Welcome to this informative article on the Rivian stock price prediction. We will be providing an overview of Rivian Automotive Inc and making predictions for the Rivian stock price in 2022, 2023, 2025, 2030, 2040, and 2050. Let's begin.

Rivian Automotive Inc. is a United States-based manufacturer of electric vehicles founded by R.J. Scaringe. The company's headquarters are located in Irvine, California and its primary focus is the production of electric SUVs and pickup trucks on a skateboard platform. Rivian has also teamed up with the world's largest e-commerce company, Amazon, to create an electric delivery van.

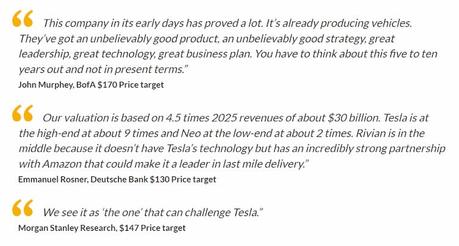

In late 2021, Rivian began delivering its R1T pickup truck and in November of that year, the company also launched its initial public offering (IPO), raising more than $13.5 billion. As of March 2022, the delivery van and R1S SUV were still under development. Several business leaders invested in Rivian with the hope that the company will eventually be able to compete with Tesla. Many traders and investors are interested in predicting the Rivian stock price for 2025.

As of September 29, 2022, the current market price of Rivian stock is hovering around $35.08.

Some technical analysts have predicted that the Rivian stock price will remain in the range of $40 to $75. In a bear market, the stock may be valued at around $40, while in a bull market, it could reach as high as $75.

Elliott wave analysis and technical analysis suggest that the expected range for the Rivian stock price will be between $57 and $67. This means that the stock price could potentially reach a low of $57 and a high of $67.

Rivian stock price prediction for 2025 is $80 as the initial target, and the next target could be $95. This means the stock price would vary between $80 and $95.

But some analyst estimates that the Rivian stock price prediction for 2025 would be $38.

According to expert analysis, the Rivian stock price is projected to fall within the range of $250 to $287 by 2030. This potential range is due in part to the growing popularity of Rivian's SUVs and pickup trucks, which have attracted investment from other parties thanks to their appealing and unique designs.

As a producer of utility trucks, Rivian is well-positioned to become a leading brand in the electric vehicle market for SUVs. Furthermore, the company's vehicles are suitable for off-road use, which sets them apart from other brands.

If the demand for electric vehicles continues to rise, it is likely that this will lead to an increase in profits for Rivian and a corresponding increase in the company's stock price through 2025 and also in 2030.

According to various analyses, the Rivian stock price is expected to reach $1550 by 2040. Some experts predict that the stock price will range between $1500 and $1600.

In order to achieve profitability and long-term success, the company will need to continue operating for several years and build trust among customers by consistently selling high-quality products.

In 2050, Rivian Automotive Inc will be a 40-year-old company and it is predicted that the stock price will be around $2500.

If all goes well, it is possible that the stock price could potentially even reach higher than $2500.

The table above presents the Rivian price predictions for the years 2022, 2025, 2030, 2040, and 2050, as determined through technical analysis by experts.

It is important to note that these predictions are based on expert analysis and should not be taken as guaranteed outcomes in the stock market.

Taking a Bull View of Rivian (RIVN):

Rivian was the first to deliver electric trucks to customers due to its early adoption of EVs. Many pre-orders have been placed for their trucks, and the company secured a deal with Amazon in 2022.

Bearish View of Rivian (RIVN)

During the early months of 2022, Rivian Automotive Inc. only produced around 5,000 electric vehicles. The company had hoped to produce about 25,000 vehicles by the end of that year. Meanwhile, Rivian's competitors have much higher production rates. For instance, Ford produced millions of vehicles in 2021, and Tesla produced around 300,000 cars in the first few months of 2022.

Rivian Stock Price Prediction: Frequently Asked Questions

Is it a good idea to invest in Rivian shares?

It is ultimately up to you to decide if investing in Rivian is the right choice for you based on your investment goals and evaluation of the company. As of September 29, 2022, Rivian's market capitalization was over $32.14 billion, and some sources suggest that Rivian is still a strong stock to hold. You can also check the company's quarterly earnings reports to track its progress and consider whether you believe it is trending in the right direction and is well-managed.

