GIVE.ME.SOME.HELP! "Hey Contender this market is a little pricey isn't it? How do I find some value stocks?"

GIVE.ME.SOME.HELP! "Hey Contender this market is a little pricey isn't it? How do I find some value stocks?"CoNTeNDeR: "Look - Is that a forest over there?"

GIVE.ME.SOME.HELP!: "I can't see there are trees in the way??!!"

CoNTeNDeR: "Seriously we need to do a bit of investigation don't we?"

I want to invest but where should I start looking?

Stock indices are surging.

Is it just the case of buy an index tracker and enjoy the ride?

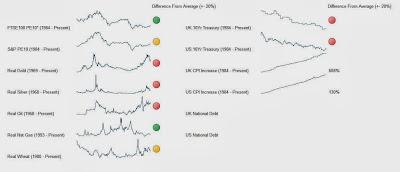

Perhaps there is better value somewhere else like commodities or government bonds?

How do you screen for value \ growth stocks to add to a GROW portfolio? Are there some good dividend stocks out there for a HYP (high yield) portfolio? Where to start?

In December 2012 THE.CoNTeNDeR was actively looking for investments. After paying for several news letters, reading investing books and using web based stock screening tools it was time to create his own screening tool.

Why - make it quick and easy, focus on value and dividends, the ability to look at multiple markets having the data filtered and calculated into user friendly dashboards. It now includes some market overview information as well.

So a stock screening tool was added to this website see the post Financial Independence Planner & Stock Screener for further information.

This has been re-visited and enhanced to do away with a lot of the manual aspects top the tool, make it more user friendly and enhance the information it provides.

Improvements

- List of stocks for main stock exchanges pulled in automatically

- Simplified steps to get the result

- More explanation of the stock screening process

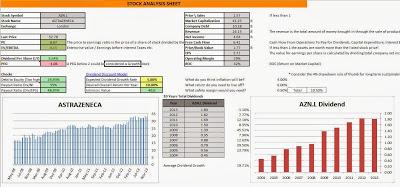

- Individual Stock Analysis screen added with the Dividend Discount Model

- In/Out of favour asset classes / adjusted for inflation dashboard......

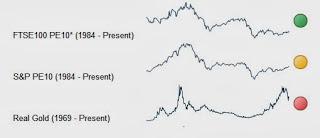

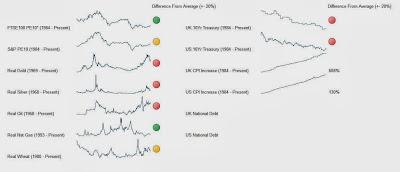

- Schiller PE10 Calculations for S&P Composite and FTSE 100

- Commodity prices adjusted for inflation (Gold, Silver, Oil, Wheat)

- Some key 10 year government note historical graphs and inflation information

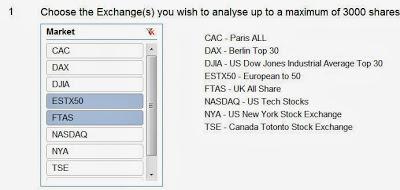

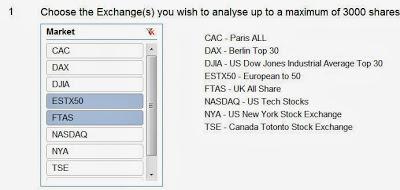

- Choose up to 3000 stocks from the major indices and down load the financial data from Yahoo! by clicking the magic button into an excel spreadsheet

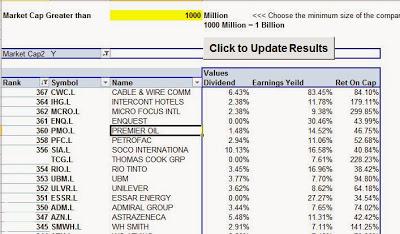

- Data is automatically converted and cleaned up and analysed for

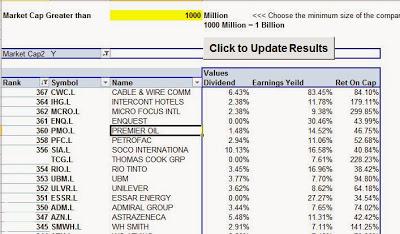

- Value Shares - companies with a high earnings per share and return on capital based on The little book that beats the market (2010)

- Dividend shares (at good valuations)

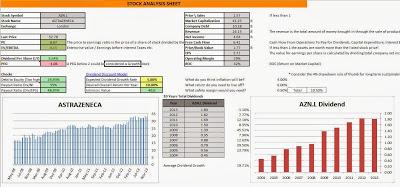

- Individual companies can be analysed in a dashboard

- Shows historical graphs of the share price and dividends

- Key metrics such as debt, dividend payout ratios

- Dividend discount model is included to help estimate a fair value for the stock

- Big picture inflation adjusted Schiller PE10 calculations and investment classes added (more to be added)

- Choose Your Stock Exchanges (view the market analysis tab for value ideas?)

- Click the update data button

- Select a stock of interest and click the analyze stock button

Peace, prosperity and happiness

THE.CONTENDER

* Like everything on this website the tools have been created for personal use / entertainment purposes. The information is as accurate as far as the author is aware (unfortunately he is human and is prone to mistakes from time to time - **** happens). THE.CoNTeNDeR is not a financial adviser just a guy who is on the cusp of financial independence for his little tribe through frugality and investing for THE.FuTuRe.

Please read the disclaimer that comes with this website and always do your own due diligence and research. Seek professional advice as required.

References for Schiller PE10 Information:

http://monevator.com/the-cyclically-adjusted-pe-ratio-pe10-or-shiller-pe/

http://www.multpl.com/shiller-pe/

http://www.retirementinvestingtoday.com/2011/05/s-500-cyclically-adjusted-pe-s-pe10-or.html

A great article from Monevator with loads of links to financial calculators - Financial calculators and tools collected

Here you can find out about THE.CONTENDER and the purpose of the blog is or perhaps browse the all posts list, have a look at the pictures on the notice board. Please feel free to play with the planning tools and checklists.

Welcome New CONTENDER Readers! Please take a look around.

Keep in Touch: RSS Feed, follow THE.CONTENDER on Twitter or Facebook or subscribe to posts by email: