The potential “third energy corridor” – the Greece-Cyprus-Israel energy triangle may be the winner of the European energy game.”Third Energy Corridor” into the EU, a development of certainly wider geo-economic proportions.The gas could be a geopolitical game changer especially for Israel as well for the wider region (meaning the Balkans, the Middle East and especially the Eastern Mediterranean).

The potential “third energy corridor” – the Greece-Cyprus-Israel energy triangle may be the winner of the European energy game.”Third Energy Corridor” into the EU, a development of certainly wider geo-economic proportions.The gas could be a geopolitical game changer especially for Israel as well for the wider region (meaning the Balkans, the Middle East and especially the Eastern Mediterranean).

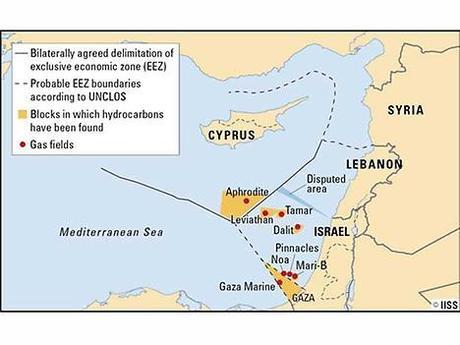

The Energy Triangle refers to the joint natural gas extraction between Cyprus, Israel and Greece that is estimated to begin in 2015. Officials from all three countries have agreed to the establishment of a gas pipeline from the Aphrodite gas field and the Leviathan gas field to a liquefied natural gas plant in the Vasilikos Power Station by 2019. (Note: here is not referred EU’s energy policy triangle ”emissions-supply-affordability”). So for the Energy Triangle and the EU there is now three projects of common interest: the first is the connection of an electricity cable between the three countries, the second is the feasibility of a pipeline from the East Mediterranean to Europe via Greece and the third one is the gas storage pipeline that will enhance the strategic resources of Cyprus, Israel and other European countries such as Greece.

Russia is the key player – even a game changer - in this triangle too. Future production in the eastern Mediterranean would be too marginal to offset Russia’s dominant market position. Nevertheless, the state-owned gas monopoly Gazprom is seeking a financial stake in the development of local resources. Israel and Cyprus see Russia as a source of both technical expertise and potential political support. Russia has repeatedly affirmed Cyprus’ right to explore offshore deposits in its exclusive economic zone.

Moscow won’t jeopardize its new deeply strategic energy partnership with its Israeli-Greek Cypriot ‘Western’ partners – in particular, its burgeoning relationship with the Middle East’s coming energy superpower, Israel. It is not only energy but geopolitics as Russia’s actions might cause selling out of Russia’s backing for both Iran and Syria for a Stake in Israeli Gas.

Map credit: Gazprom

Gazprom has also revealed that the company still has plans to link Greece with South Stream. This implies that the Russian strategy is to use Greece as a potential LNG hub, supplied by South Stream. South Stream, as far as its geostrategic role is concerned, is one of the most important projects in Balkans since WWII. Especially Serbia can be the heart of energy transport in the Balkans but also two branches will be built – to Republika Srpska and Croatia. In addition the Serbian side has proposed the construction of branches to Kosovo and Montenegro and Macedonia has also expressed the wish to get a branch of the pipeline from Serbia. On the other side the competitive project, the Nabucco pipeline, is already practically dead. More about background of Nabucco/South Stream battle in my articles Is it time to bury Nabucco? and EU’s big choice – Nabucco or South Stream?

The new opportunity with energy gives also some new political leverage to Israel. There has been a bit uncertainty how Israel will formulate its export policy. Israel’s options for selling the gas include Europe, China or even India. In terms of development, a partnership with Cyprus tying in its gas fields and co-operating on building sub sea gas pipes makes sense. And Greece has proposed becoming a distribution hub for eastern Mediterranean gas throughout Europe. Just how Israel’s vast reserves are to be monetized is yet to be seen. However in the few years since the state’s changeover from oil to gas-powered electricity generating plants Israel is already believed to have saved around $5 billion in revenue.

The new Gulf

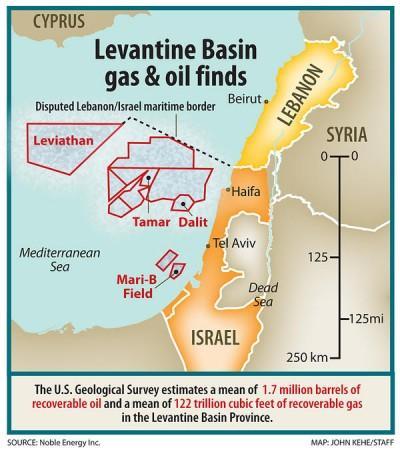

The U.S. Geological Survey says the Levant Basin, encompassing Syria, Lebanon. Cyprus, Israel and the Gaza Strip, contains 123 trillion cubic feet (tcf) of gas and 1.7 billion barrels of oil.