What is the growth potential of Rivian stock?

In the stock market, it is possible to make price predictions for any stock using both fundamental and technical analysis, but it is not possible to guarantee that a stock will increase in value. Rivian Automotive Inc. expects to produce around 300,000 vehicles by 2025, which would generate revenue of over $25 billion. It is projected that Rivian will deliver more than 700,000 vehicles by 2030, generating an estimated $80 billion in revenue. If this occurs, Rivian could become a major player in the automotive industry.

What is causing Rivian's low stock price?

Currently, the company is experiencing supply chain issues that are hindering mass production and delivery. If the company sells fewer cars, it will make less profit, which could cause the stock price to drop. Additionally, news of an impending recession has also contributed to fewer people investing in stocks.

Is it worth buying Rivian stock?

Based on our technical analysis, we believe that Rivian Automotive Inc is a strong brand. There are several reasons why Rivian stock may be worth purchasing, including their focus on electric vehicles and utility trucks. In 2023, Rivian plans to build a network of public charging stations across the United States and Canada, which could be a major milestone for the company. Additionally, Rivian intends to compete with Tesla by offering both slow destination chargers and fast chargers, as well as selling home chargers.

Is Rivian stock a good choice for long-term investment?

Some experts believe that Rivian is a strong brand and that its stock could see significant growth in the coming years, making it a potentially good choice for long-term investment.

Is Rivian's stock overpriced? There is no doubt that Rivian shares are currently overpriced given their current production, which has been impacted by supply chain inefficiencies around the world.

Will Rivian stock recover? It is expected that Rivian stock will eventually recover as the company continues to grow and gain more clients.

What will Rivian stock be worth in 5 years?

Based on technical analysis, it is projected that Rivian's stock price will increase five times and trade at over $150 in five years.

What will the value of Rivian stock be in the next ten years?

According to technical analysis, the projected Rivian stock price for the next ten years is $700.

Is Rivian (RIVN) listed on the stock exchange?

Rivian Automotive, Inc. (RIVN) had its Initial Public Offering (IPO) on November 9, 2021, and was subsequently listed on the Nasdaq exchange.

What is the Rivian stock price prediction for 2025?

Based on current predictions, the Rivian stock price for 2025 is expected to be between $80 and $95. RIVN has the potential to reach these targets by the end of 2025.

What is the prediction for Rivian stock?

According to analysts, the median target for Rivian Automotive Inc. is 46.50, with estimates ranging from a low of 23.00 to a high of 70.00. This represents a potential increase of 53.21% from the current price of 30.35.

Is RIVN a buy, sell, or hold?

Overall, RIVN is considered a good long-term investment. Some experts recommend holding onto the stock and accumulating more as opportunities arise. Others believe it is currently a strong buy, with the stock trading at $30.34.

Is RIVN a strong buy?

Some analysts consider RIVN a strong buy, especially when it reaches its volume weighted average price (VWAP). It is recommended to accumulate more quantities and hold for the future.

How much will Rivian's stock be worth in 5 years?

According to predictions, Rivian's stock price could reach $250-320 by 2030 or earlier.

Is RIVN a good stock to buy?

Opinions on RIVN's potential vary, with some experts viewing it as a good investment due to its strong management, while others believe its current growth score is not up to par. It is recommended to do your own research before making any decisions.

Is it safe to invest in Rivian stock?

Rivian is a well-established player in the electric vehicle manufacturing industry and has strong partnerships with major brands. Its financials are considered solid, and the company is actively working on various projects. As such, some experts believe it is a safe investment. However, it is always advisable to thoroughly research a stock before investing.

Rivian Q1 2022 Earnings Results

Conclusion:

In this article, we analyzed Rivian Automotive Inc., a brand that manufactures electric vehicles, and its stock price predictions for various years. We provided technical analysis of the expected range of the stock price for 2022, 2023, 2025, 2030, 2040, and 2050, as well as its current market price and past performance.

Have an opinion on the Rivian stock price prediction? Share it in the comments below. If you enjoyed this article, please consider sharing it with your network. For more information on topics like cryptocurrencies, top exchange business models, and more, check out our other articles.