The Republicans are still demanding more spending cuts for the federal government. They claim that enough raises in revenues (taxes) have been done, and now they want the budget balanced completely by new spending cuts -- and they want all of those cuts to come from programs that help hurting Americans (like education funds, unemployment funds, food stamps and school lunches for children, health care for women and children, etc.) while protecting the giveaways to corporations (like subsidies).

The Republicans are still demanding more spending cuts for the federal government. They claim that enough raises in revenues (taxes) have been done, and now they want the budget balanced completely by new spending cuts -- and they want all of those cuts to come from programs that help hurting Americans (like education funds, unemployment funds, food stamps and school lunches for children, health care for women and children, etc.) while protecting the giveaways to corporations (like subsidies).There are some cuts that can still be made, but not where the Republicans want them. We spend more for military defense than the next sixteen biggest spenders in the world combined -- and there is no excuse for that. A lot of money could be cut from that military budget (especially in the contracts awarded to the corporations of the military-industrial complex).

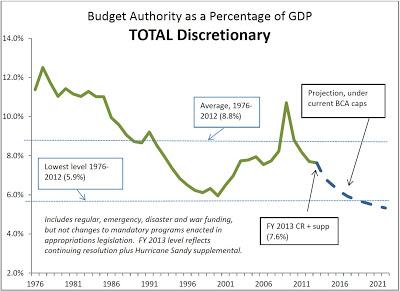

But the top chart above shows the situation we are in on spending cuts. The cuts we have already made to discretionary spending have put us on a downward trajectory -- a trajectory that will, in the next eight or nine years, put our discretionary spending (as a percentage of national GDP) lower than anytime since the early 1970's. To put it bluntly, spending is not the problem. The real problem has been the loss of revenue through tax cuts and tax avoidance by corporations and the rich. Even though the Bush tax cuts on the richest Americans were recently eliminated, taxes for the rich and for corporations are still lower than any time since before World War II (and even lower when viewed as a percentage of GDP).

There is much that needs to be done to restore some of the revenue the federal government has lost. Loopholes that allow rich people like Mitt Romney to pay a smaller percentage of their income in taxes than the middle class does need to be closed. The wealthy and the corporations should be prevented from hiding money in foreign countries to avoid paying taxes. Subsidies should be eliminated for corporations making billion of dollars in profit. Tax breaks should be eliminated for companies that outsource American jobs. And a small tax should be levied on all trades made on the nation's stock and commodities exchanges.

Those things could bring hundreds of billions of dollars into the government coffers over the next few years without hurting the economy at all. But more spending cuts will just take money out of the economy, causing it to shrink and put the nation in danger of a worsening recession (a recession the bottom 80% of Americans are still experiencing). Austerity, as proposed by the Republicans is the wrong answer -- and no nation has ever cured a recession by shrinking the economy. In fact, some new spending is needed -- spending to create new jobs (and that kind of spending will pay for itself by taking people off of unemployment and poverty roles, and making them tax-paying citizens).

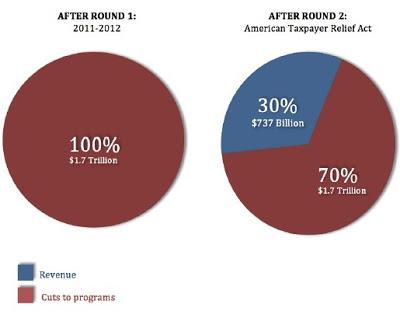

Austerity did not work for Europe and won't work here. We have already cut spending, and now it is time to create jobs and increase revenues. The second chart above, made by congressional progressives, shows that revenue expansion has only been a tiny part of what the government has done so far. Much more needs to be done in that area.