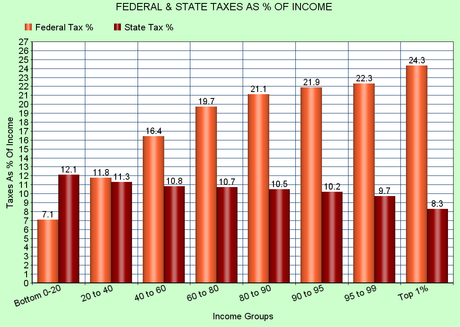

I have often said on this blog that state taxes punish the poor, while basically letting the rich off the hook. Now we have some numbers (from the Citizens for Tax Justice) to show you.

While the rich don't actually pay their fair share of federal taxes (with almost none of them paying the federal tax rate for their income level, due to loopholes, deductions, and special tax rates), the federal tax system is generally a progressive one -- and as an average, the rich do pay a little higher percentage than other groups.

But it is far different when it comes to the states. The chart above shows the average of all states. Note that the poorest quintile of our population pays a larger percentage of their income in state taxes than any other group -- and significantly less than the rich pay. This is because most states, even blue states, rely on regressive taxes (like sales taxes) rather than progressive taxes (like income taxes).

And this includes the poorest of the poor (like those working for minimum wage or less). These people must pay the same sales taxes as those making much more pay -- even though they already are in poverty. Personally, I think this is a shameful situation. If we are not going to require employers to pay a livable wage (and that seems unlikely with the GOP in charge of Congress), then we should not be demanding the poor pay taxes (and at a higher percentage of their small income than the rich).

Is this really the kind of nation we want to be? A nation that punishes the poor so the rich can pay less in taxes?