Below is a step-by-step process that one needs to follow to check their EPS balance after their UAN activation:

- First, one should access the official website of EPFO website

- Select the ‘For Employees’ option in the ‘Our Services’ menu

- Choose the ‘Member Passbook’ option on the next page

- Enter the correct UAN, password and captcha details next, and ‘Login’

- There will be a list of different member IDs on the next page; the specific ‘Member ID’ needs to be selected

- The complete pension amount corresponding with the particular account will be visible in the ‘Pension Contribution’ column

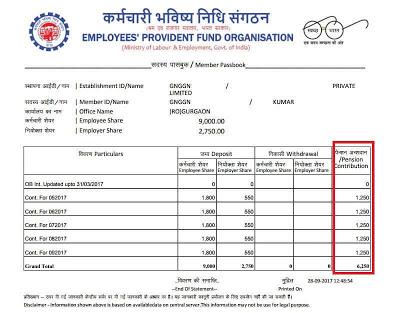

Here is a preview as to how it looks:

Besides this, EPF statements with records of all transactions can also be checked, like the EPF passbook (or e-passbook). This can be used to view an individual’s EPF balance online. This passbook can be checked or downloaded as many times as required in a month. This is especially important to note because the EPFO does not give out hard copy statements.

Besides this, EPF statements with records of all transactions can also be checked, like the EPF passbook (or e-passbook). This can be used to view an individual’s EPF balance online. This passbook can be checked or downloaded as many times as required in a month. This is especially important to note because the EPFO does not give out hard copy statements.To view and download an online statement of an individual’s EPF account at the EPF passbook portal, one needs to register on the EPFO website with the following details:

- Phone number

- DOB

- KYC documents like Passport, Voter’s ID, Driver’s License and PAN card

- Email address

Once registered, the individual gains access to their online EPF statement. It is to be noted that this facility of viewing and downloading e-statement or e-passbook online is only for those who contribute to the PF directly.

Important points about EPS scheme

- Every EPS contribution is to be done by the employer.

- An 8.33% contribution to the EPS scheme is to be given by the employer.

- The central government also contributes by saving 1.16% of an individual’s salary.

- There is no interest rate on the employee’s contribution to the account.

- Basic wages along with dearness allowance, retaining allowance and permissible cash value of food concessions comprise the employee’s pay.

- The employer’s contribution needs to be made within 15 days of every month’s closing.

- The employer bears all applicable contributions.

- The contribution for all working employees under the employer, directly or through a contractor, must be done by the principal employer.

- An employee has to have served for a minimum of 10 years for them to avail the benefits of EPF pension.

- An individual who has served for more than 6 months but less than 10 years can withdraw from the account of their EPF pension scheme after being unemployed for a period of more than 2 months.

- According to the scheme’s guidelines, the retirement age of an individual is 58 years.

- An individual who starts availing reduced pension (from the age of 50) or after they reach the age of 58 ceases to be a part of the EPS.

- An individual eligible for this scheme receives their pension for their lifetime. Upon their death, the pension is eligible for their spouse and children below 25.

- There is no provision of multiple pensions under this scheme.

- The EPS scheme also has provisions for individuals who become physically challenged during their service. The employer should have made a deposit for a minimum of 1 month for the specific individual to be allotted their pension despite not having completed the required service of 10 years.