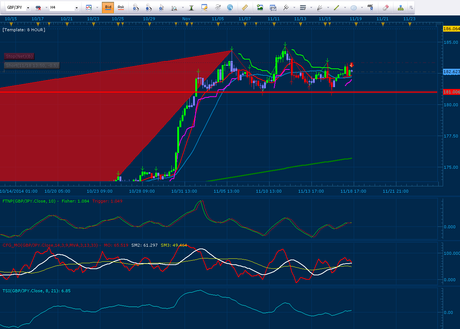

This pair is interesting because one of my monthly indicators is at the same level it was in 1998, 2000, and 2007. Chart:

This pair is interesting because one of my monthly indicators is at the same level it was in 1998, 2000, and 2007. Chart:

Now, I am not saying the result will or will not be the same. For me to change back to the alternate long term bear primary I would need to see some things confirm the bearish analog that I have been ignoring so far. The reason it is of interest is the long term cycle peak (under the bearish scenarios) which I showed in Today's Equity Post.

There is always a bull path and a bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the Disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

Now, I am not saying the result will or will not be the same. For me to change back to the alternate long term bear primary I would need to see some things confirm the bearish analog that I have been ignoring so far. The reason it is of interest is the long term cycle peak (under the bearish scenarios) which I showed in Today's Equity Post.

There is always a bull path and a bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the Disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester