Debt Management Strategies for Every Level of Income

The nation is facing a debt crisis from the homes all across America. According to recent data, total household debt hit an all-time high of $18.036 trillion in the fourth quarter of 2024 — which translates to the average household owing $105,056.

The enormity of this financial burden highlights the urgent necessity for proactive and impactful debt management. As it may lead to a situation of misery and stress for many, it shows the need to control it with clearly defined strategies.

Principles of Debt Management At its most basic level, debt management is about managing existing debt and creating an orderly repayment plan. It includes everything from careful budgeting and expense tracking to negotiating with creditors and considering debt consolidation plans.

However, the success of any debt management strategy depends on its applicability to specific financial circumstances, especially income levels.

A strategy that proves effective for one person may be completely unworkable for another, underscoring the inherent flaws in a generic approach to debt management.

Income brackets are more than just different price labels; they also characterise unique abilities, aspirations, and access to financial tools. Therefore, it is crucial to tailor strategies to account for these disparities.

In this article, we will explore the current state of U.S. debt, discuss how debt burdens tend to differ across income brackets, and provide a step-by-step guide for implementing personalised debt management strategies.

This guide guides the reader through overarching debt management systems, budgeting methodologies, optimisation strategies for high-income earners, real-world examples of success, and tools to help people on their journey to establish financial health and eventual debt-free status.

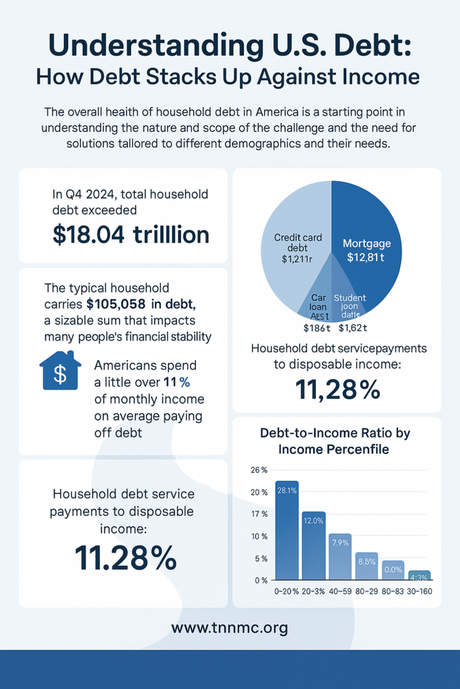

Understanding U.S. Debt: How Debt Stacks Up Against Income

The overall U.S. health of household debt in America is a starting point in understanding the nature and scope of the challenge and the need for solutions tailored to different demographics and their needs.

In the fourth quarter of 2024, total household debt exceeded $18.036 trillion. This number includes all sorts of credit—non-mortgage and mortgage—and the liabilities of US households.

The typical household in the U.S. holds $105,056 in debt, a sizable sum that affects many people’s financial stability.

Americans spend a little over 11% of their monthly income on debt payments on average, which means that a significant amount of earnings is allocated towards paying off existing debt instead of being saved or invested.

This debt can be broken into multiple categories, such as credit card debt, which the latest count places at $1.211 trillion; mortgage debt, which has the largest share of the total with $12.605 trillion; car loan debt, which is $1.655 trillion; and student loan debt, which is currently $1.615 trillion.

In addition, the proportion of household debt service payments (TDSP) to disposable personal income was 11.28% in the fourteenth quarter of 2024, which captures the comprehensive cost of debt versus disposable income.

Differences in income categories show considerable discrepancies in both total debt and repayment as a percentage of income. Data from an Annuity.

A study by a non-profit called the New York Times Org found a fairly straight good news/bad news correlation between income bracket and debt, as those with less income use a greater percentage of their income for debt.

Those who are 20% below the top 1% income ($570,003) spend an enormous 26.11% of everything they make on debt service.

This proportion declines steadily as incomes increase, with taxpayers in the 20%-39% income bracket paying 11.98%, the 40%-59% bracket paying 7.33%, the 60%-79% bracket paying 6.45%, the 80%-89% bracket paying 5.95% and the top earners (90%-100%) paying the lowest proportion at 4.31%. These data point to the lopsided burden of debt on poorer households.