In 2009 and 2010, a pair of U.S.-Israeli consortiumsexploring the seabed near Haifa discovered the Tamar and Leviathan fields, which collectively hold an estimated 26 trillion cubic feet (tcf) of natural gas. Israel has also worked to expand political, military, and economic cooperation with other local stakeholders, particularly Cyprus. But even at a combined total of 25 Tcf, worth some 200 billion euros at today’s prices, Tamar and Leviathan only represent around a fifth of the estimated gas in the Levantine Basin, much of which falls within Israeli jurisdiction. Anyway only this is enough gas to supply Israel’s needs for 150 years.

Since Cyprus signed a maritime border agreement with Israel in 2010, it has become the second main beneficiary of the gas boom. The island straddles Israel’s most likely gas export route to European markets. Cyprus also lays claim to its own gas deposits. The Aphrodite field, which is next to Leviathan, may contain up to seven tcf of natural gas — enough to meet Greek Cypriot domestic consumption needs for decades to come. Yet even that field is contested by others. The breakaway Turkish Republic of Northern Cyprus claims co-ownership of the island’s natural resources.

On the borders of energy triangle one should not forget Syria, which is in the middle of two important energy corridors: It links Turkey and the Caspian See to Israel and the Red Sea and it links Iraq to the Mediterranean. Syria’s civil war is preventing seismic soundings in its waters but there’s every reason to assume they contain similar-sized gas fields.The Eastern Mediterranean gas fields might be the reason the Kremlin has created a military foothold in Syria for the Russian Federation. Moreover, it has been Iran that has agreed to explore and help develop these natural gas fields off the Levantine coast for Beirut and Damascus. Before civil war Syria was seeking foreign investment for three offshore oil and gas concessions. If the present regime in Syria falls the question is who would control these energy routes. If western powers are taking more firm grip from Syria it would also mean that the large natural gas fields off the Lebanese and Syrian coastline in the Eastern Mediterranean would be out of reach for China and instead go to the E.U., Israel, and Washington.

Also Lebanon, whose waters border both those of Israel and Cyprus, is expected to start issuing tenders to international companies to explore its maritime exclusive economic zone.

To its south, Israel has a difficult relationship with Hamas and the Palestinian Authority (PA) over natural gas, and has been obstructive to the PA’s own natural gas exploitation opportunities. Gas was discovered in 2000 by BG in waters that would include Gaza’s EEZ. However, political difficulties made it impossible to tap and transport the gas – not only is the PA not a member of the UN Convention on the Law of the Sea (UNCLOS) and hence has not declared its EEZ, but Israel occupied the Gaza Strip until 2005 and holds de facto control over the waters off Gaza’s coast.

With a newfound focus on maritime security, eastern Mediterranean states are also keen to modernise their navies and coastguards. Israel, for example, announced in July 2012 that it would spend $800 million on acquiring four offshore patrol vessels to protect its platforms and enforce maritime security. Turkey, meanwhile, has a number of naval procurement projects, including 16 Tuzla-class patrol craft for the navy and four Dost-class offshore patrol vessels for the coastguard. The most substantial Turkish procurement is for a $1.7 billion landing helicopter dock, the navy’s first amphibious assault vessel.

Two other claimants, Greece and Cyprus, are hamstrung in procurement efforts by lack of funds. Inspired by the gas finds, however, Nicosia finally gave the go-ahead for the procurement of two offshore patrol vessels in January, with a likely budget of $150m (although it is unclear how the country’s financial crisis will affect this programme). Greece, meanwhile, with a defence budget constrained by a political decision to stick with the purchase of six submarines from Germany, has resorted to unusual deals to bolster its Mediterranean presence. In February, Athens sought to lease two frigates and four maritime patrol aircraft from the French navy to better patrol the eastern Mediterranean.

Volume of gas fields

US firm Noble Energy and Delek Energy, a domestic company, discovered gas off the country’s coast in 1999. The Mari-B field, which began production in 2004, contained about 1 trillion cubic feet (tcf) of gas but is now severely depleted and likely to run dry within two years. Other nearby fields, such as Noa and Pinnacles, are now connected to the Mari-B platform and began production in June 2012 – they are thought to hold a further 1.2tcf of gas.

The first well, Leviathan 1, was first drilled to a depth of 5,170 metres where the deposit found was estimated to contain 16 trillion cubic feet (450 billion cubic metres) of natural gas. The second stage of drilling of the Leviathan 1 well was intended to reach a depth of 7,200 metres where the estimated natural gas reserve is an extra 9 trillion cubic feet (250 billion cubic metres) and potentially 600 million barrels of oil.

