Oracles are arguably the most important infrastructure in crypto, and that's because they provide external data to blockchains, allowing their smart contracts to provide valuable use cases like DeFi and GameFi. The biggest and most popular oracle is Chainlink, which is not surprising given that it has the first-mover advantage. What is surprising though is how quickly Pyth network, the so-called Chainlink killer, has been growing.

So which of these two cryptos has more potential? Link or Pyth? Today we're going to compare Chainlink and Pyth network across multiple metrics to find the answer. I'll start by saying that nothing in this post is financial advice. It's purely educational content intended to inform you about the similarities and differences between Chainlink and Pyth network.

Table of Contents

Chainlink Founders vs. Pyth Network Founders

Now Chainlink was founded by crypto entrepreneur Sergey Nazarov and crypto developer Steve Ellis in 2014.

Chainlink began as a company called Smart Contract Inc., which focused on smart contract development. They soon realized that smart contracts required external data to be useful and this led to the creation of Chainlink, a solution to the so-called Oracle problem. Chainlink was originally proposed in a 2017 white paper authored by Sergey, Steve and a Cornell University professor called Ari Jules.

This technically makes Ari the third co-founder of the Chainlink protocol, which launched in 2019. Chainlink raised 32 million dollars in a 2017 ICO to finance the development of the protocol, which was subsequently built by Chainlink Labs, an American software company. The ongoing development of Chainlink's ecosystem is coordinated by the Chainlink Foundation, a non-profit which is based in the Cayman Islands.

The Pyth network was originally founded by Jump Crypto in 2021. Now, Jump Crypto is a subsidiary of Jump Trading, a Wall Street trading firm famous for using algorithmic trading in its strategies. Jump Crypto itself is famous for being very involved in Solana's ecosystem, such as building infrastructure like Firedancer.

Now, whereas Chainlink was created to solve the Oracle problem, Pyth Network was created to solve the efficiency problems of existing crypto oracles. Pyth Network launched the same year it was founded and I'll quickly note that Jump Crypto purchased the wormhole bridge the same month the oracle was launched. We'll come back to why that's relevant in the next round.

Pyth Network raised an undisclosed amount in a 2023 VC raise. Interestingly, the Pyth Data Association, which is the Swiss non-profit that oversees the oracle's ongoing development, was founded back in 2021.

But Duro Labs, the Portuguese software company consisting of former Jump Crypto employees who built Pyth Network, wasn't founded until 2023.

SOLANA Crypto Is Exploding & These 4 Coins Will Follow

Chainlink Technology vs. Pyth Network Technology

All right, time for round two, the technology. As I hinted in the first round, Chainlink is no longer just an oracle. Today it's an ecosystem consisting of various crypto-focused products and services, such as proof of reserves for exchanges, verifiable random functions for NFTs and GameFi, and cross-chain communication for blockchain interoperability. For the purposes of this post however, we'll focus only on Chainlink's oracle services.

This is partly because of time, partly because it makes for a fairer comparison, and partly because Chainlink's other products and services have not seen as much adoption according to DeFi Llama. We'll come back to adoption a bit later. Now Chainlink's oracle services can be divided into two buckets, data feeds and data streams.

Data Feeds

Data feeds are Chainlink's original oracle service. As the term suggests, data feeds provide external data to smart contracts, namely data about crypto prices. And this is done by a network of Chainlink nodes.

According to Chainlink's ecosystem directory, there are currently around 100 node operators. And per the data feeds page on the Chainlink website, node operators are providing around 1000 data feeds to almost 20 blockchains. Notably, these blockchains are all EVM-based, i.e. there is no non-EVM support.

Another thing worth noting is that Chainlink's data feeds use a push-based design. And this means that smart contracts must pay for data feeds even when they don't need them. And Chainlink's data feeds are also, well, relatively slow.

However, the trade-off is that they come with much greater security and decentralization due to their unique design.

The Next Big Crypto Opportunity is on Base

Data Stream

This ties into data streams, which are newer Oracle services that Chainlink launched last year. In contrast to data feeds, data streams use a pull-based design, meaning that smart contracts only pay for the data they actually need.

Data streams are also much faster, allowing for sub-second delivery of external data. This is made possible due to a small change in the architecture of Chainlink's original oracle. Data streams use additional layers of nodes called data oracle networks, or DONs.

