There is an interesting technical indciator that has occurred this week. According to Albertarocks, upon whom I rely with this indicator and who does a great job tracking this indicator, we have a "Hindenburg Omen" this week in the stock market. Here is the link to Albertarock's Hindenburg Omen Analysis. The link to his site, and other technical analysis sites I like, are in the blog posts to the right. Also, if you are interested, vote on the two polls on the right side of the blog as I think the results are so far very interesting.

STOCK MARKET SUMMARY

To understand fully what I am talking about, you need to review the prior thesis posts and the recent indicator analysis. So, before I get into the charts, here is the link to the recap of the overall stock market thesis which so far has not deviated. Important Thesis Update. The recent top occurred 7 trading days after the May 13 date, which is a bit late but given the date was identified months ago, not too shabby.And, here is the recent update where I laid out the next fractals that I am watching after completion of the long wave 4 from mid-March and the wave 5 thrust up. Et tu Price? Is a Hard Rain Gonna Fall?

Also, though all my current scenarios are overall bull scenarios, I do from time to time update the bear scenario. The November 12, 2012 low is the key to the universe on this scenario is my overall thesis which I have been talking about for some time. Bear Market Scenario. I won't really ponder that bear market scenario from a trade perspective unless the November 12, 2012 low were to break. That does not mean I think it can or cannot break; it just means that I need the market to presently do something long term bearish before I ponder trading a long term bearish scenario.

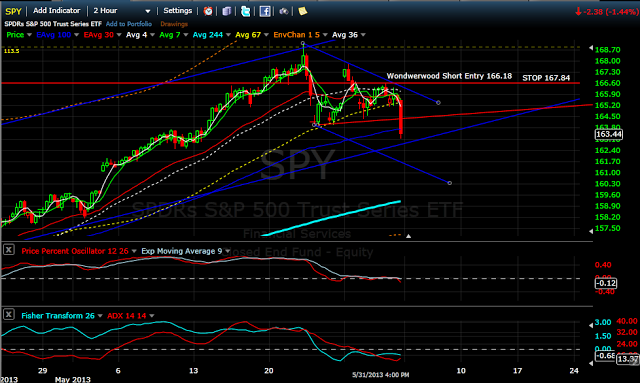

On Thursday I entered a Wonderwood short trade that I still hold. Wonderwood Short Entry. I will probably exit that trade on Monday or Tuesday and will post the exit. Exiting that trade is not a directional call. I try to hold Wonderwood trades for approximately 3 days and book the profit rather than attempting to catch all of the move. You can click on the "names of trades" tab at the top of the blog for further information.

STOCK MARKET UPDATE

As shown in the chart below, I believe the stock market is poised to make its back test of the November 2012 low, which is what from a thesis perspective was anticipated after the final thrust out from the long wave 4 from Mid-March 2013.

First, here is the S&P 500 Chart Below:

Second, here is the update on Wonderwood trade I was talking about.

I have now moved the stop down on that trade to approximately break even (the entry was 166.18 and the top and now the stop was 166.59). Currently, trend is still up as indicated on the long term moving averages. So, despite thesis, this is a countertrend short play.

CURRENCY UPDATE The NZDUSD long trade was stopped out at the break of the 38.2 fib level and large channel. Accordingly, I am no longer interested in that trade without that fib and channel support. It was a tight stop against potential long term support and I still like the setup even though it did not confirm. The USDJPY short trade delivered again on Friday by giving us another high lower than the prior 12. Accordingly, trend remains down on that trade for 4 more days at least. Here is the USDJPY chart update: