Photo by Sun Brockie

Medicare Part D is a government-sponsored insurance program that subsidizes beneficiaries' prescriptions. If you don't understand the basics, please take some time to view the Medicare Part D website.This program does not cover 100% of prescription costs. Beneficiaries are responsible for these expenses:

- Monthly premium

- Deductible

- Co-pays

- Full costs of over-the-counter drugs

- Full costs for drugs not covered in your plan's formulary.

- And if beneficiaries delay signing up for Part D, they have another cost: a permanent penalty for late enrollment, which is 1% of the premium for every month the beneficiary delays signing up for coverage when eligible.

Falling into a coverage gap called "the donut hole" increases the percentage of co-pay costs beneficiaries must pay. This presents incredible hardships for many older adults. A 2007 study found that about a quarter of beneficiaries with Part D enter the coverage gap. The Affordable Care Act will slowly close this coverage gap between 2013 and 2020 so that beneficiaries pay only 25% of prescription costs after meeting the deductible. In the mean time, there are some cost-cutting strategies worth pursuing.

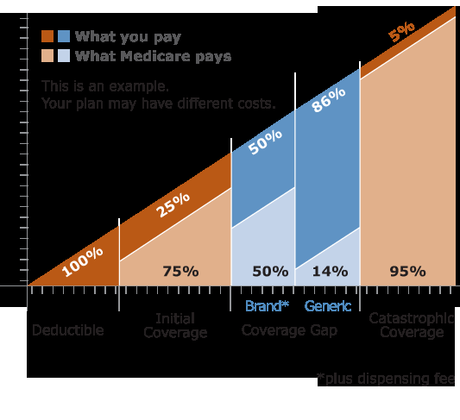

Kaiser Family Fund, a nonpartisan research organization, has this chart illustrating the closing of the donut hole. Note, "closing" does not mean erasing out-of-pocket costs; it just means changing to maintain a level percent of cost (after meeting a deductible) where a "hole" or dramatic increase in out-of-pocket costs exists today.

If you want to learn more about what costs Medicare Part D beneficiaries currently pay--and some of these costs will persist--read on. There are some informative images below.

The average costs for premiums is close to $30 a month. Deductibles vary by plan, but they must be paid before lower costs at the counter kick in. This example shows a $250 annual deductible. However, the co-pays vary from person to person, depending to a large degree on how many prescriptions they take. Monthly co-pays could be $0 if you just take a couple of generic drugs, or monthly co-pays could total hundreds of dollars each month if you are on multiple, expensive medications.

Glaucoma medicine, for example, can cost a beneficiary between $30 and $100 or more each time it's filled, depending on the drug, the plan, and the beneficiary's location in or out of the donut hole (see below). And that is just one possible prescription. I have helped beneficiaries who are taking as many as 14 prescriptions regularly.

There are some programs for low-income beneficiaries that help with some of these costs. The Social Security Administration reviews applications for help with this CMS (Medicare) program. Start here.

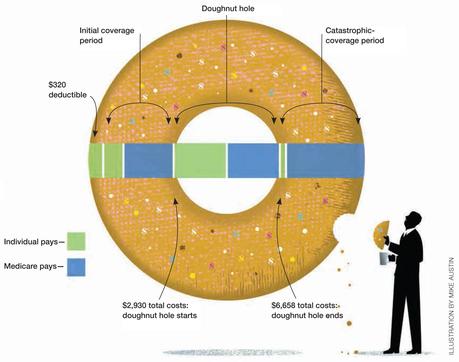

Click to Enlarge. Graphic by Mike Austin (no relation)

The graphic on the left illustrates the shared costs of prescription by the plan (blue) and the beneficiary (green). Once the blue + green total cost (click to see a spreadsheet example) of prescriptions reaches $2930, the beneficiary must pay more for prescriptions. This coverage gap is called "the donut hole."

Image by Group Health. Not an endorsement.

The graphic on the right gives another view of the costs to beneficiaries. The donut hole is blue, using dark blue to show the increase of costs to the beneficiary. By 2012 limits, the initial coverage is exhausted after a $2930 total cost. Once beneficiaries pay $4,700 out-of-pocket, they reach a catastrophic level of costs (which in 2012 is $6,658 total), the cost to the beneficiary is greatly reduced--just 5% of the total cost of each drug.

Beneficiaries can anticipate the coverage gap by using the Plan Finder on Medicare's website. This online tool can help beneficiary's select plans each year during open enrollment (October 15 through December 7th). And it can serve as a reference throughout the year in anticipating monthly expenses.

Related:

Manifold Factors for Rising Medicare Costs

Quick-and-Dirty Medicare Basics