These basically make it possible to deliver external data much faster. Note that DONs are used to power Chainlink's other products and services, namely its cross-chain protocol. According to the data streams page on the Chainlink website, DONs are providing around 100 data streams to five blockchains.

Notably, one of these blockchains is Solana, which foreshadows additional non-EVM support for data streams. This makes sense given the use of DONs in data streams and the use of DONs in Chainlink's cross-chain protocol, as I just mentioned. Now, as for Pyth Network, its oracle is a pull-based design by default.

And like Chainlink data streams, the Pyth oracle is very fast, likewise allowing for sub-second delivery of external data. The Pyth oracle even uses a similar architecture to Chainlink's DONs. The difference is that Pyth technically has its own blockchain.

This blockchain is called PythNet, and it's essentially a private and permissioned copy of the Solana blockchain. According to the Pyth Network documentation, the PythNet blockchain is operated by the Pyth Oracle's data publishers. Per the Pyth Oracle's KPI dashboard, there are currently over 120 publishers.

The KPI dashboard also notes that the Pyth oracle is providing over 500 data feeds to almost 100 blockchains. And this is where the wormhole bridge comes back into the picture. The reason why the Pyth oracle supports so many blockchains is because it uses the wormhole for cross-chain interoperability.

In other words, data is published to the PythNet blockchain by its data publishers who double as its validators. Then this data is bridged to other blockchains using the wormhole bridge when requested. And I'll quickly remind you that Jump Crypto purchased the wormhole bridge the same month that Pyth launched.

Now this is where things get interesting again. If you've been keeping up with our Solana updates, you'll know that we flag the fact that Pyth's data publishers push feeds to Solana directly and to every other blockchain indirectly via PythNet and Wormhole. This therefore gives Solana a slightly unfair advantage.

And that's because publishing data feeds indirectly results in slightly slower data feed delivery to other blockchains. Pyth Network seems to have recently tweaked its documentation so it's not clear if this is still the case.

However, the fact that Pyth data publishers need to run both a Solana RPC node and a PythNet validator suggests that the Pyth oracle still publishes data directly to Solana and indirectly to other chains. In other words, data publishers feed data directly to both Solana and PythNet.

Will Eigen become one of the largest cryptocurrency in Ethereum's ecosystem?

LINK Tokenomics vs. PYTH Tokenomics

Alrighty time for round three, tokenomics and price potential. LINK is an ERC677 token that was originally minted on Ethereum and now exists on more than a dozen smart contract chains including Cardano and Solana.

LINK is used to pay chain link nodes for all the products and services they provide and can be staked by both node operators and LINK token holders. The catch is that there's a limit to how much LINK can be staked in each version of Chainlink's staking rollout. A maximum of around 41 million LINK can be staked in the current 0.2 version.

Lo and behold the staking cap has been maxed out. Those who were lucky enough to join are earning just over 4.3 percent per year in LINK. The caveat is that these rewards don't come without risks.

According to the Chainlink staking website, node publishers who choose to stake in version 0.2 risk being partially slashed if they act maliciously or ineffectively. To clarify, node staking is currently only voluntary according to Chainlink's documentation. To be exact, the requirement to use LINQ as collateral depends on the data feed contract in question.

Now LINQ has a maximum supply of 1 billion which was allocated as follows. 35 percent to ICO participants, 35 percent for node operator incentives such as staking rewards, and 30 percent to the company behind Chainlink. It appears that all LINK allocated to ICO participants was immediately unlocked when the token launched.

It also seems that the remaining supply has no predetermined vesting schedule. LINK supply data from tokenomists suggests that LINK's supply schedule is determined by Chainlink and related to things like staking and developer funding. As you can see there was significant supply growth in 2022 and 2023.

Lo and behold the significant increase in LINK's supply in 2022 and 2023 corresponds almost perfectly to its poor price action during this period. To be fair the entire crypto market was also getting wrecked at the same time and this means it's impossible to say for sure that the supply increase was the cause of LINK's bad price action. Even so, LINK's long-term price action doesn't look as promising as you'd think given that Chainlink is the most integrated oracle in crypto.

From our perspective, this has to do with the simple fact that LINK isn't legal tender and that means that LINQ bought to pay node operators is then sold by node operators for fiat to run their operations. The result is a net neutral effect on LINK's price.