The Tamar field is considered to have proven reserves of 200 billion cubic metres (7.1 trillion cubic feet) of natural gas and is estimated to contain an extra 80 BCM of probable natural gas reserves. In a related development, natural gas from the offshore Tamar gas field near Haifa started flowing last April 2013.Tamar produces a gross 636 million cubic feet of gas a day.

Karish is Israel’s latest offshore gas discovery northwest of Haifa and the fifth field to contain over 1 tcf of gas. Noble Energy announced on the 22nd of May 2013 the discovery of the Karish well, in the Alon C license approximately 20 miles northeast of the Tamar field, in 5,700 feet of water.

Beyond Israel, the most active country in gas exploration has been Cyprus. Nicosia was eager to negotiate its Exclusive economic zone (EEZ) boundary with Israel (having already done so with Egypt in 2003), and reached an agreement in December 2010. A year later, the real Aphrodite field (Block 12) was discovered in Cypriot waters, just 35km west of the Leviathan field. The estimated reserves of up to 8 tcf would more than cover Cyprus’s entire energy needs for 200 years.

More about topic in Outlook for Oil and Gas in Southern and Eastern Mediterranean Countriesby Manfred Hafner, Simone Tagliapietra and El Habib El Elandaloussi, MEDPRO 10/2012

Transfer of gas

The Israeli energy minister Uzi Landau announced that his country has established a high level commission that actively examines the prospects for transfer of gas. To date, the following options have been proposed:

- Transfer gas to Israel for the purposes of electricity production

- Creation of LNG stations in Cyprus and Israel to supply the world market

- Creation of a floating LNG station close to the gas fields

- Creation of a pipeline connecting the fields with Greece and from there on to the EU via Italy

- Use the gas production for electricity generation and creation of a high voltage cable to connect Israel-Cyprus-Greece who will consume the electricity. it would mean that Israel could export energy to Europe, and in times of crisis could fall back on European electricity. it would mean that Israel could export energy to Europe, and in times of crisis could fall back on European electricity.

(Source: Natural Gas Europe)

It should be pointed out that any transfer of gas to Europe from developments in the eastern Mediterranean would take upwards of a decade to begin, once investment decisions were taken. In one other point of view, a dynamic triangle between Greece-Cyprus-Israel could be treated as an efficient geo-political counterweight to Turkey.

Already on end of June 2013 Cyprus inked a deal with a US-Israeli partnership to build a liquefied natural gas plant on the island to exploit untapped energy riches. Building a multi-billion euro LNG plant is seen as the biggest infrastructure investment project in the island’s history.

Early August 2013 Greece, Cyprus and Israel signed a memorandum of mutual understanding to cooperate in energy and water resources. The delegations from all three countries voiced their support for the EuroAsia Interconnector project that plans to link the electricity grids of all three countries via an underwater cable that is also going to hook up with the Paneuropean Electricity Grid. The 2,000-mega-watt EuroAsia Interconnector could potentially allow for the export of electricity generated in the eastern Mediterranean to the EU energy market through the trans-European electricity networks; it is also seen an important reason for stability in the eastern Mediterranean.

Conclusion

The term “Energy Triangle” was first issued at the Cyprus-Israel Business Association in Nicosia, Cyprus in 2010. Due to the joint establishment of the Exclusive economic zone (EEZ) between Cyprus and Israel, this marked the beginning of an increasing collaboration between the two Mediterranean neighbors. Both countries agreed to a joint extraction of natural gas by the American company Noble Energy in order to cut the financial burden of extraction by both countries. Shortly after the exchange of representatives between Israel and Cyprus, the Gaza flotilla raid occurred in 2010, thus destroying the Israeli-Turkish relations and pushing Israel towards a closer alliance with Greece. Since 2011 Greece joined Israel and Cyprus in the plan to export natural gas to Europe by 2015 through a power plant close to Limassol.

The discovery of natural gas is a huge strategic opportunity but it also has complicated rivalries in the eastern Mediterranean, an area already full of long-standing security issues.Among those to have issued assertive statements of intent regarding undersea gas finds are Greece and Turkey, Cyprus and the self-declared Turkish Republic of Northern Cyprus, as well as Israel, the Lebanese militia group Hizbullah and Palestine’s Hamas.

The energy discoveries during last decade have transformed Israel’s energy calculus and caused a significant strategic shift.. In 2012, when Egypt abruptly cancelled natural gas exports to Israel, the country was reliant on imports for 70% of all natural gas used, and on its Arab neighbor alone for 40% of its supply. But the Tamar and Dalit fields alone hold enough natural gas to supply all the country’s needs for two decades. When combined with Leviathan, Israel could meet all of its electricity needs and export gas.