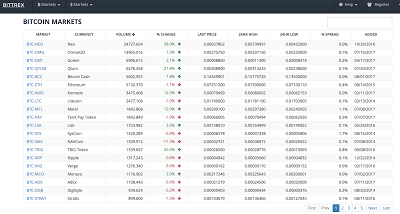

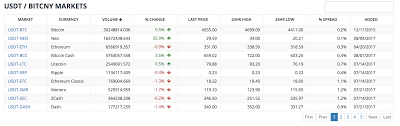

There are about a couple of hundred cryptocurrencies / tokens one can trade / swap with likeminded counterparties now. All the little ones can be traded like an fx pair against the more established bitcoin or ethereum. If you would rather trade against the dollar you can, well kind of. You see you can trade against the US Dollar Tether, here's the screen shot:

There are about a couple of hundred cryptocurrencies / tokens one can trade / swap with likeminded counterparties now. All the little ones can be traded like an fx pair against the more established bitcoin or ethereum. If you would rather trade against the dollar you can, well kind of. You see you can trade against the US Dollar Tether, here's the screen shot:

Tether is a cryptocurrency that is pegged to the US dollar, except the peg isn't actually guaranteed. Tether Limited (based in Hong Kong) do guarantee that 'tethers' will be backed by an equal amount of US dollars, but they don't guarantee to exchange them for you should you want to 'cash out'. Presumably the Hong Kong regulators keep a close eye on the activities of this unregulated firm trading predominately in the USA. Bittrex appear to insist you play their markets using only cryptocurrencies, including the tether.

So it's kind of like a computer game then? Users deposit their dollars or euros or yen, change it into their chosen token, then try to swap their tokens with other users with the aim of increasing the number of dollars (or tethers or bitcoins) in their account. You can even remove your tokens and buy into an ICO with them. As nobody can go short (and a few people who invented these cryptocurrencies or got in early have the bulk of chips) there really is no limit on how high the prices can get. Even if a bitcoin is worth a million dollars, grotty students in their pjs can still buy in for ten bucks and receive 0.00001BTC. It's just numbers on a screen that the players are bidding higher and higher. Online Texas Hold-em is so last decade!

I think the price of a bitcoin - or any of these other cryptocurrencies - could very well go to a million dollars. After all, it's just a closed system of folk (and 97% men apparently) trading imaginary tokens with one other and they all want the reference prices to increase. I reckon as long as more actual money is flowing into cryptospace (and into that bank account in Hong Kong and into these ICO's) than out, the prices of bitcoin and other cryptocurrencies will continue to rise and increasingly the participants will become paper rich. But what happens when a significant proportion of them become millionaires and can retire aged 24 or just rich enough to want to cash out some and buy a car or a house?

Is this is an over-simplistic analysis? Is it really cynical of me to suspect that the people on the other side of this trade (the people swapping the tokens for actual dollars and euros and yen) will decide they'd rather hang onto the cold hard cash thank you very much and switch off their exchanges? The only alternative explanation I can see is that a massive revolution really is happening where so many people will change all their cash into bitcoins and refuse to take part in the consumer economy until the politicians, bankers and shops have no choice but to start accepting them? Have I missed something?

Tether is a cryptocurrency that is pegged to the US dollar, except the peg isn't actually guaranteed. Tether Limited (based in Hong Kong) do guarantee that 'tethers' will be backed by an equal amount of US dollars, but they don't guarantee to exchange them for you should you want to 'cash out'. Presumably the Hong Kong regulators keep a close eye on the activities of this unregulated firm trading predominately in the USA. Bittrex appear to insist you play their markets using only cryptocurrencies, including the tether.

So it's kind of like a computer game then? Users deposit their dollars or euros or yen, change it into their chosen token, then try to swap their tokens with other users with the aim of increasing the number of dollars (or tethers or bitcoins) in their account. You can even remove your tokens and buy into an ICO with them. As nobody can go short (and a few people who invented these cryptocurrencies or got in early have the bulk of chips) there really is no limit on how high the prices can get. Even if a bitcoin is worth a million dollars, grotty students in their pjs can still buy in for ten bucks and receive 0.00001BTC. It's just numbers on a screen that the players are bidding higher and higher. Online Texas Hold-em is so last decade!

I think the price of a bitcoin - or any of these other cryptocurrencies - could very well go to a million dollars. After all, it's just a closed system of folk (and 97% men apparently) trading imaginary tokens with one other and they all want the reference prices to increase. I reckon as long as more actual money is flowing into cryptospace (and into that bank account in Hong Kong and into these ICO's) than out, the prices of bitcoin and other cryptocurrencies will continue to rise and increasingly the participants will become paper rich. But what happens when a significant proportion of them become millionaires and can retire aged 24 or just rich enough to want to cash out some and buy a car or a house?

Is this is an over-simplistic analysis? Is it really cynical of me to suspect that the people on the other side of this trade (the people swapping the tokens for actual dollars and euros and yen) will decide they'd rather hang onto the cold hard cash thank you very much and switch off their exchanges? The only alternative explanation I can see is that a massive revolution really is happening where so many people will change all their cash into bitcoins and refuse to take part in the consumer economy until the politicians, bankers and shops have no choice but to start accepting them? Have I missed something?