When you run a business it is highly important to keep a track of all the expenses which occur in the office which includes the office's daily expenses, salaries, sales, and every type of other transaction.

Choosing the right tool to manage the accounts.

Quickbooks and Tally ERP are the most used and highly recommended accounting software across businesses.

Accounting software allows you to reduce manual work, human accounting error and helps you keep track of all the business expenses.

Having an accounting software to track your expenses is highly important because it helps you understand how far you're in the business, how much profits you're making, it can also help you understand which expenses you can control.

No matter what your business size is, you must think of having accounting software.

In this blog, we will talk about the two most highly recommended tools, Quickbooks & Tally.

Let's know what each tool has to offer and how much it costs.

Let's start with Quickbooks.Quickbooks Overview

Quickbook is basically an accounting software that is developed and marketed by Intuit. It is mainly famous mostly among Small to Medium size Businesses.

Quickbooks are mainly focussed on-premises accounting applications, it also offers could base versions that accept business transactions, manage and pay bills, manage payroll functions, etc.

Quickbook offers an introductory accounting solution with packages offering basic inventory management. It is a great tool for startups and small to medium-sized businesses.

Quickbooks provides a 30-day free trial which includes all the features, so before you get into using the software you know what you're getting into.

Let's know more about the accounting software, the key features, pricing, and pros & cons. Let's start with the key features.

Quickbooks allows you to create and send invoices, you can track sales and transactions on the go as Quickbooks offers cloud storage which allows you to work from anywhere, anytime.

The best part about Quickbooks is, you don't need any prior training or an expert to use Quickbooks.

You are allowed to connect your bank account which automatically imports & categorizes transactions. You can add third-party apps or tools to take a snapshot of the receipts and save them on mobile.

Quickbooks have made coordination and communication easy. Instead of calling your clients or mailing them manually for payment reminders, you can simply send the journal entries to your clients without any third-party tool.

You can send the journal entries as an attachment without the hassle of printing or exporting as a PDF.

In case you don't have enough time to check the errors in the bills manually, you can check it with Quickbooks tools which scans and highlights the errors in the document.

You can access it from anywhere, anytime. You can access your account, stay organized, and manage your business from any device. You can use Quickbooks from Desktop, Mobile or Tablet.

One of the biggest hurdles with accounting software is difficulty in understanding. Well, Quickbooks is easy to handle and manage accounting software. It helps you keep a record of financial transactions which include sales, income, payroll, daily expenses, etc.

It also helps you in budgeting.

Quickbooks has an easy to understand user interface. It allows you to enter or segregate data in different batches, you are allowed to import numbers from Excel sheet and Quickbooks files.

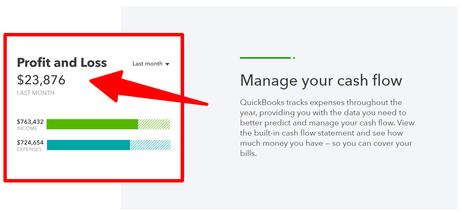

The greatest advantage with Quickbooks is, you can generate reports without exporting the data to an excel sheet. Quickbooks has a separate report menu, where you can automatically generate reports like profit & loss sheets, cash flow statements, balance sheets, etc.

You can do manual work if you require something more.

With Quickbooks, you can create custom and professional invoices, sales receipts, etc within a few clicks.

Keeping a track of payments manually is quite difficult. With Quickbooks, you can save invoices and bills from vendors and pay them on the due date. You can schedule recurring payments and save time.

Quickbooks isn't limited only to one login or one device. It can be accessed by multiple users. So in case you want to invite any of your associates or accountant for the assistance you can do it.

You don't need to start the entire system or laptop to access your account information. Quickbooks has a mobile application which can be accessed through android or iOS devices.

You can easily access all the information by your phone or tablet.

With Quickbooks, you can easily track billable hours and clock employee time. You can even track billable hours by employees or clients and automatically add to invoices.

In case you feel stuck or confused at any point then you can definitely contact the support and they will help you.

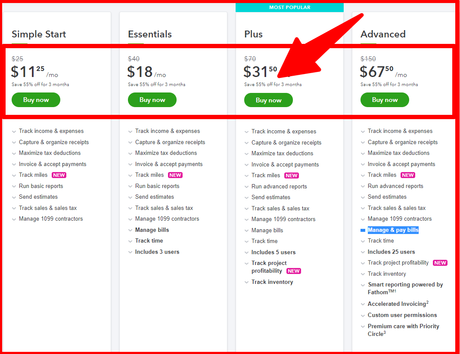

Quickbooks offers 2 affordable packages; Package for small businesses and for accountants. Let's know what each plan has to offer.

For small businesses:

- Free mobile app

- Allowed to send custom invoices

- Allowed to send quotes

- Track income & expenses

- Snap & sort receipts

- Includes free updates and new features

- Import data from excel sheets

- Connect multiple bank accounts

- Allowed to create budgets and purchase orders

It basically includes all the important features which a small business require to maintain their accounts.

Let's know more about the next package, i.e., For Accountants.

For Accountants:Just as the name suggests, it is a version designed for accountants. It costs Rs. 223/ Month which also includes a bundle of 15 licenses.

