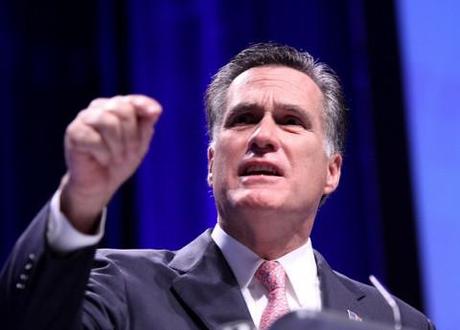

Mitt Romney. Photo credit: Gage Skidmore, http://flic.kr/p/9itUtP

With two primary wins already in the bag and a seven point lead ahead of the upcoming South Carolina primary, Mitt Romney is red-hot favorite to win the Republican nomination. But he’s found himself in more than a spot of bother after he was forced to concede that he pays a lower rate of tax than millions of Americans despite reportedly having amassed a $250 million (£160 million) fortune as a private equity boss.

Under intense pressure from rival candidates and political reporters to release his tax returns, Romney said he paid “probably close” to 15 percent of his income in tax. Romney made the admission the morning after he was repeatedly put on the back foot in a televised Fox debate. “Either there is nothing there, so why doesn’t he release it, or there is something there, so what is he hiding?” Newt Gingrich asked at the Fox debate.

“This means that despite earning millions of dollars a year, the former Massachusetts governor’s effective tax rate is the same as an American worker paid $39,000 (£25,400) a year, thanks to a controversial loophole”, noted The Daily Telegraph, which informed that under reforms made by George W. Bush, dividends, capital gains and other returns on investments Romney made as head of corporate buy-out firm Bain Capital, are subject to a marginal rate of 15 percent, compared to 35 percent for regular income above $379,150 (£246,217).

“My income comes overwhelmingly from some investments made in the past, whether ordinary income or earned annually”, explained Romney after a rally in Florence, South Carolina.

Romney’s slow striptease. Reid J. Epstein at Politico assessed “Romney’s toxic tax problem” and said his “choice is stark. He can stop equivocating and cough up the tax returns that his rival Republicans and reporters are clamoring for. Or he can make an audacious effort to reverse a precedent that has been in place for more than four decades.” Epstein insisted that “there really isn’t genuine drama – there is virtual unanimity among veterans of presidential politics that Romney has no choice but to disclose. What’s left is a mystery: What could Romney be thinking with his slow striptease.” Epstein expressed surprise at “the awkwardness with which Romney is handling the question” which he opined is “proving to be a serious distraction, and a contrast to the generally smooth fashion by which his campaign has dispatched most controversies.” That said, Epstein understood Romney’s reticence to reveal his taxes: “The returns are sure to cause problems for Romney — running in a recession with every one of his many millions of dollars revealed isn’t the image he’ll want, and it’s almost inevitable that some of his investments will get him into political trouble. But he was going to be pressed to release them at some point ahead of November, and the intensity of attacks he’s been facing since Monday night’s debate suggest that he’s only hurting himself for not releasing them already.”

“The tax return storyline threatens to be the next cut in a dangerous narrative for Romney: That he got rich by exploiting the little guy and isn’t interested in explaining the details”, forecast Reid J. Epstein at Politico.

Not the only millionaire paying 15 percent (or less). Writing at The New York Times, David Firestone said that Romney is far from alone in paying an effective tax rate of 15 percent: “Romney is one of the 200,000 millionaires in America who pays a rate less than that of a taxpayer making $100,000. And if his rate turns out to be lower than 15 percent (a feat usually achieved through various tax avoidance schemes), he will be one of the 22,000 millionaire households paying less than half the rate of a middle-class family.” Firestone said the Democrats are preparing an “onslaught over his (Romney’s) income” in which they will aim to replace Warren Buffett with Romney as ”the country’s most prominent example of elite tax treatment … The concept of income inequality is about to become far less abstract.”

The pressure on Romney was ratcheted up by the White House: “It’s not for us to call on someone to release his tax records, but it is an established tradition for presidential candidates to release their tax record”, said White House spokesman Jay Carney.

Tax disclosure is now standard. Associated Press reminded that presidential hopefuls being encouraged to come clean over their taxes is nothing new: “Romney’s promise to release his 2011 tax return in April follows the practice of leading presidential candidates that began after Watergate. If history is any lesson, questions and criticism will continue long afterward. For more than three decades, the major party nominees have released their income tax records. Some offered one year and others more than 10 years of returns.” AP said that although there is no law requiring presidential candidates to release personal tax information plenty of recent candidates including Hillary Rodham Clinton have come under sustained fire from their rivals for dragging their feet.