Debt breakdown by income comes from statistics on credit card debt:

Income Percentile Median Annual Income Median Credit Card Debt Average Credit Card Debt Percentage With Credit Card Debt

Less than 20% $20,540 $1,400 $3,630 33.40%

20% to 39% $43,240 $1,600 $3,840 46.40%

40% to 59% $70,260 $2,500 $5,950 56.90%

60% to 79% $115,660 $3,500 $7,440 54.40%

80% to 89% $189,160 $5,000 $8,900 44.60%

90% to 100% $390,210 $6,000 $11,210 25.40%

All families $70,260 $2,700 $6,120 45.20%

This table shows that although those in higher income brackets are more likely to have higher average credit card balances, having credit card debt is skewed toward the middle-income groups.

This granular perspective on the debt landscape, by income segment, reveals the unique struggles people meet at different economic strata.

Lower-income people spend a much bigger share of their limited resources on debt payments, limiting their ability to save and invest.

Such a high debt-to-income ratio creates a cycle of financial vulnerability, as it becomes harder to build any form of financial safety net or deal with unexpected expenses.

In contrast, if, say, higher-income individuals may indeed hold larger amounts of debt in absolute terms, the percentage of their net worth devoted to debt service is smaller, leaving them more room to manoeuvre financially.

However, the high level of indebtedness can also be a major risk if the management is not strategic. Understanding these income-based variations is crucial to recognising that targeted debt management approaches are imperative for successful financial planning.

Debt Management: Not a One Size Fits All

Debt management cannot be defined as just paying off the debt. It involves a variety of techniques and measures that seek to consolidate and repay overdue financial commitments in an efficient manner.

At its simplest, debt management requires crafting a personal budget to record income and expenses and devising a feasible repayment plan and usually entails negotiations with creditors to help reduce interest rates, monthly payments or fees.

For others, debt management might include consolidating multiple debts into a single payment that is more manageable.

For those who have been unable to resolve their debt on their own, they may want to seek guidance from professional credit counselling agencies or debt management companies.

These experts are able to create a structured repayment plan, negotiate with lenders for the benefit of the debtor and provide educational resources to boost the debtor’s financial literacy and prevent future debt problems.

A one-size-fits-all debt management approach is not appropriate Along with the variety of income levels from which debt adversely affects people, it needs to be understood that a one-size-fits-all debt resolution strategy does not consider the other variables that determine the financial pain threshold and repayments of the borrower.

What might be a super effective strategy for the high earner could be useless, or even damaging, for the low earner.

The income levels guide the amount of disposable income available for debt repayment and savings. An unsustainable debt burden will not be possible for poor people to service.

Likewise, income groups have very different financial goals and priorities.

For someone making a low income, the goal of debt payment is primarily to meet basic needs and to avoid taking on any new debt, while a middle-income earner might be repaying loans while also trying to save up for education and/or retirement.

People with a higher income don’t have simple financial lives; for example, they might be using leverage on investments or advanced refinancing options alongside debt freedom.

Access to financial instruments and instruments, such as credit on beneficial terms or investment opportunities, also varies dramatically by income. Low-income people have limited access to low-interest loans or balance transfers, making strategies like debt consolidation even more difficult.

On a related note, higher-income individuals with good credit might more easily qualify for these types of tools, allowing them the ability to optimise their debt repayment on a better scale.

Thus, the futility of such a homogenous approach is rooted in the importance of these stark differences in financial realities, disposable incomes, expected debt-to-income ratios, financial targets and availabilities.

Providing debt management advice based on income gives an opportunity to cater to the individual’s financial status, helping them achieve the goal and facilitating real financial health based on research data.

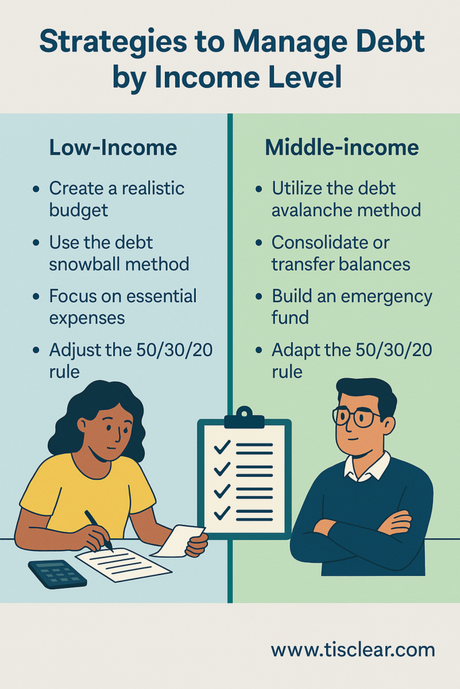

How to Find Strategies to Manage Debt with Low Income

For those on low incomes, the principles of managing debt are somewhat more focused and stringent when it comes to repaying with your few resources.

