This is the first time i'm writing my reflection for one full year of blogging. SG Young Investment was started in June 2013. Till now, it has been just 1.5 years. The experience so far was just unbelievable that I thought I've been a blogger for much longer than that.

Never would I have expected that a blog which started out of nowhere could survive till today. I really have no idea what got this blog started. Perhaps its the desire to share on finance and investment. But, I wasn't really investing a lot of money back then in 2012 and in fact was just recovering from losses I had back in 2011. It was only in 2013 that I got back the confidence in investing and made some money. Looking back, it took me almost 2 years to come back again.

My first post was on My investing journey. I read my own writings again and it was just a sharing of my story in the stock market. Reading it made me think back on what I had gone through. In an instant, more than 1 year had passed.

Took more than 6 months for the blog to reached 100,000 page views which I wrote a post on it on 2nd February 2014: 100,000 page views! This was right after Chinese New Year.

It quickly went pass 1 Million page views on 30th October: SG Young Investment crosses 1 Million

Writing on HDB, Condominium and marriageI went on to write on topics such as buying a HDB flat, buying a condominium, cost of getting married. Researching and writing on these topics actually helped me to see what I need to plan ahead for. Naturally, because young people are worried about all these costs, these blog posts attracted a lot of views. I hope the posts have helped you plan better as it has helped me too. When we know the numbers and can see ahead, the future doesn't look that scary any more.

Writing on CPF and attending eventsAnother highlight is the post on the CPF. This was a hot topic among Singaporeans this year. I wrote a simple posts on the CPF minimum sum and CPF life. To say the truth, I have very little knowledge on the CPF prior to writing that post. It was only after hours of reading up that made me understand it better. After that, I was invited to the Forum on CPF and retirement adequacy. This was my first event attending as a blogger. Some other bloggers were there too but I didn't get to meet any of them as I only know that they were there after the event. Later on, I also went for the CPF Focus Group Discussion. It was fulfilling to contribute and interact with the other participants who were there.

Meet up with other bloggers and making new friendsMaking new friends was one of the highlights too. From commenting on each other blogs to chatting on Facebook to meeting up face to face. It was great to be able to meet up with like minded people where we could just talk for hours and hours.

My Financial life in review for 2014

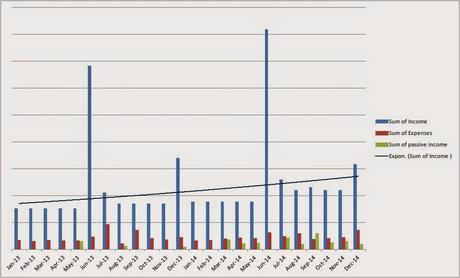

For the year of 2014, my active income increased, passive income increased while expenses remained stable. Actually, expenses did increase also but at a lower rate. I've been writing on passive income and this is the result of creating other streams of income. You can see it below from the green bar. This is a distinct difference from 2013 where there is very little passive income.

For the year of 2014, passive/other income has been quite consistent except for the months of Jan, Feb and June. This income comes from adverts such as Google adsense, sponsored articles, direct banner adverts and dividends from stocks. All in all, this income adds up to $3028 for this year.

On average, I've invested about 20k in the stock market this year. I've increased my stocks portfolio to 30k as of today and would probably increase again next year. This still makes up about 50% of my investment capital only.

Promoted and graduated from University

Besides focusing on passive income, I did not forget about my active income as well. This year was a tough year considering I was still studying part time for the first half of the year. But, I was still able to manage everything well and got promoted. Bonus was also better for this year.

Another relief is I finally graduated from the part time degree course which I was taking. This freed up a lot of my time for me to do other things such as meeting friends and writing more. I also took more time to reply the emails from you guys. I just checked and realised I've received more than a thousand emails so far. It's becoming a part time business to manage now.

Meeting new friends

This year is a year of meeting new friends. Through events, I got to network with more professionals. In summary, I got to know a lot more people who are passionate on finance and investments. Its amazing that as I set my path on the world of finance and investment, I start to know all these like minded people as well. Its the law of attraction at work. That is why if we want to attract positive people into our lives, we should also be positive.

As mentioned earlier, I also met some of the other bloggers. As for readers, I recently met the first one just before Christmas. This year, I been contemplating with the thought of forming investment groups for people to learn and interact together to know other people who are into personal finance and investments as well. There are students and young people who want to start managing their money better but do not really know where to start. Forming this group will create a platform for new friendships with like minded people. Let's see how this will develop.

That's all for my year in 2014. Its just 1 day away to the year 2015. I hope you had a good 2014 too. If not, always look on the bright side and 2015 will be a better year.

Happy New Year!!

Related Posts:

1. New year resolutions and investment strategies for 2014

2. Reflections for 2013