Again to be fair this is a dynamic that arguably exists with every cryptocurrency but what makes it slightly different in LINK's case is that Chainlink's original oracle had effectively integrated with every crypto project and protocol and therefore had limited room to grow and this means that the demand for LINK isn't growing as fast relative to the LINK selling coming from the nodes which is what was happening when Chainlink launched and everyone was integrating with it.

As Chainlink's growth has started to level off the demand for LINK for fees has as well but the LINK sales from nodes continue to happen. This is something we pointed out in our past reviews of Chainlink and we do reckon a small correction is in order.

Now that Chainlink has launched data streams it can start supporting non-EVM chains and this means there is an entirely new set of cryptos and protocols buying LINK to pay for these data streams and this means LINK buys for fees could once again outpace LINK sales by nodes if growth does take off.

With more room to grow both inside and outside of crypto LINK faces only one hurdle and that's its sizable market cap of almost 8 billion dollars at the time of writing and as most of you will know the larger the market cap the more money it takes to push a crypto's price up or down and this means it's going to take a lot of capital to push its price substantially higher.

Now to put things into perspective if LINK was to pull a 10x it would have a market cap almost as large as Solana's SOL around 80 billion dollars and this would require tens of billions of dollars of investment which right now seems a little bit unlikely. Then again basic technical analysis suggests that LINK could rally as high as a hundred dollars which would practically be a 10x from here and this makes sense when you realize that the entire crypto market would grow substantially.

As a quality large cap, we reckon a 10x return is a reasonable expectation for LINK. As for PYTH network its PYTH is an SPL token on Solana. In contrast to LINK PYTH is not used to pay fees to the PYTH oracles data publishers.

Per PYTH's documentation quote the ongoing existence of and size of the fee will be determined by governance on a per blockchain basis. Until governance is live the fee will be one of the smallest denominations of the blockchain's native token e.g. one way on ethereum. In case that didn't give it away PYTH is used for governance and can also be staked by data publishers.

Like LINK staking PYTH staking is optional for data publishers and does come with slashing risks. PYTH token holders can also stake or rather delegate their tokens to data publishers to earn a yield as high as eight percent. The difference is that it's still possible for anyone to stake PYTH because each data publisher has their own staking limit which seems to vary based on various factors including their self-stake.

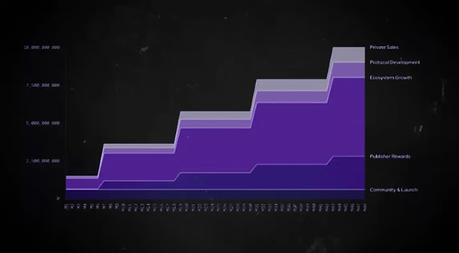

Like LINK staking PYTH staking rewards come mostly from the original token allocation rather than oracle fees. Now PYTH has a maximum supply of 10 billion which was allocated as follows- 22 percent to data publishers, 52 percent to ecosystem growth, 10 percent to protocol development which appears to include Durolabs the company that spun out of Jump crypto, six percent to community and ten percent to investors. The vesting schedule for PYTH can be seen right down below.

As you can see it's extremely aggressive with enormous cliffs happening every May until 2027. For what it's worth the next vesting cliff for PYTH doesn't come until May next year so there's still a lot of time for the altcoin season to rally before then. More importantly this means that PYTH's supply won't be changing between now and May 2025 at least on paper.

In practice, more of PYTH's supply will come steadily online as early investors from earlier vests periodically sell their tokens and PYTH data publishers periodically sell their staking rewards. Whereas LINk's demand equation cancels out PYTH doesn't have a demand equation because it's not used to pay for fees. The thing is that this is something that could easily change given that PYTH technically has its own blockchain.

PYTH could be used to secure PYTHnet in the not-too-distant future. At the same time, the PYTH oracle is new and this means that it has lots of room to grow as far as crypto integrations go. The fact that PYTH is natively cross-chain also means that no blockchain is off limits and it definitely helps that its cross-chain integrations have effectively been outsourced to wormhole.

The cherry on top there is that PYTH has a market cap in the low single-digit billions and as we've learned the larger the market cap the harder it is to push a crypto's price up or down. PYTH is on the smaller side of the large caps and it also helps that we have a benchmark of how high PYTH could grow. Of course, that benchmark is LINK.

