Republicans like to denigrate the Social Security program, but the truth is that it is actually a good investment for most Americans. Here is part of an article by Monique Morrissey at the Economic Policy Institute on the subject:

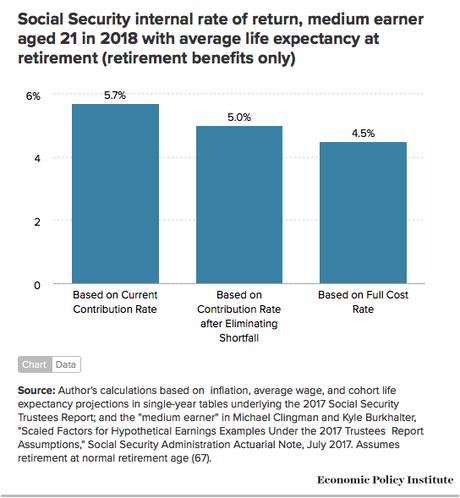

In 2005, President George W. Bush attempted to partially privatize Social Security. He centered his argument for this change on the claim that people would fare better investing in asset markets than contributing to Social Security. The privatization push proved highly unpopular, as research from EPI and others highlighted the high transition costs and investment risks. Nevertheless, the belief that Social Security amounts to a low-risk but low-return investment persists, hampering proposals to expand the popular program. This is unfortunate, as Social Security looks better than ever in comparison to low-performing 401(k)s and IRAs. As shown above, a young worker today with average career earnings will receive Social Security retirement benefits equivalent to total employer and employee retirement contributions plus a 5.7 percent annual rate of return. This “internal rate of return” is not much lower than the 7.0 percent net return for 401(k)-style defined contribution plans between 1990 and 2012, and it’s higher than more recent returns for these plans and IRAs (3.1 percent and 2.2 percent, respectively, over the 2000–2012 period). This calculation doesn’t take Social Security’s projected long-term shortfall into account. But even if we closed the shortfall by raising the contribution rate from 10.0 percent to 12.6 percent (excluding contributions going toward disability benefits), the internal rate of return for a medium earner would be 5.0 percent. Though Social Security is primarily funded through worker contributions, a small share of the cost is paid for by taxes on the benefits of better-off retirees that revert to the program. If these taxes on high earners were eliminated so that the entire cost of retirement benefits were funded by worker contributions, the internal rate of return for a medium earner would be a healthy 4.5 percent, still an excellent return for such a low-risk investment. Rates of return on 401(k)-style plans vary widely and are subject to market downturns. To reduce the risk of worse outcomes, most investors, especially retirement savers, would choose a secure 5 percent return over a volatile return averaging 7 percent, since, contrary to popular belief, investment risk doesn’t disappear over long time horizons. . . . Some readers may be surprised that Social Security’s internal rate of return is on the order of 5 percent, when Treasury bonds in the Social Security trust fund have been earning only half that over the past decade. One reason is that Social Security actuaries expect interest rates to rise now that the economy has recovered from the Great Recession. But the much more important reason is that Social Security’s ability to pay for benefits has almost nothing to do with the interest earned on Treasury bonds. Social Security is mostly a pay-as-you-go system, with each generation of workers supporting previous generations in retirement and the trust fund mostly serving to smooth baby booms and busts. . . . But there’s no reason to expect investment returns to exceed Social Security’s internal rate of return over the long run. And investment returns are more volatile than economic growth rates because asset markets are speculative and forward looking—you may have the misfortune of retiring in a long bear market. When stock market returns do outpace economic growth, price-earnings ratios increase and future returns are likely to lag. . . . In short, for the vast majority of Americans, Social Security is a great investment and an insurance plan in the bargain. Multimillionaires who might think they don’t need it can easily afford to participate, and many—like investors who lost their life savings with Bernard Madoff—will be glad they did.