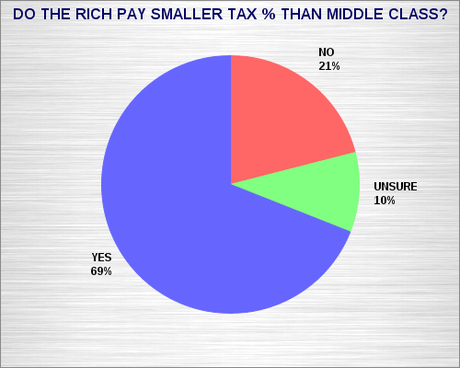

The chart above was made from information contained in a new Rasmussen Poll. The survey was done on March 17th and 18th of a random nationwide sample of 1,000 adults, and has a margin of error of about 3 points.

During the presidential campaign of 2012, Republican candidate Mitt Romney refused for months to release any of his income tax returns. It was only when he began to realize that this refusal was hurting his electoral chances that he finally agreed to release any of this information. And when he did, the amount of taxes he had paid turned out to be shockingly low -- only about 13% of his income of more than $20 million.

Romney was not a special case. Many of the rich pay only a tiny tax percentage -- far less than the 35% their tax bracket would have demanded. And their doing so is legal, thanks to tax laws passed by the Republicans. First, many of them pay less because they make much of their income through capital gains -- and capital gains are taxed at a far smaller percentage than earned income (the type of income poor, working class, and middle class workers have).

During the Bush administration (and most of the first term of President Obama), capital gains were taxed at a 15% rate. That has now been raised to 20% -- still far lower than the earned income rate required of earners in the top tax brackets.

The other way many of the rich are able to avoid paying taxes on their income is to keep much of that income in foreign banks and investments. And they don't even have to hide that money these days, since the income is not taxed until it is brought back to this country.

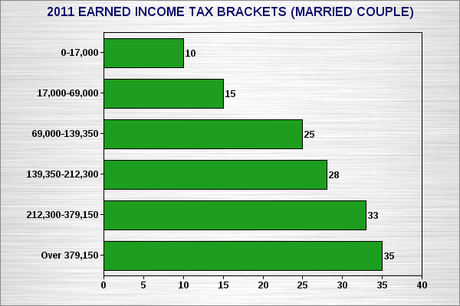

As the chart above shows, a significant majority of the American people believe that the rich pay a smaller percentage of their income than people in the middle class pay. Are they right? Here is the 2011 Earned Income Tax Bracket for married couples.

A quick look at that tax bracket chart shows it is true, but let's look at some figures. A married couple making $50,000 a year in 2011would have paid 10% on the first $17,000 of income ($1700), and 15% on the remaining $33,000 in income ($4950). Adding those two figures together, we get get a tax bill of $6650, or 13.3% of their total income. That's already above the 13% that the Romney's paid -- and they were far from the only rich couples to pay that small a percentage. A middle class couple earning $100,000 would have paid about 17.3% of their income in tax.

The 7 out of 10 Americans who believe the rich pay a smaller percentage of their income than most of the middle class are right. And since the laws today are very similar (with the capital gains tax still being far less than the earned income tax, and the rich still being able to shield money from taxation by keeping it in another country), it is a pretty safe assumption that the rich (who make millions) are still paying a smaller percentage.

The 2013 taxes have gone up for the rich, but that won't keep them from hiding money out of the country or taking advantage of the lower capital gains tax. The Republicans have tilted the economic playing field in the United States to favor the rich, and nowhere is that more apparent than in tax laws that favor the rich. We need to change the tax laws in this country to make them fairer to everyone -- and we should start by taxing all income at the same rate (the earned income rate), and by eliminating the rules that let the rich hide money overseas.

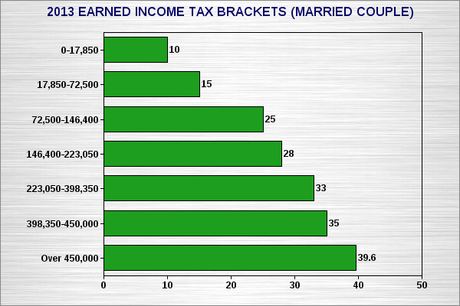

The 2013 Earned Income Tax Bracket is shown below. As usual, it will apply to all working and middle class taxpayers -- but not the rich.