In the last crypto bull market, LINK hit a market cap of 20 billion dollars. If we assume that PYTH is following LINK one cycle behind, which is certainly possible given the growth of the PYTH oracle, this means PYTH could pull a 14x and this could actually be a conservative estimate if the PYTH oracle becomes the standard in crypto. Logically this is unlikely to happen for the simple reason that the PYTH oracle appears to continue giving preferential treatment to Solana.

Case in point, STALK is another crypto oracle that's emerged recently and it's partnered with SUI to create a de facto PYTH killer. Appropriate given that SUI is a Solana killer. You can learn more about the differences and similarities between Solana and SUI by CLICKING HERE.

Chainlink Adoption vs. Pyth Network Adoption

In case it wasn't clear enough, Chainlink is the most integrated oracle in crypto. The Chainlink ecosystem website shows that Chainlink has over 2,200 integrations and counting. The catch is that not all of these integrations are related to oracles.

You'll recall that there are only around 1,000 data feeds and 100 data streams and you'll recall that most of the blockchains Chainlink has integrated with are EVM-based. Again there are some exceptions such as Solana and you'll recall there have been some integrations with the likes of Cardano and this foreshadows more Oracle integrations but it's still not as long of a list as you'd think. That said there's no denying that Chainlink secures an incredible amount of on-chain value over 25 billion dollars worth according to DeFi Llama.

As you can see though this figure has been fairly stagnant since the last bull market and could continue to be if on-chain activity keeps moving away from EVM chains. While it's true that Chainlink offers more than oracles, data from DeFi Llama suggests that its other products and services have seen relatively limited adoption. Take Chainlink's verifiable random function for example.

DeFi Llama shows that there's been no demand for VRF version 1 or version 2 over the last year. Then again there hasn't been much demand for VRFs lately in general. Now although it is true that Chainlink has also secured partnerships with lots of institutions it appears that most of these have not really translated into demand for the LINK token beyond just pure speculation.

Take Chainlink's partnership with SWIFT for example. This partnership involved leveraging CCIP but Chainlink's documentation about CCIP billing notes LINK doesn't need to be used for fees. Not to burst anyone's bubble but I don't think that SWIFT is buying LINK in bulk to pay for CCIP fees.

As for Pyth Network, you'll recall that its Oracle offers over 500 price feeds on almost 100 blockchains. Even though the Pyth oracle secures less than 10 billion dollars of on-chain value this figure has been growing at an exponential rate. Some of you might have seen the recent reporting that the Pyth oracle's total value secured grew by a staggering 47 times between the start of the year and September this year.

When you notice that the total value secured by the Pyth oracle at the start of the year was 100 million dollars you realize that this means this 47 times figure is on track to hit 100 times by the end of the year. And this is the kind of growth in adoption Chainlink saw in its early days and it's why so many people are bullish on Pyth. The difference is that the Pyth oracle is truly cross-chain and this means that it has room to grow on next-generation blockchains like SUI and Aptos where more and more on-chain activity is moving to.

Pyth Network's uncomfortably close relationship to Solana also means that its oracle will benefit from the fact that Solana is taking lots of market share from Ethereum and EVM chains in general.

Chainlink Challenges vs. Pyth Network Challenges

The main challenge that Chainlink faces is competition from other oracles such as Pyth Network. If you need evidence of that well look no further than the fact that Chainlink launched its data streams shortly after Pyth Network started gaining traction late last year. Remember that Chainlink's data streams are almost identical to Pyth's native oracle. The difference is that Chainlink's interoperability relies on its own in-house cross-chain protocol.

In our view, this is Chainlink's Achilles heel because it means that the developer team needs to allocate lots of resources to building out Chainlink's cross-chain functionality to get its oracle on more chains. Developer resources have also been allocated to Chainlink's other products and services. However, this depends on your perspective of Chainlink.

If you believe that Chainlink is just a crypto project then its ecosystem of products and services is counterproductive because it means that it's competing on multiple fronts against crypto projects that are hyper-focused on a single product or service. But if you believe that Chainlink is more than just a crypto project then its ecosystem of products and services is the correct strategy because it allows Chainlink to evolve to become well more than a crypto project.

The question then becomes how much of Chainlink's off-chain activities benefit Link? As discussed in the previous round the answer is that it might not benefit Link very much beyond just price speculation.

As for Pyth Network, its main challenge is centralization. Not in terms of architecture per se but in terms of its approach. For starters, Pyth Network is hyper-focused on being a crypto data oracle and nothing more.

