The Republicans are still telling horror stories about Social Security and Medicare. The claim both of those programs are broke, and will soon go bankrupt -- causing the programs to fail (and not be in existence when today's young people need them. They claim the only way to save those programs is to cut recipient benefits in Social Security and change Medicare into a voucher program (that would cost seniors much more out-of-pocket expense). None of that is true.

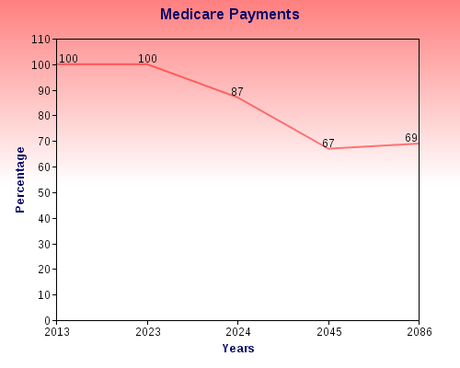

The Republicans are still telling horror stories about Social Security and Medicare. The claim both of those programs are broke, and will soon go bankrupt -- causing the programs to fail (and not be in existence when today's young people need them. They claim the only way to save those programs is to cut recipient benefits in Social Security and change Medicare into a voucher program (that would cost seniors much more out-of-pocket expense). None of that is true.Social Security can keep making 100% of the designated payments to recipients until at least the year 2033. After that the payments would have to drop to 75% of current benefits, and in 2086 those payments would drop another couple of points to 73%, and maintain that far into the future. Medicare is a little worse off. But it could pay 100% of its obligations until the year 2023. In 2024 those payments would decline to 87%, and by 2045 Medicare would be able to cover only about 67% of its expenses. It would then start to rise slightly and cover 69% by 2086.

I did not make up those figures. They came from the latest yearly bipartisan report of the Social Security and Medicare Trustees. And those figures represent what will happen if nothing is done by Congress. Note that neither program will go completely bankrupt or is in danger of ceasing to exist. Social Security will be able to meet at least 73% of its obligations far into the indefinite future, and Medicare would be able to do the same at no less than a 67% figure.

Of course, we want both programs to be able to meet 100% of their obligations far into the future. So some kind of changes must be done by Congress (before 2024 for Medicare and before 2033 for Social Security). The only real question is what kind of changes need to be made. The Republicans want to cut benefits. While that would solve the problem, it would be about the same as doing nothing -- because seniors would be hurt both ways by seeing benefit cuts. Those cuts would just come earlier under the Republican plan.

Many millions of the recipients of both these programs already live very close to (or in) a poverty situation, since the average Social Security monthly check is about $1000 ($12,000 a year). Those millions of recipients simply cannot afford to have their benefits cut for Social Security (or their cost-of-living adjustment cut so that their checks no longer keep up with inflation). Such a thing would be disastrous. And they also could not afford to have more out-of-pocket medical expenses (which would be the result of the GOP voucher plan).

It is equally unthinkable to raise the age to qualify for either program. While some are living longer and retiring later, that is not true of all workers. Those who do manually-difficult, low-wage or high-risk jobs have not seen their life-span increased, and they still need to retire at 65-66 years of age and start receiving Medicare at that age. Raising the age to enter Social Security or Medicare would discriminate against those people to appease high-income workers and investors.

So what should be done? Well, there are two things that could be done that would not hurt those currently on the two programs or discriminate against low-wage future retirees -- and either or both of those would solve the program needs far into the future. And both have the support of a clear and significant majority of the American people (while cutting benefits and turning Medicare into a voucher program do have have the support of most Americans). Those two things are -- institute a means test for both Social Security and Medicare, and remove the cap (or raise) the cap on the amount of income subject to payroll taxes (where Social Security and Medicare get their funds).

Means testing is simply denying benefits to those people with a very high wealth. After all, millionaires and billionaires do not need the meager benefits they would get from Social Security or Medicare. Their benefits could be used to prop up the benefits of retirees who depend on the programs. The fly-in-the-ointment for this solution comes in trying to determine just where the cut-off figure should be set to deny benefits.

A much better solution to fully funding both programs is to remove or raise the cap on the amount of income subject to the payroll taxes. Currently the rich pay a far smaller percentage of their income than do low-wage or middle class workers. Raising the cap (or eliminating it) would not hurt low-wage or middle income workers, since they would still pay the same amount they currently pay (about 6%). It would just require high-wage workers to pay the same percentage as other workers. That is fair, and it would fully fund the programs far into the future. Money could also be saved for Medicare by allowing that program to negotiate drug costs and to put a greater emphasis on preventive care.

In short, there is no reason to cut benefits, raise the qualifying age, or privatize either Social Security or Medicare. Simply eliminating the payroll cap so that all income-earners pay the same percentage of their income (and making sure it applies to all types of income) would solve any problems that exist. But it would require the rich to pay more than they currently pay, and that's why the Republicans (the party of the rich) don't like that solution. They would rather punish the elderly to protect their Wall Street and corporate benefactors.