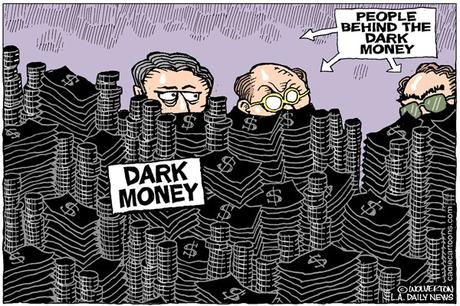

(Cartoon image is by Monte Wolverton in the Los Angeles Daily News.)

(Cartoon image is by Monte Wolverton in the Los Angeles Daily News.)Much has been written about the odious GOP tax reform plan to give huge tax cuts to corporations and the rich. But one big give-away that's flown under the radar is a plan to let secret dark money political contributors get a tax deduction for those contributions. This would allow billionaires and millionaires to give even more money to buy a political candidate (since they could recoup that money by writing it off as a decuction on their tax form. It would be one more giant step toward an oligarchy, and away from democracy.

This is from CNN.com:

For the first time in American politics, anonymous "dark money" political donations could become tax-deductible. That's if a provision currently being debated between House and Senate negotiators makes it into the final tax bill.

The issue at hand started with the "Johnson Amendment," named after then-Sen. Lyndon Johnson's 1954 measure that prohibits nonprofit groups who maintain tax-exempt status, including churches and charities, from directly participating in politics.

But efforts to repeal the Johnson Amendment have resulted in language that would ease political speech rules for all nonprofits. The results, critics say, could effectively let people deduct de-facto political donations and further hide those donations and spending from the public. . . .

The original bill introduced in the House this year limited the Johnson Amendment repeal to "churches," but the language was changed in the House Ways and Means Committee to broaden the scope of the repeal to include all 501(c)(3) nonprofits, meaning every nonprofit would be able to endorse and support candidates and causes. . . .

The change would also cost billions of dollars. The non-partisan Joint Committee on Taxation estimates the rule change would cost the US treasury around $2.1 billion over the next decade in lost revenue, assuming billions of dollars of political donations would be funneled through newly tax-deductible nonprofits. . . .

One of the outcomes of the Citizens United ruling was that politically-active nonprofits, or 501(c)4 groups, could accept unlimited anonymous contributions, so called "dark money." According to the Campaign Legal Center, at least $800 million of dark money has been spent since the 2010 Supreme Court ruling. With the repeal of the Johnson Amendment, donors could now shift their money into tax-deductible 501(c)(3)s. . . .

With the new rules in place, billions would likely be diverted from Super PACs into charities. And that new money could come with strings attached. Donors would be free to make donations to a charity or religious organization contingent on the group supporting a certain piece of legislation or candidate.