Saving the first $100K is a hurdle that once we achieve it, our life gets easier because of the compounding effect. There is another savings target which if we achieve that early in our lives, we can actually stop saving for the rest of our lives and still be able to retire quite comfortably.

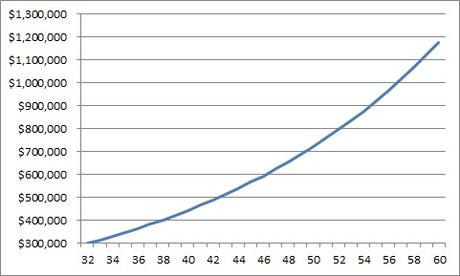

So what exactly is this amount? In this post, I will show why saving that amount will enable us to stop saving indefinitely and how we can save up that amount in the first place? Let's start off with a chart which gives an overview of what the savings target will be:

The x-axis shows the amount and the y-axis shows the age. The assumption made for this chart is a 5% investment return consistently for every year and all profits are reinvested. There are no additional savings injected into the portfolio, the money grows just because of 5% investment return over the period of years.

As we can see, if we have $300K at the age of 32, we can actually grow our money to $1 Million somewhere at the age of 57 even without saving a single cent after the age of 32. We can continue to work and spend all the money we earn but still can achieve $1 Million in savings at retirement age. This doesn't even include our CPF savings yet which most of us will have another few hundred thousand dollars for retirement.

This is how the money grows year after year in detail:

It is amazing how the power of compounding works to achieve that $1 Million even without additional savings. However, many of us may be thinking how do I even save that $300K at age 32 to begin with? I admit this is not an easy task and I personally won't be able to achieve that since I'm only just 2 years away from age 32 and I am nowhere close to $300K in savings yet.

To save $300K by age 32, assuming most of us start work at the age of 25 or 26 after graduation, we will need to save close to $50K a year. This is almost impossible for a fresh graduate salary since most don't even earn $50K to begin with. In view of this, I will tweak the scenario a little which should suit most of us.

Here is the new scenario:

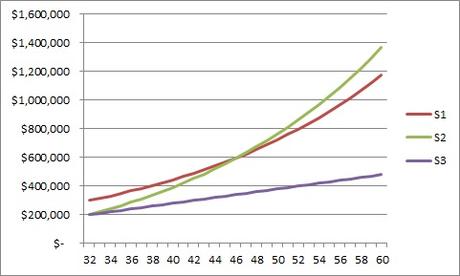

Now, the savings target at age 32 is lowered down to $200K. Because of this, it is impossible to achieve $1 Million by retirement age without any additional savings so there is an additional $10K of savings added in per year. With the same 5% investment returns and the additional $10K annual savings, we can now still get a decent Million dollars for our retirement.

Saving $200K by age 32 should still be achievable. With this, it sets the new savings target which I aim to achieve bearing in mind the expenses which I need to incur for a new house, renovation, marriage and more. Thereafter, we actually do not really need to save that much anymore if we can get a 5% investment return which shouldn't be too difficult to achieve. That additional $10K savings annually is just an average of less than $1,000 savings per month.

What happens if a person does not invest at all and leaves the money in the bank? This is the result with the same scenario above taking out the 5% investment return:

A person who does not invest at all only manage to save $430K at the age of 55 vs $1M at age 55 for a person who invests. This is why investing is so important for long term savings goal while reaching a substantial savings target is important early in our life.

Let me put together all the 3 scenarios on a chart:

S1 - $300K at age 32 with $0 additional annual savings and 5% investment return

S2 - $200K at age 32 with $10K additional annual savings and 5% investment return

S3 - $200K at age 32 with $10K additional annual savings and 0% investment return

Visualisation helps us plan for our finances better. I mainly use excel to tabulate the numbers with simple formulas and charts to visualise the outcome. I would say excel is a really good financial planning tool. From the visualisation above, we can see having a savings target and an investment return target are both important. It is also important to run the numbers and make sure we are comfortable with it. Financial planning is all about making sense of it and asking ourselves is it practical and achievable? For example, we would want to be setting a investment target of 10% and think it is easily achievable over the long run. That would be quite difficult for most people.