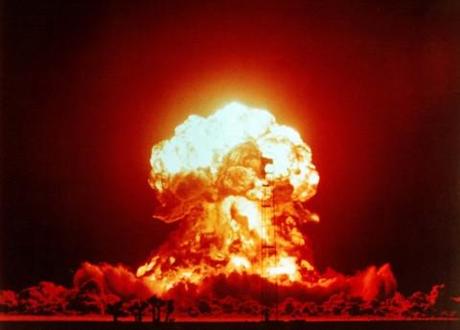

World War III, anyone?

At the risk of being accused of scaremongering, I’ll state my point simply and up front: Things in Europe are not as bad as they seem – they’re worse.

And though the commentariat is queuing up to predict the imminent demise of the euro currency and to lament the ongoing recession, that’s not even the half of it: We’re looking at World War III.

As major corporations start drawing up contingency plans for a world without the euro and as weaknesses in government finances become ever more glaring, the end of the euro currency becomes an increasingly realistic prospect. Related, the total absence of business growth, or trading among European nations raises the question of what benefits a unified trading block offers. The driving motive behind the original Coal and Steel alliance that ultimately became today’s European Union European was a desire among nations, traumatised by the worst war in their collective history, to provide a deterrent against another war. My concern is that that trauma has faded, and that the fear of war has been replaced by the fear of recession.

As anyone with even a fleeting familiarity with European history can confirm, ours is not exactly a history of love and peace. In fact, the period since the end of World War II has been probably the longest period of relative peace the region has ever known. Arguably, it’s no coincidence that that period of peace has coincided exactly with the ever strengthening ties that have been forged between European nations over these past 60 years.

If the bonds that tie European nations together are weakened, the incentives to avoid total war dwindle. And its not as dramatic or far fetched a theory as it may at first sound. The end of the euro currency and a reversion to national currencies could quite possibly provide the impetus for a further dissolution of the union. The unraveling of painstakingly negotiated ties becomes easier and easier as each strand frays and breaks. Combine this unraveling with an ongoing or even deepening recession, and it all makes for a combustible atmosphere.

Unfortunately, it is human nature to blame others for our woes. In an environment of unemployment, austerity, and general resentment, it is not difficult to imagine nations starting to point the finger at their neighbours. And without the unifying effect of a common currency, thriving trading relations, free movement of peoples, and common interests, Europe would find itself increasingly susceptible to war. Moreover, as so few Europeans in my generation, let alone subsequent generations, have even the slightest inkling about how horrific war is, it may be tempting to consider it as a solution to problems, or at minimum an acceptable response to perceived slights.

Look around us today: Britain standing alone and isolated in Europe; France and a united Germany standing together and more powerful than the rest of the nations of a Europe mired in recession; strengthening nationalist political parties; unelected technocrats running nations; and quite possibly in the not too distant future, each nation with their own currency.

Sound familiar?