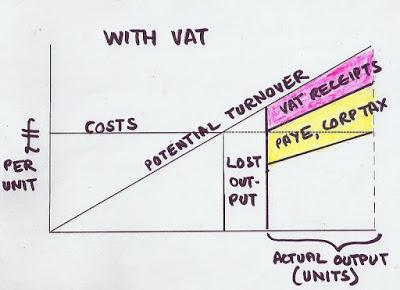

Here's a simple diagram showing how VAT reduces economic activity (assuming a certain fixed level of costs) and sketching in the receipts from VAT (about £100 bn) and PAYE/corporation tax. This assumes that the overall average rate paid by employees (income tax and NIC), company and business owners averages out at 40%. So mathematically, PAYE and corporation tax receipts etc are about £200 bn and total tax paid by the VAT-able sector is £300 bn:

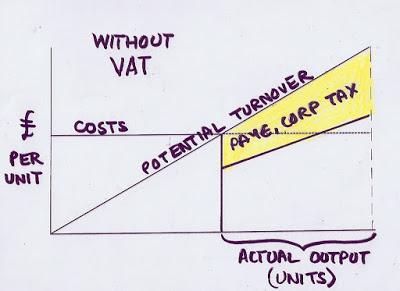

Now, what happens if we got rid of VAT but left other tax rates the same?

Output, in units, increases by one-fifth and the 40% average rate, now applied to a much larger tax base, would raise about £280 bn (if my geometry is correct). So although VAT taken in isolation is £100 bn a year, getting rid of it would only mean total revenues falling (a 'cost' from the government's point of view) by £20 bn.

For sure, I have made a lot of assumptions here, the higher the fixed cost line, the more dramatic the effect and vice versa. But even if the fixed cost line is set to zero, total receipts would only fall from £300 bn to £240 bn, a dynamic 'cost' of only £60 bn.

And the 40% is just an overall average rate, the average rate for low earners will be lower, but all those extra jobs means millions off the dole queue into low paid jobs at least, and the welfare savings is well in excess of 40% of the extra money they earn.

Perhaps we can split the difference between £20 bn and £60 bn and call it £40 bn?