One of the pillars of sound debt management, in this case, is applying some basic budgeting techniques. This starts with showing every source of all money into the house and everything going out, with clear demarcation between needs and wants.

Most lower-income individuals spend most of their money on needs such as housing, food, utilities, and basic transportation.

Spotting and reducing unnecessary expenses, even the small stuff, can free up thousands of dollars that can go to paying off debt or to creating a tiny cushion in case of emergency.

Above all, you must establish a reasonable budget with total expenses not exceeding total income. This budget will guide your financial decisions going forward, directing your spending and helping you to decide where the money you have should go.

Multiple tools (including free budgeting apps and printable worksheets) can help you account for income, categorise expenses, and track changes over time.

With limited resources, prioritising debt repayment usually means concentrating on one debt and paying the minimum on others until the chosen debt is gone.

One method that can work particularly well for low-income earners is the debt snowball method. This technique involves stacking debts from least to most, ignoring interest rates.

This person then throws as much money as possible at the little debt while just paying the minimum on the other debts.

After the smallest debt is paid off, the funds that were going towards its minimum payment would then be added to the minimum payment of the next smallest debt, thus creating a snowball effect.

The debt avalanche method (eliminating debts beginning with the highest interest rates) is more precise in terms of expenditures in the long run, but the psychological advantages of wins very early on offered by the debt snowball method can be particularly encouraging for individuals who could feel like their debt load is in the means of doing something. However, it is important to make at least the minimum payment on all debts to prevent late fees and potential credit damage.

The popular 50/30/20 budgeting framework — which divides after-tax income into new categories of spending, with 50% for needs, 30% for wants, and 20% for savings and debt payments — might be too strict for low-income people without modifications.

Essential needs may realistically take up more than half of someone’s income if they’re on a limited income. Flexibility is key in such cases.

And those who are low-income earners will have to allocate a lot more towards paying down debts using that 20% savings and debts or reduce their 30% wants to focus more on needs and paying down debts.

The goal is to build a sustainable budget around essential spending, with any leftover funds going toward saving and chipping away at debt — even if that means less to play with in terms of wants or savings in the beginning.

To manage debt effectively, you must also take into account your repayment plan and long-term goals.

Middle-income earners often need to balance the need to pay off debt against other important financial goals, such as saving for retirement, education, or a down payment on a home.

If you fall into this income band, a meticulous budget will give you not only a clear handle on your cash flow but also help you to identify expenses that can feasibly be curtailed to figure out how much money you realistically can set aside for both debt repayment and savings.

This is how income and all outflows should be tracked, and they should be categorised in a way that shows you where you spend money and where you can make changes in your spending.

Although the debt snowball may still work out for middle-income earners, the debt avalanche tends to yield higher results for this group.

This strategy assumes that middle-income earners can save more interest money in the long run by prioritising the repayment of debts with the highest interest rates first and becoming debt-free as soon as possible.

This approach takes discipline and consistent work, but middle-income earners often carry the confidence to stick with this approach far better than lower-income earners, who may benefit more from the immediate psychological wins of the snowball method.

Balance transfers and consolidation, when strategically utilised, can be very effective methods of debt management for the middle class, too.

Balance transfer credit cards that offer introductory periods in which a 0% APR applies can help people temporarily stop paying interest on high-interest debt, allowing a greater portion of their debt payments to go to reducing their principal balance.

Another option is debt consolidation, where you take out one loan to cover multiple debts; hopefully, this can have a lower interest rate, make payments easier, and also minimise the overall amount of interest you’ll pay in the long run. Those in good credit ranges with middle incomes are generally in the best position to use these types of options.