Key Features of Accountants Package:- GST Compliance

- Cash flow Management

- Real-time document exchange

- Automatic bank updates

- Dedicated training & support

- Professional, GST Compliant invoices

- Access to client files anytime, anywhere with cloud storage

- Higher team productivity

Pros & Cons of Quickbooks

Pros of Quickbooks:- Efficient for small businesses and accountants

- Easy to use

- Reports can be generated easily

- Pricing is affordable

- Integrates with third-party tools easily

- System crashes easily

- File size limitations

- The limitation with the number of users

- Lack of industry-specific and business-specific features

- Not the right choice for e-commerce businesses as it does not includes important features like tracking, barcode scanning, etc

- Limited reporting

When I first got introduced to accounting, I got it through the Tally ERP system. Tally ERP is an accounting software that can be used to record several financial transactions. It is a multi-functional software that includes inventory management, payroll management, accounts management, cost center management, go-downs management, etc.

Tally has constant updates and that's what I truly like about the software ever since I started using it.

Let's know more about Tally's versions:- Tally's first version: It was released in the year 1990, this was built on MS-Dos. It was known as Tally 4.5.

- Tally's second version: It was released in the year 1996, the version was known as Tally 5.4. It was designed on a graphic interface.

- Tally's third version: It was released in the year 2001, the version was known as Tally 6.3. This version was windows based. It supported printing and implementation of Value Added Tax (VAT)

- Tally's fourth version: It was 7.2 which was released in the year 2005. It had additional new features of the new tax regulations and VAT rules by the state and central government rules

- Tally's fifth version was 8.1 which was developed with a completely new data entry structure. It had additional new features which included POS (Point Of Sales) and payroll.

- Another version of Tally was Tally 9 which was released in the year 2006, it was released due to errors & bugs. This version carries more features which include FBT, Payroll, TDS, Payroll, E-TDS Filing, etc.

- The latest and the current version of Tally was Tally ERP 9, Which was released in the year 2009. This version of Tally offers the maximum features which include GST (Goods & Services Tax). It is suitable for all businesses small to large businesses.

Tally offers to use different interest calculation methods which are and can be customized for every invoice and transaction. Once the calculation is completed the user gets a detailed report of the interest.

The reports help in knowing the balance amount that is yet to receive from the client.

I remember, when I used it we created 2 different interest calculators for interstate and intrastate.

Tally has a voucher entry system that allows you to diversify your transactions at ease.

As per the accounting terminology, a Voucher is basically a document that carries details of business transactions.

Tally ERP software offers you several similar accounting vouchers, you can even create a customized voucher as per your choice.

THE Tally ERP system allows you to track the bills of trading and non-trading accounts.

You can easily track the bill details with all the essential information which includes accounts payable, accounts receivable, receipts, adjustments to be made against some bills, etc,

Tally offers to integrate multiple ledgers including Sales Ledger, Single Ledger, Purchase Ledger, General Ledger, etc.

Segmentation of ledgers into different groups makes the accounting process easy to manage. It helps in data entry and record keeping of files.

Tally's feature helps you track the changes and make the corrections easily if required at any point. You can even use the security levels and gain robust access control,

The tally comes with superior audit capabilities which ensure the user to have unlimited periods and budgets.

Coding scares most of us. Not every accountant or accounting professional has good technical knowledge or know coding, Tally is the escape for such people.

Tally replaces accounting codes with regular account names, It eases the maintenance of the complex ledger.

- Tally supports multiple currencies

Tally has replaced the accounting codes. The replacement of accounting codes has made Tally to be easy to use accounting software.

Companies who deal internationally often find it difficult to manage the transactions as the rate fluctuates. Tally makes this difficult easy for businesses.

Businesses often deal in several currencies across the globe. It makes it difficult to keep track of business activities, Tally can definitely help you sort.

Tally enables users to handle the top to bottom billing information which includes accounts receivable, accounts payable, pending amounts, etc. It helps organizations in the allocation of payments regarding invoices and overdue.

Tally helps you segregation the customers using the billing information.

Irrespective of the organization or business size or business type can use tally and make the best out of it.

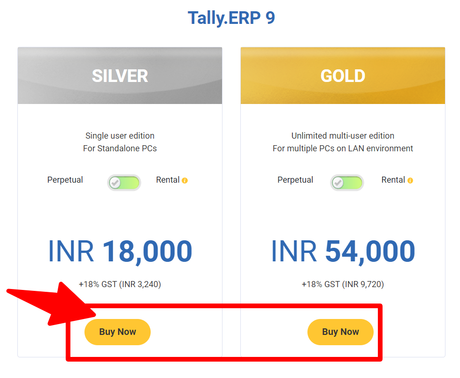

Tally's Pricing: Quickbooks vs Tally Comparison

GST offers only one pricing package. It costs Rs.18,000 + 18%GST (Rs. 3,240). It includes 9 perpetual licenses.

Pros of Tally- Provides all the accounting elements

- No third party tool needed to do any task

- Easy to understand use, no coding required

- Offers complete client information

- Supports multiple currencies

- Only one pricing package available

- System crashes sometimes

- No cloud storage

- Cannot access through phone or tablet

Frequently Asked Questions:

Quickbooks & Tally, both are amazing accounting tools in their own ways.

Quickbooks is a cloud-based software which can be accessed by any device, whereas Tally can only be accessed via desktop.

If you are a small business and you're looking out for software mainly for making invoices then definitely Quickbook is a solution for you.

Quickbook does not support inventory management.

If you're a medium-sized or a big size business then definitely Tally is a solution for you.

Tally is a complete accounting solution.

But both solutions have their own solutions and issues and you need to be clear about them before choosing the software for your business.

Quickbook can be operated by anyone, but to manage and handle tally you would need training or a trained person to manage and handle it.

Being an experienced person in tally, I can tell you it is not very easy to handle but it's a complete solution.