Did you know that mortgage providers won’t lend you a penny if you haven’t taken out home insurance? These policies are seen as absolutely essential by anybody and everybody in the business of selling and buying homes, and it’s easy to see why. Home insurance protects you against the disasters that could befall your home, covering everything from fire and flooding, to vandalism and burglary. And if total catastrophe strikes, you’ll need a policy that covers the rebuild cost of your home.

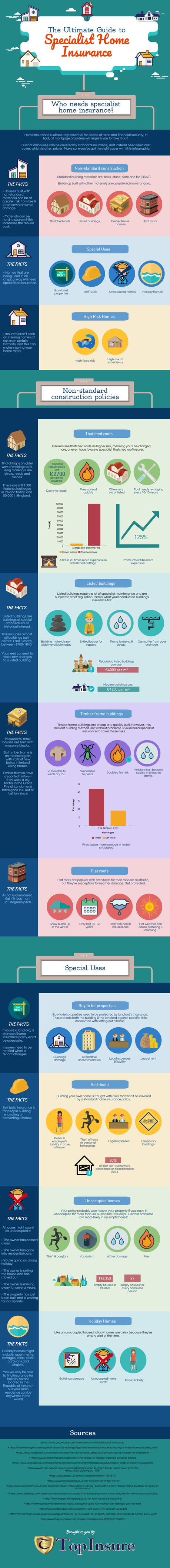

The thing is, not all homes will be covered by a bog standard policy. In Ireland alone there are a huge variety of non-standard builds, from the country’s 1500 thatched cottages, to the timber-frame houses that make up 25% of all new homes in the country. These homes won’t be covered by your basic insurance and require a specialist solution. Similarly, if you’re a property tycoon running buy to lets and holiday homes, you won’t get away with a regular policy.

But don’t worry if you’re feeling confused. To help you out, Top Insure has created this comprehensive infographic on specialist home insurance policies that will go through all the fine details.

About the author

Top Insure is Ireland’s latest home and car insurance broker. We specialise in getting people great home and car insurance at the best possible prices, including a range of niche insurance policies such as self build insurance, landlord insurance and convicted drivers insurance.