In addition to aggressive debt repayment, it is just as important for middle-income earners to save up an emergency fund. A readily available source of wherewithal for emergencies will reduce new debt incurrence when life happens. Building an emergency fund even while you are concentrating on debt reduction creates a critical lifeline and helps with overall financial health as part of your budgeting plan.

Since lower-income earners generally have less flexibility as to how they can allocate their after-tax income, the 50/30/20 rule is more easily applicable to middle-class workers.

The 50/30/20 Rule is a very useful way to budget your money towards needs, wants, and savings or debt repayment while still allowing flexibility (50% needs, 30% wants, 20% savings/debt repayment), but middle-income earners (and upper-income earners too) should always build upon these numbers according to their own financial situations and goals.

You get the point: people with a big debt burden may want to put more than 20% toward debt and less toward something(s) to buffer — even in a temporary-adjustment way. Middle-income earners should aim to strike a balance between meeting effective debt management standards and progressing toward other key financial goals.

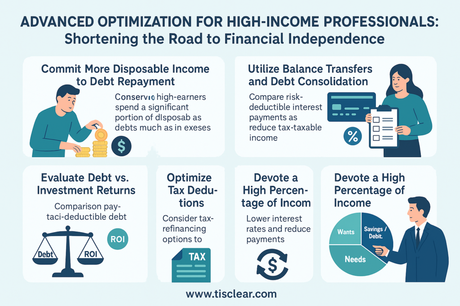

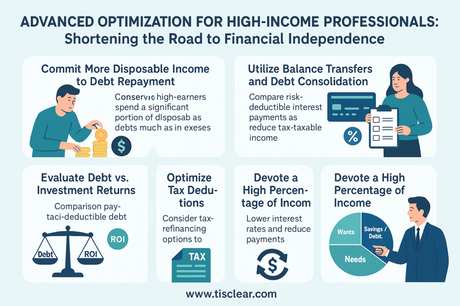

Advanced Optimisation for High-Income Professionals: Shortening the Road to Financial Independence.

If you are a high-income professional, you have both the disposable income and more advanced financial tools at your disposal to pay down debts much faster. One of this group’s primary strategies is to use its higher income to commit a larger portion of its disposable cash to debt repayment, well in excess of the required minimums. This aggressive strategy can significantly reduce the overall timeline to pay off debt and the total interest paid.

Thanks in part to access to more advantageous terms, high-income earners can similarly use balance transfers and debt consolidation to their advantage. Options like home equity loans or lines of credit (HELOCs) tend to have lower interest rates than other types of debt, meaning lots of savings. All of these options carry different terms and risks, including ones that use a home as collateral, so it’s important to understand what you are working with.

For high-income earners, one important topic is debt and how that fits into their overall investment approach. They may consider whether to use non-retirement investments to pay off high-interest debt or allow those investments to grow over time. It is a general rule of thumb that the interest rate on an outstanding debt should be compared with the expected return on investment; if the interest rate on debts is substantially greater than the expected return of investments, it may make sense to repay the debt as a priority.

Tax deductions for debt can be optimised Here, high-income earners must explore potential avenues. If applicable, knowing which payments are tax-deductible, whether it’s mortgage interest or interest on investment loans, can minimize the overall tax burden, freeing the extra cash for debt paydown or other financial objectives.

Another way high-income professionals may even also try to mitigate their payment amount over the length of their loan or even the interest is through refinancing for types of debt, like mortgages or student loans. Considering the refinancing options that are available to them will help them reduce the constraints their debts place on their goals and dreams of financial freedom.

For example, if someone is following the 50/30/20 rule, their “wants” category might be larger in absolute dollars if they are high income, but then that higher income means they’re able to boost the “savings/debt repayment” slice much higher (like 40%) than 20% comfortably. High-income professionals can achieve debt freedom faster and then invest that same amount of money towards wealth by intentionally devoting a very high percentage of their income to aggressively retiring debt.

Real-Life Wisdom: Successful Approaches to Debt Management from Every Flush

Provides their lessons learnt and how targeted strategies helped individuals overcome debt challenges across all income levels.

We frequently read about the benefits of consistent budgeting and the effectiveness of the debt snowball method in motivating debt repayment for individuals with lower incomes.

