the number one style is IPA and the number two is variety," said Ray Goodrich, director of marketing for North Carolina's Foothills Brewing. "People like trying new stuff so that's what we're going to give them."

He should know. Foothills is now in year three of an ongoing experiment, releasing a new IPA brand every month featuring different hops and flavors. Every 30 days, a 90-barrel batch is put into 22-ounce bombers and distributed across Foothill's distribution footprint. With the exception of one month, Goodrich said he's always seen their IPA of the Month or Hop of the Month beers sell out.

Goodrich is right: combining American beer drinkers' favorite aspects is a win-win. When craft beer sales are dominated by IPA, offering a continuous collection of new options is almost guaranteed to be a hit.

You can point to Utah's Epic Brewing as one of the leaders of this idea, which kicked off its Exponential Series Imperial IPA back in 2010. What a time that must've been, when Simcoe and Amarillo led the "exotic" charge to beer enthusiasts.

"It was part of our DNA as a brewery," said David Cole, co-founder of Epic. "We wanted to play with all these crazy, different hops and consumers really seemed to love that."

In Epic's wake, Widmer Brothers picked up the baton in 2011 with their Rotating IPA series, then came a whole host of other breweries in recent years: Weyerbacher, Victory, Green Man and more. This year, Firestone Walker began its Luponic Distortion series, a base beer that features a new collection of rotating hops every few months. The first batch, released this spring, quickly jumped to become the company's third best-selling beer.

To Cole, who helped start things six years ago, the rise in popularity of the rotating IPA makes perfect sense - and even goes beyond the fact that sales clearly show beer lovers are looking for something new and different on a regular basis.

"It's almost entirely grown out of the broader knowledge of consumers," he said. "They read about a batch of New Zealand hops described as 'guava' and 'tropical' and they want to try it. People are want to understand what gives their beer flavor and then calibrate their own ideas about different hops."

Naturally, there's a benefit of curiosity for brewers, too.

"Our concept came out of the idea that we enjoy hoppy beer, but as a very young brewery, we didn't have access to the cool, sexy hops we wanted to use to make an IPA that met today's flavor profiles," said Rob Burns, co-founder and brewer for Massachusetts' Night Shift Brewing. "We decided to blend what we could get to create a concept that was always changing based on our hop sourcing abilities."

What came out of the plan was the aptly named Morph series. Since August 2014, Night Shift has created almost 40 different batches of the beer, tweaking aspects each time to highlight different flavors and letting Burns and colleagues play to figure out what does and doesn't work for IPA lovers. A dedicated page on Night Shift's website helps to set expectations, offering hop selections and tasting notes.

In late 2015, after securing hop contracts, there was consideration to discontinue Morph since Night Shift had an IPA (Santilli) and double IPA (The 87) in regular production. Consumer demand said otherwise.

"I was talking to a hop supplier who asked what we do if stores have overlapping batches of Morph on the shelf," Burns said. "My answer was 'that never happens.' Getting an understanding of the process and what goes on behind the scenes of making a beer is considered cool."

When the rotating IPA was first brewed in 2014, it started out as 20-barrel batches. Now it's done in 60-barrel increments.

The success of Night Shift and others with creating an ever-changing IPA showcases an important aspect of the beer industry: regardless of a brewery's size, there's some wiggle room with this particular "style" of IPA. Whether it's a startup or established player, finding new ways to breathe life into a brand can be as easy as changing a few ingredients. In some cases, it may even be getting more cost efficient to do so.

While contracts can assure a brewery a continuous flow of hops, the spot market continues to play an pivotal role, especially with a looming threat of a hop shortage occasionally being reported. But at places like the Lupulin Exchange, an online marketplace to buy and sell hops, some examples show business is healthy for brewers interested in finding varieties to mix and match with their own brands.

In a blog post from the beginning of this month, Lupulin Exchange's John Bryce offered an update on the potential for over-contracted brewers, causing a decrease in some hop prices. The overall average of hops listed on the website went up in 2014 and started to drop in 2015. In some cases, that trend has continued:

Today, you can find more than 11,000 lbs of Mosaic parked on LEx in the $15-20 range. This would've been unimaginable only a few months ago. Mosaic isn't cheap, but the average price is approaching half that of early 2016.

Other varieties saw decreases, including Simcoe and Amarillo, which is certainly a difference from just a few months ago.

$19/lb for Amarillo on contract? Get the fuck outta here with that nonsense. Beer consumers, get ready to start paying a lot more soon

- Alex Tweet (@MrAlexTweet) July 15, 2016

Even public varieties like Cascade and Centennial have seen dropping prices.

Three years ago, the Barth Haas Group estimated 125 hop varieties in common use worldwide. This summer, that amount jumped to 155. Not all of these are available to everyone, but emphasizes the situation, that options can be plentiful for brewers, especially when variety and "new" is king. If the growth of the American hop market is impacted by lower yields, too few farms and what needs to be grown to serve a thirsty audience, there are ways to work around these challenges, whether that's how hops are used or what brewers want and can buy.

In conversations with brewers and owners around the industry, there is a continued stress around what can be contracted and guaranteed, and rightfully so. The trend to lock in ingredients is crucial to the success of a business, but even more so when we're talking about the key to America's favorite style of craft beer.

But given all the obstacles that may face the beer industry when it comes to hops, the success of the rotating IPA is surely a bright spot. In recent years, utilized by many different breweries for many different purposes, it's shown to be a powerful tool to boost sales and work around changing logistics facing raw materials.

Most of all, it allows brewers to keep giving drinkers what they want.

"Craft beer people in general seem to be fairly free-spirited and adventurous," said Goodrich, the director of marketing with Foothills. "We all depend on an audience that wants to try new things and the great thing about this is how it can be different and accessible for anybody."

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac