The following assumes no other changes to our tax and benefits system whatsoever.

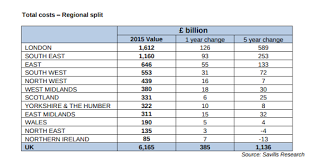

According to Savills residential property values in the UK are £6,165bn. There are 28.2 million dwellings in the UK.

Let us assume that LVT is the equivalent to 3% tax on the current selling price of each home.

Total potential LVT revenues are £185bn.

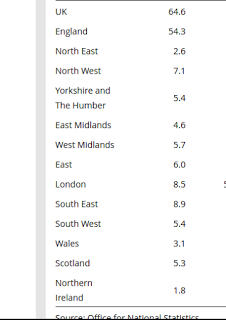

UK population is 64.6 million.

A Citizen's Income from which we all get an equal share of LVT=£2864 per person.

Property value London/SE =£2772bn. LVT=£ 83.16bn pa

Property value other regions =£3393bn. LVT=£101.84bn pa

Population London/SE =17.4m Citizens Income = £49.833bn pa

Population other regions=47.2m Citizens Income = £135.180bn pa

Net flow of income to regions outside London/SE = £33.34bn pa

Break even point for owner occupiers = £95,500 property value per person

So a household of a couple and two children would be no better or worse off if they lived in a home worth £382,000.

Average UK house price £218,474

Conclusion.

Almost all constituencies outside London/SE would be better off under a LVT + CI

Couples with two children living in a house less than 176% of current average house prices would be better off.

Over half of Londoners who now live in rented accommodation would be better off.

In short, on a small minority of UK constituencies, mainly in the SE of England would be worse off and vote against such a proposal.

As well as reducing both regional and individual inequality, a LVT + CI would allow the market to allocate property at optimal efficiency, reducing vacancies and under occupation.

It would also reduce the selling price of property to its capital only value. Saving future owner occupiers £36bn per year in mortgage interest repayments. (assuming current outstanding mortgages total £971bn would be reduced to £324trn)

A win-win-win.

For the purposes of a clear illustration of distributional effects, no changes to our tax and benefits system take place. However, it would be better if as many bad taxes were replaced with an LVT as possible, and our benefits system largely replaced with a Citizens Income. Reducing the deadweight losses associated with each.

A win-win-win-win.

All we need is some politicians who can make a good pitch.......