One woman, with upwards of $20,000 in debt, with high-interest credit cards and medical bills, was partnered with a non-profit financial wellness group. With their debt management plan, they paid off their debt in 40 months and saved around $5,000 in interest.

Another tells of a single mother whose modest income allowed her, with careful budgeting and the focus on paying off her smallest debts first, to pay down $18,000 in credit card debts. These stories highlight the fact that even with minimal income, a methodical approach and steadfast dedication can result in significant debt elimination.

Middle-income people frequently talk about using debt avalanche, debt consolidation, and a balanced approach to debt payoff and saving.

One couple, making a six-figure income, used zero-sum budgeting and the debt snowball method to pay off $50,000 in debt in a couple of years.

That meant slashing non-essential spending and putting every additional dollar toward their debt. Another couple graduated college with $100,000 in debt; they worked with a financial planner and employed the debt snowball approach to become debt-free.

These stories show how having a plan, being consistent and often tweaking lifestyle choices can speed up your payoff of debts while you also work toward other financial goals.

At high levels of income, people often leverage their capacity to add more and use more complex financial instruments to succeed. For example, a couple that accumulated a record $311,000 in debt over the years managed to pay everything off in 32 months thanks to good budgeting and working together.

Such strong emphasis on cooperation and rigorous adherence to the budget helped this couple to reach such results in a relatively short time.

A law school graduate who amassed $755,000 in debt managed to start his own law firm and sell his house to remove the burden of the house debt.

These examples show that high-income individuals can pay off record amounts of debt with the right resources and strategy in place.

Although not all paths to financial freedom are smooth, success stories provide hope and direction on how to address debt-related challenges.

Knowledge is Power: Resources and Tools to Guide the Way

In order to take control of debt, there needs to be more than just knowing what to do. Making printable debt and income worksheets is an invaluable first step in this process.

CC3: Make a comprehensive debt tracking worksheet that contains the following key information for each debt: creditor name, total balance owed, interest rate, minimum payment, and due dates.

Furthermore, it should leave space to indicate whether payments were made, the date of each payment, and the amount remaining for each payment so that it is visually clear if individuals are making progress on the debts they owe.

Worksheet layout — For those using the debt snowball or avalanche methods, the worksheet can be arranged to compare debts based on balance or interest. There are many free templates online for debt tracking worksheets that can be printed off and used to keep track of progress and keep you motivated on your journey to becoming debt free!

In addition, the talking points and worksheets for doing a debt reset challenge or free budgeting trackers are all great ways to get people inspired.

The challenges often motivate those in debt to intensely reduce debt over a predetermined time frame, giving you a framework to help and inviting community support.

Free budgeting trackers provided by many financial institutions and resources can give people a better sense of their income and spending habits, which is the basis of a good debt management plan.

These trackers often provide functionality for linking various financial accounts, categorising transactions automatically, setting a budget and monitoring progress toward the budget and other financial goals like debt repayment.

By using these tools, actively participating in challenges, and monitoring their finances, they can build momentum, stay motivated, and make informed choices that will help them manage their debt and eventually become financially happy.

Final Thoughts: Custom Debt Solutions for Financial Wellness

In summary, debt management is a personalised approach that requires strategies tailored to a specific financial situation, particularly the individual’s income. NEWARK, N.J. — A new analysis of the U.S. debt landscape suggests that debt burdens and the ability to handle them diverge sharply depending on income level and that there are no easy solutions to a hyper-individualised problem.

For lower-income earners, meticulous budgeting, prioritising necessary expenditure, and utilising the debt snowball method to take advantage of early wins in repayment is a better strategy.

Therefore, for a middle-income person, it is important to take a balanced approach where strategy is driven by a combination of debt repayments, like the debt avalanche approach, and balance transfers or consolidation with savings and investments to achieve future financial goals.

Salaried professionals benefit from their bigger incomes with large payments towards their debt, transaction tools and utilising debt as part of their broader wealth management strategy.

With intent, the right approach and use of available tools & resources, debt freedom is possible, with real-life success stories across the income spectrums.

By accurately gauging their specific situation, establishing achievable targets, and selecting pathways for managing debt that best fit their income and priorities, it is possible to empower individuals to reclaim control over their debt and lay down a path toward long-term stability in all aspects of money.