Recently President Obama introduced a new tax reform proposal. He wants to lower taxes on the middle class, and pay for that with a small raise in taxes on the wealthy. The Republicans immediately called the president's proposal a "non-starter". That's no surprise, since the primary aim of GOP economic policy is to see that the rich pay as little in taxes as possible (i.e., "trickle-down" economics). In fact, the only tax proposal supported by Republicans is to give more tax breaks to the rich and the corporations -- the only two groups in our society that don't need more tax breaks.

But just like on many other issues (like raising the minimum wage, protecting Social Security & Medicare, stopping the export of jobs, lowering college costs for students, etc.), the congressional Republicans find themselves at odds with the American public.

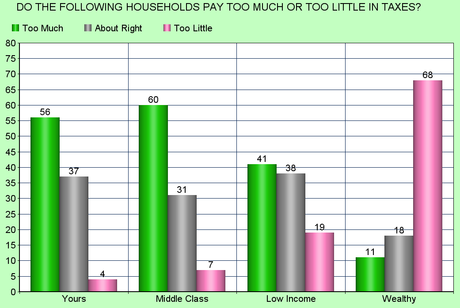

The figures above are from a recent AP-GfK Poll -- done between January 29th and February 2nd of a random national sample of 1,045 adults, with a margin of error of 3.5 points. Note that 60% of the public says the middle class pays too much in taxes (and a plurality says the same about low income workers), while a whopping 68% say the wealthy don't pay enough in taxes.

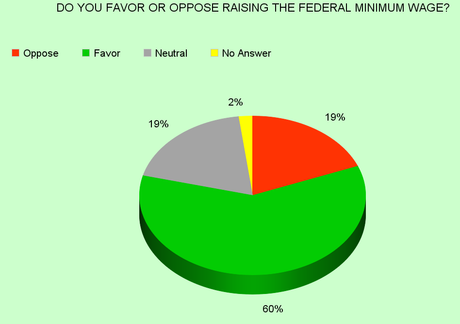

The public knows that there is a vast and growing gap in wealth and income between the rich and the rest of America -- and they want the government to do something about it. One thing that could be done is to raise taxes on the rich while lowering them for others. Another is to raise the minimum wage to a livable level, which would put upward pressure on wages for most workers (and which 60% of the public supports, while only 19% opposes).

I honestly don't know how the Republicans can expect to win the White House in 2016, when they oppose most of the issues supported by the general public.