Again this is good if you think that Pyth will benefit from just being a crypto project but it's bad if you think that Pyth would benefit from expanding to other products and services. Pyth Network also appears to be reliant on Jump Crypto albeit to a much lesser extent than it once was. Let's be real, Portugal-based Duro Labs probably isn't the one that's onboarding all of the data publishers coming from Wall Street.

Pyth Network is also critical infrastructure for Solana and Jump continues to be heavily involved in Solana's ecosystem and this ties into another potential point of failure and that's the wormhole bridge. As most of you will know the wormhole bridge was exploited for over 300 million dollars in 2022.

If the wormhole bridge were to be exploited again it would not only result in billions of dollars lost but potentially result in Pyth's oracle feeds going offline and this relates to another point of centralization for Pyth Network and that's its focus on Solana.

On the one hand, this could help the Pyth token because Solana looks like it's going to be the ethereum of this cycle so to speak. On the other hand, this could limit Pyth's oracle integrations due to its apparently preferential treatment of Solana and that's the bell. Gloves down, let's see who won the fight.

Which One Is Better, Chainlink Or Pyth Network?

Pyth Network arguably wins round one and that's because the Pyth oracle was founded by one of the world's top trading firms which literally specializes in cutting-edge financial technology. Pyth Network's funding may be unknown but it's known that Jump Crypto has spared no expense on crypto infrastructure.

Let me remind you that they bailed out wormhole after that massive hack and we reckon it's possible that was mainly because of the wormhole's key role in the Pyth oracle's cross-chain infrastructure.

This segregation of the oracle and bridging also underscores the fact that we're dealing with an advanced approach to crypto infrastructure. But Chainlink arguably wins round two and that's because it pioneered the oracle technology that almost every other crypto oracle uses today including Pyth Network. Chainlink paved the way for data-filled smart contracts and continues to raise the bar for other kinds of crypto infrastructure that interfaces with the off-chain world.

What's remarkable is just how modular this infrastructure is. To refresh your memory Chainlink's data oracle networks or dons can be customized to do anything from providing low latency data to moving messages between chains. The fact that don-based technology like CCIP is being used by institutions like Swift highlights just how innovative this technology was.

Pyth Network arguably wins round three though and that's because it has more potential across every vertical. The Pyth oracle has more room to grow in terms of supported chains protocols and data feeds. The PythNet blockchain has more room to create utility for the Pyth token and the Pyth token itself has more room to grow in terms of market cap.

Let me remind you that it's possible Link will be 10x but it's likely that Pyth will be 14x if it's following Link one cycle behind. If we're talking strictly in terms of potential returns Pyth has the advantage because of this fact alone and the growth of the oracle and evolution of PythNet are the perfect narratives to get it to 14x and beyond. However, Chainlink arguably wins round four and that's because Chainlink is a trusted brand and rightfully so.

It has reliably delivered data to crypto's most valuable protocols for five years and counting. The recent launch of Chainlink's data streams means that no blockchain is off limits thanks to its don-based architecture. When you combine this with the fact that Chainlink doesn't play favorites it's easy to see how Chainlink's data streams could become more popular than the Pyth oracle on every chain but Solana.

The presence of dons also opens the door to data streams that connect to critical non-crypto native infrastructure such as Swift and this leaves the final round and we're two for two. The crypto oracle that wins this round ultimately depends on your perspective which is the bigger challenge. A lack of innovation and focus on the oracle front or cutting-edge oracle innovation that's only made possible by multiple levels of centralization.

If you believe the former is the bigger challenge then Pyth wins the final round. If you believe the latter is the bigger challenge then Chainlink wins the final round. We honestly don't know which of these is the bigger challenge but some people fall into the former camp.

This is because the fastest crypto projects win not just in terms of functionality but also development. The more centralized a crypto project is the faster it can build and evolve. Pyth network might have decentralized governance but it's otherwise centralized enough to move faster than Chainlink which is centrally managed but decentralized due to its sheer size but again this fundamentally depends on your perspective.

Chainlink's oracle may not be evolving as fast as it once was but its ecosystem of products and services have as a whole. Make no mistake this ecosystem is a force to be reckoned with and it could create new use cases for Link that have yet to be realized. With all that said Pyth and Link will probably pump by similar percentages by the end of the crypto bull market and both crypto projects will achieve historic milestones in the coming months.