During a recent discussion regarding the economic situation that is haunting businesses all over the globe, a speaker began by asking - should business leaders take on a world with corona, or take on corona with the world?

While the dexterity of the wordplay seems pretty interesting, what is more important is the course of action that businesses need to take in the coming future - especially in the real-estate realm.

The jury is still to come in terms with how confusing the year-ending stats would be for real estate after COVID. But one thing is for sure, the shadow cast by the virus and its after-glow will keep those with acumen guessing regarding the time-frame of return to normalcy.

The biggest challenge in the market is the lack of demand due to several uncertainties. That deadlock can be broken by bringing down prices, reducing the cost of financing / mortgage rates, reworking tax structure and imbibing technology.

Primary Challenges Faced

Like all other major sectors that are facing upheaval, the real estate business too will be shaken at its foundation. The impact to the real estate business is likely to be both ruthless and lingering.

Deployment of technology can help realty developers augment efficiency with time, cost and quality across the value chain, especially in designing, planning, budgeting and executing projects.

Developers will need to take steps and navigate around a minimum of four primary challenges - demand being deferred, construction being hampered, liquidity crunch having considerable effects, and the ever shifting customer preferences.

Reduce In Demand & Shifting Preferences

Various analysts forecast at least 25% decline in demand for new homes this year. This is indeed a plausible scenario and will afflict those with significant market-share immensely. It has always been experienced time and again, that market retrenchment is never justifiably distributed among the participants.

There isn't any room of doubt that stronger brands and those with conceivably better products, could in fact stand to gain at the expense of smaller players.

A contrarian view is that due to the lockdown situation faced by the masses, fence-sitters will finally commit to buying that better home they've been putting off for some time now. Such a situation where the intent of a purchase is pretty strongly felt will take a few quarters to materialize into sales.

Those who endorse this view would in all probability envision a postponement of demand rather than a reduction of requirement and set themselves up for the expected bounce back.

Economic & Social Effects

The construction sector employs millions of people in most parts of the world, especially in the Middle East and India. A large chunk of them are unskilled laborers. With the tag of being a key employer, this sector is not only economically imperative but also socially crucial as governments seek to rekindle the economy and re-establish livelihoods.

Operational disruptions, such as labor shortages, suspension of construction activities and disrupted supply chains will adversely affect project delivery and timelines.

We are aware that most of the construction labor tends to migrate seasonally from rural regions to the large cities. But will they feel secure and safe in the aftermath of the dreadful experience of having faced the ill-effects of COVID-19?

There isn't any doubt that governments as well as private firms will do all that it takes to proffer incentives financially through better wages and facilities.

This should in turn tip the balance for construction contractors in favor of enhanced mechanization or automation. But rest assured not every contractor or developer would be in a position to embrace this modernization during such a constrained situation.

Liquidity Crunch

It has been also noted that clients who purchased apartments earlier have been deferring subsequent payments for their under-construction apartments because of the overall financial insecurity and uncertainty right now.

In these challenging times, the priority for developers will be to operate with maximum efficiency and reduce operational costs and leakages.

If and when a project performs well during its launch, the entire working capital would ideally get funded by customer down-payments. But that isn't the situation now due to demand deferral and construction delays.

When these are consolidated with heightened customer anxiety and penny-pinching on their part, the possible development would be a dire scenario of liquidity crunch for developers. They will in fact necessitate the need to harness other means of gathering a working capital and this would be only possible for those with stronger bottom lines.

A challenging time for marketers

Finally the long term aspect that will grab the limelight is what home buyers are looking for and how they choose to buy will both change visibly and otherwise. Crowded launch events where developers seek to create a situation of amazing deals will no longer be possible, forcing marketers to reinvent the selling processes.

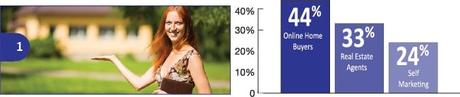

Product research will go online and comparison among portals will take center stage. To defend their turf, developers will be forced to step out of their comfort zone of lead-generation to build end-to-end digital sales capabilities.

Buyers will start placing importance to premium features such as sustainability, security and convenience.

The demand slowdown has been keeping price growth in check, while the pandemic threatens to impact global economic growth immensely and any hope of value appreciation in the property market.

Despite prices being affordable, buyers are still cautious regarding investing in property. Timely delivery is their primal fear.

Technology To The Rescue

Five technologies that are touted to have a significant impact on the real estate sector are Digital Engineering, Internet of Things (IoT), Generative Design, Project Management, Mobile Applications and Digital Engagement.

The pandemic has induced new KPIs around building safety and security. Developers who demonstrate redesigned infrastructure, such as touch-free surfaces, digitally enabled entry and exit, resident and guest management systems, smart homes and smart club houses, will draw buyer attention and provide value.

As customers visits reduce and traditional lead conversion techniques lose traction, developers who imbibe digital sales channels by including virtual tours and online customer bookings, will find themselves as leaders of change.

Covid-19 is expected to prompt both home buyers and developers to focus on smart homes with IoT hardware to enable hands-free home security, energy management and home entertainment.

The real estate sector needs to start accelerating their digital transformation to improve efficiency, redefine the end-product and synergize with an upgraded operating model for a better future.